The recent acquisition of OANDA by FTMO marks a significant shift in the retail trading industry. It highlights how traditional brokers who fail to innovate risk losing market dominance. This unprecedented move represents the first instance of a prop trading firm acquiring a major retail broker, inverting the usual industry pattern.

OANDA Legacy vs. FTMO Innovation

OANDA, once a powerhouse in the retail trading space due to its strong regulatory standing across seven Tier-1 jurisdictions, gradually lost market momentum under CVC's ownership. Despite maintaining high trust among retail traders, the broker struggled to keep pace with evolving market demands, particularly in pricing competitiveness.

Since 1996, OANDA has been considered one of the leaders and pioneers in online trading, including CFDs. In 2018, it was acquired by CVC Capital Partners, a fund managing nearly $200 billion. Although initially it was suggested that there would be no changes in the company's leadership, the then-CEO Vatsa Narasimha was demoted to Non-Executive Director, ultimately leaving the company in January 2020.

What was once one of the top three brokerage firms worldwide was reportedly weakened by the fund’s management. Coupled with rising competition, this resulted in the firm’s gradual decline. The company attempted to save itself by acquiring TMS, Poland's second-largest broker, in 2020, which was finalized in 2021. However, this did not provide sufficient momentum for further growth, especially since XTB had become the dominant player in the local market.

Meanwhile, FTMO, which started in 2015, has been growing steadily. The Czech prop firm has become so large and confident that it decided to acquire OANDA from CVC for its purposes, an event first reported by Finance Magnates. The potential benefits from this acquisition could be substantial.

When a Prop Firm Acquires a Broker

FTMO's acquisition strategy appears well-calculated, targeting OANDA's robust regulatory framework while planning to operate it as a standalone business.

"Prop firms are a good sales channel for CFD brokers. So, OANDA will be able to leverage the FTMO business to drive new traders into their brokerage,” commented Ryan Nettles, the Director and Head of Advisory at Guru Capital.

"We will continue to see more prop trading firms acquiring, establishing or partnering with CFD brokers as prop trading firms are good sales channels for brokers."

Finance Magnates has learned through insider discussions that this move isn't about acquiring a brand, but rather about securing established regulations and the expertise of people who know how to manage these regulations. OANDA holds licenses in the USA, where obtaining local market licenses is notably challenging.

"By acquiring OANDA, FTMO basically gains access to a team that knows how to navigate a lot of these challenges—regulation, getting licenses—it's like having a seasoned guide in one of the trickiest markets in the world," commented Kathy Lien from BKTraders.

Furthermore, running a prop trading business becomes much easier when having a fully licensed FX/CFD broker in the portfolio. As Lien from BKTraders pointed out, a licensed broker can directly access liquidity providers and interbank markets, eliminating the need for third-party companies. This enables immediate execution of hedging positions and better control over trading costs and spreads.

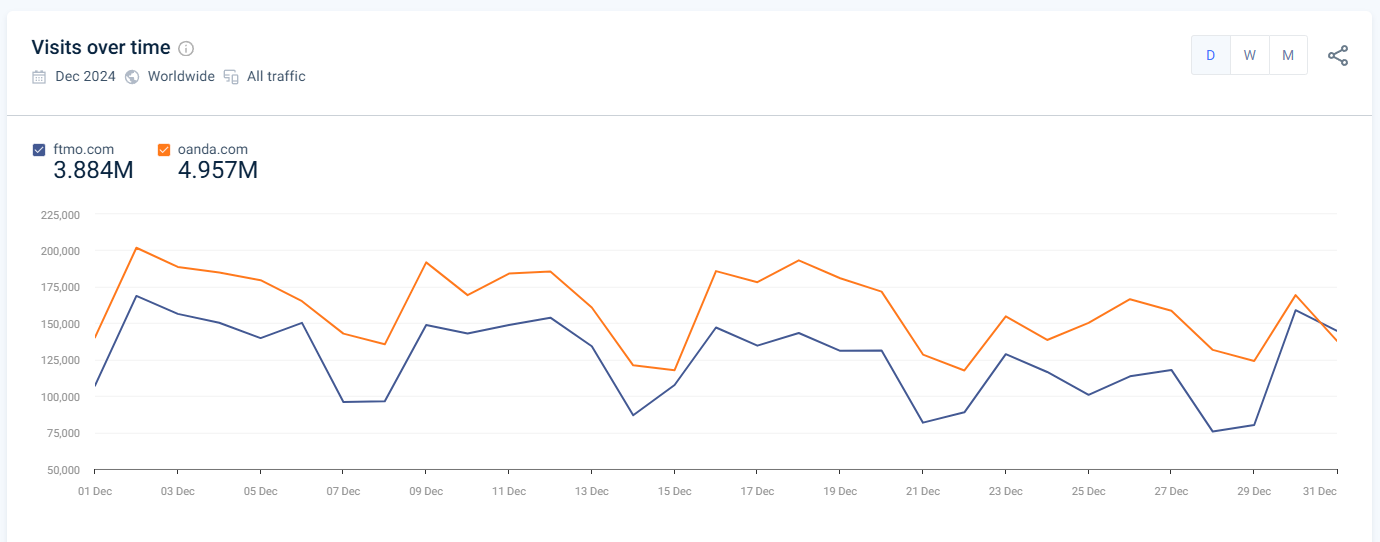

A key factor could also be the intention to attract clients from other markets. Similar Web data, which may not be entirely precise but can still indicate general trends, show that a significant portion of OANDA’s traffic comes from the United States (91% for OANDA vs. 9% for FTMO). Moreover, monthly traffic figures suggest that OANDA remains a slightly more popular brand than FTMO, by a margin of roughly 30% in favor of the broker.

"OANDA is a highly-respected name in the United States and Canada," commented Adam Button, the Chief Currency Analyst at Forexlive. "It's one of the few firms that were able to navigate the shifting regulations through the Swiss National Bank crisis and the many changes in the broker landscape since."

Prop Trading Industry's Pain Points in 2024

Traders are becoming increasingly successful, generating substantial costs for prop trading firms, which has led to the downfall of many such companies. In 2024 alone, 40 such businesses have ceased operations. OANDA's infrastructure and direct market access could help FTMO hedge trades directly, thereby reducing the risk of large-scale payouts destabilizing the firm's financial stability.

“One of the biggest challenges for prop firms is handling their top traders who consistently hit the profit targets,” added Lien. “Without solid risk management and experience, this can expose the firms to significant financial strains.”

It's no coincidence that as prop trading has become increasingly popular in recent months, many FX/CFD brokers have started joining this trend. For them, running a prop trading business is both easier and more cost-effective. OANDA itself recognized this opportunity and launched its OANDA Prop Trader brand over a year ago.

Brand Power Dynamics

The acquisition reveals an interesting dynamic in brand strength. While OANDA maintains significant recognition in the US market, FTMO has emerged as a more powerful global brand in recent years. This is evidenced by FTMO's impressive growth, generating over $213 million in turnover in 2023, marking a 20% year-over-year increase.

Additionally, the Czech firm reported that the number of open trading accounts exceeded 2.3 million in 2024—a 33% increase from the previous year. It also noted an 80% rise in total payouts to traders in the first seven months of 2024 compared to the same period the previous year.

"FTMO should focus on what it does best—marketing. The company can continue collecting challenge fees consistently," said Brian Griffin, the Chief Executive Officer at Fuze Traders. "Any customer who starts a challenge with FTMO would automatically receive a live account with Oanda. Additionally, copy trading should be enabled between the customer’s challenge account and their live account if funded."

As Griffin added, from now on, FTMO needs to stop using the term "DEMO trading" on its website and in its materials and all clients, upon signing up, should be moved directly to the live OANDA servers.

The OANDA transaction also signals a broader trend toward industry consolidation and demonstrates how prop trading firms, traditionally seen as market disruptors, are now becoming major institutional players.

"The industry is probably going to stabilize between say 2-3 players which will take 70-80% of the market," Otakar Suffner, the Co-Founder of FTMO commented during FMLS:23.

How Much Could FTMO Have Paid for OANDA

While the financial terms of the deal weren't disclosed, CVC purchased OANDA in 2018 for $175 million. At that time, the company claimed to have approximately 100,000 active traders worldwide.

Assuming the company's valuation remained stable, the acquisition cost per OANDA client for FTMO would amount to $1,750. However, these are merely estimates, and the final cost per client could be significantly different, especially considering OANDA's structural changes and diversification under CVC ownership in recent years.