“I was actually making my company for the cheaters, not for the traders,” James Glyde, the CEO of PipFarm, candidly admitted in his latest interview, detailing how he uncovered an international ring of fraudsters. He stumbled upon an organized group of traders systematically exploiting proprietary trading firm challenges through coordinated hedging operations.

The scale, reach, and professionalism in their operations exceeded even the boldest expectations. As he acknowledged, it turned out that “what’s good for traders is often good for cheaters,” too.

Inside the 800-Member Trading Cartel Bleeding Prop Firms Dry

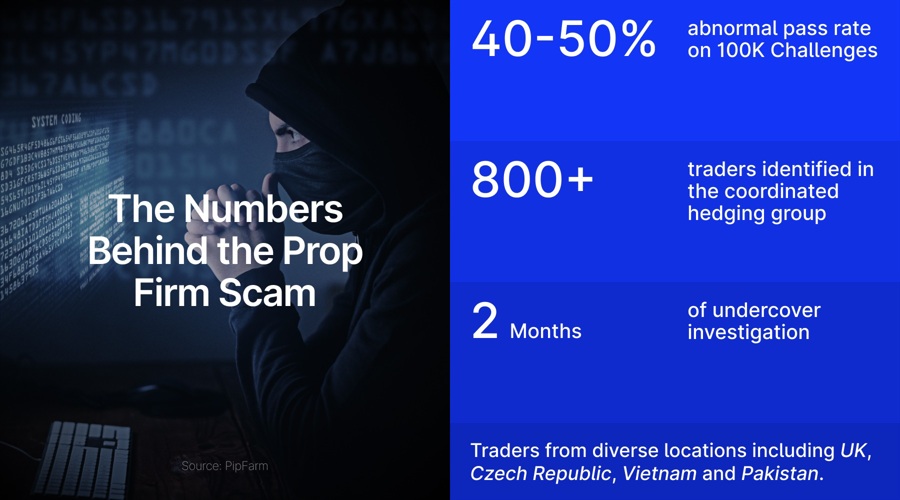

The investigation began when PipFarm noticed an unusually high pass rate—approaching 50%—on their 100K two-stage challenges with static drawdown parameters. This anomaly prompted Glyde to suspect coordinated manipulation rather than legitimate trading success.

“We had this incredibly high pass rate on the 100K accounts. Our pass rate was above 40%, kind of like way too close to 50,” Glyde explained in a revealing interview with Prop Firm Journal, “My first instinct was like, these gamblers are so lucky. But it didn't make any sense.”

The breakthrough came when a whistleblower provided PipFarm with a list of suspected cheaters. After verifying several email addresses matched actual PipFarm customers, the company created an alias and infiltrated the group, which Glyde described as “an open outcry pit for hedgers.”

“They were all working together to do their buys and sells on different firms. It's crazy,” said Glyde. “This was not even a small group—it was like 800 traders inside.”

You can check the whole interview in the video below:

“They're From Everywhere”

Contrary to industry assumptions that such schemes originate from specific regions, Glyde discovered participants came from diverse locations including the UK, Czech Republic, Vietnam, Pakistan, and Canada.

“They're from everywhere,” Glyde noted. “Banning countries doesn't make any sense because there are cheaters everywhere.”

For two months, PipFarm operated undercover within the group, identifying participants and studying their methods. The hedging strategy typically involved taking opposite positions across different prop firms to guarantee profits regardless of market movements—essentially turning the 50/50 probability of market direction into a near-certain win.

You may also like: “MetaQuotes Did a Huge Favor for Prop Trading”; 70% of Traders Want Regulation

How “Successful Traders” Are Actually Cheating

The investigation revealed the groups employed sophisticated methods to avoid detection, including:

- Using time delays between trades

- Hedging 100K accounts against 250K accounts

- Coordinating across multiple prop firms

- Adapting quickly to rule changes

When PipFarm implemented new rules to counter the manipulation, the group would immediately adjust their strategies. After conducting a trader interview on a Thursday, by Monday the group had issued warnings that “PipFarm is suspicious” and instructed members to “be more random.”

“Changing rules doesn't make any sense because by definition a cheater is going to manipulate rules,” Glyde said. “Adding these rules only limited normal traders and didn't do anything for the cheaters.”

When Scammers Demand KYC

In one of the most surprising twists of PipFarm's undercover operation, the company's team encountered an unexpected hurdle—the fraudsters had implemented their own verification system to protect their operation.

"We tried to join the group, but they could see that we used a VPN. For them that was a red flag, just like how firms also don't like some traders using VPNs," Glyde explained. "Then they wanted to do KYC—they wanted passport, selfie holding up the passport next to his face."

The irony wasn't lost on Glyde, whose team went to extraordinary lengths to circumvent the scammers' verification process. "We turned off all the lights to make it a dark room so that his face wouldn't be clear. Our KYC was rejected by the scammers," he recounted with a hint of disbelief.

Industry-Wide Problem

After two months of undercover surveillance, PipFarm reached its limit. "In the end, we kicked everyone out and shut it down," Glyde stated. "It was painful, but necessary." The decision to terminate the operation wasn't taken lightly. "I had told myself that this will not go beyond the end of the year," Glyde explained. "Already two months of paying these people—that was my absolute tolerance."

The aftermath required significant rebuilding efforts for PipFarm, but the insights gained proved invaluable not just for the company but for the entire industry. Within 48 hours of Glyde's public disclosure, approximately 20 prop firm CEOs reached out to share similar experiences and collaborate on solutions.

"It made me feel better about being taken advantage of because I knew that it didn't just happen to me," Glyde said. "It's something that's happened to the entire industry."

The experience has led PipFarm to shift its approach from adding restrictive rules to implementing behind-the-scenes monitoring systems. The company is now removing restrictions added last year that primarily hindered legitimate traders while doing little to stop coordinated manipulation.

For the prop trading industry, which offers funded accounts to traders who pass challenges, this type of manipulation represents an existential threat. Glyde believes the solution lies in industry-wide vigilance rather than more restrictive trading parameters.

"What I need is a healthy industry," Glyde emphasized. "Traders need stability."