In the world of institutional liquidity, “business as usual” is a dangerous concept when the underlying market dynamics have fundamentally shifted.

For years, the industry treated Gold (XAU) and Silver (XAG) with a static mindset regarding spreads and financing costs. However, the recent price action in precious metals is not merely a trend; it is a categorical shift in market structure.

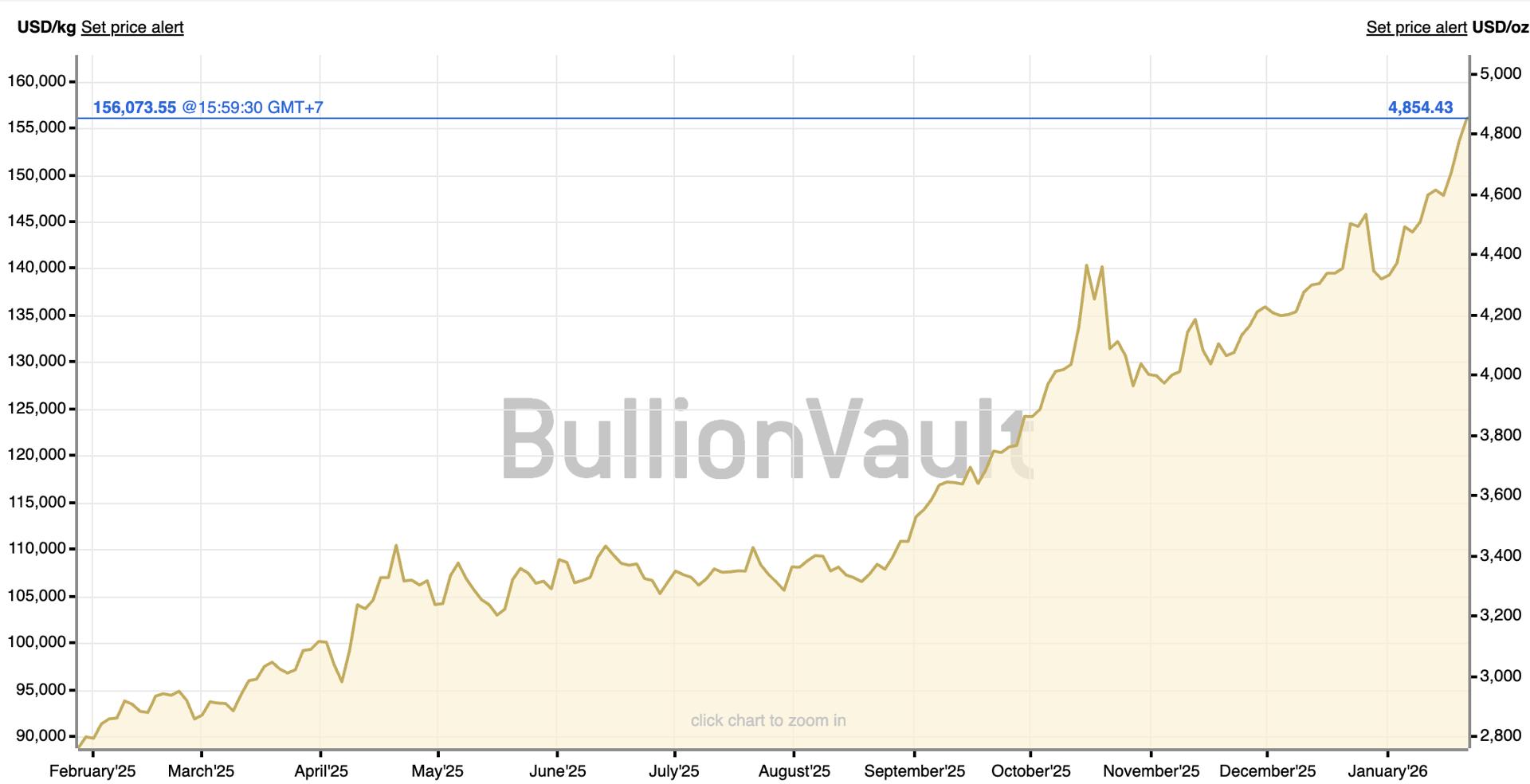

As we move through the post-2025 landscape, marked by record nominal highs and severe dislocation in physical inventories, the brokerage industry faces a critical choice: cling to outdated pricing models that risk liquidity failure, or adapt to the reality of the new volatility regime.

At Scope Prime, we believe in the latter. We believe that transparency regarding these structural pressures is the only way to build long-term trust.

Read more: Gold Trading Rises to 90% of Total Volumes, but Liquidity Is Not a Concern for CFD Brokers

The Precious Metals “Trilemma”

The widening of spreads we are seeing across the institutional space, including our recent updates to XAU and Gold Futures (GC) structures, is a rational market response to a “trilemma” of structural pressures.

To understand why trading costs are evolving, we must look at the engine room of the market.

1. The Nominal Value and Capital Reality

As gold breaks nominal records, the “real cost” of a fixed spread diminishes. A 10-cent spread at $1,500/oz represents a different risk profile than at $4,500/oz or beyond.

Furthermore, the shift by major exchanges, such as the CME Group, towards percentage-based margins rather than fixed nominal values has sharply raised the capital requirements for holding positions.

Market makers are capital-constrained entities. When the cost of capital to hedge a trade doubles, the cost to facilitate that trade must adjust to maintain the same depth of liquidity.

2. Physical Dislocation and the “Liquidity Drain”

The spot price is no longer decoupled from physical reality. We are witnessing historic levels of central bank demand that are effectively draining liquidity from the accessible market.

This was clearly shown in 2025, when we saw significant arbitrage opportunities open between London and Shanghai. While gold has grabbed headlines, silver has quietly faced a liquidity crisis of its own, with prices rising by more than 100% in the last quarter alone. This is not standard bullish sentiment; it is a sign of acute physical scarcity that has forced a split in liquidity.

As industrial demand from China reduced physical inventories, the arbitrage window closed, leaving traditional liquidity pools shallower than they have been in decades.

This shortage has triggered persistent backwardation in the futures curve, where spot prices trade higher than futures prices. This is a rare market signal showing that immediate physical ownership is valued more than future delivery.

During recent weeks of peak lease rate stress, we observed institutional raw spot gold spreads widen from a baseline of 10–15 cents at the start of last year to 40–80 cents, a 300% to 500% rise in hedging costs.

- Gold Volatility Drives Scope Prime Spread Update Amid CME Margin Changes

- Why Gold Is Surging With Silver and Why Experts Predict $6,000 Price in 2026

- Record Gold Price Drives Half of BingX's $1 Billion TradFi Trading Surge

3. Market Microstructure and HFT Sensitivity

In this environment, “toxic flow” orders that aim to predict short-term price movements with high accuracy become more dangerous to liquidity providers. Leading HFT market makers use advanced algorithms that automatically widen spreads when volatility patterns meet specific “toxicity” rules set in advance.

If a prime broker does not adjust pricing to reflect this widening from primary market makers, they are effectively subsidising the trade. This is not a sustainable business model and introduces counterparty risk for clients.

JUST IN: $4,850 Gold pic.twitter.com/K5JJhOLrDP

— Watcher.Guru (@WatcherGuru) January 21, 2026

Volatility-Adjusted Cost: The New Metric

Clients often focus on the nominal spread. However, the more meaningful metric is the volatility-adjusted cost. With implied volatility in precious metals staying high due to geopolitical tension and shifts in monetary policy, a wider nominal spread is required to provide the same chance of execution that clients expect.

Tighter spreads in a highly volatile and illiquid market are often an illusion. They may appear on screen but disappear during execution through slippage or rejected orders. We have chosen to move away from the appearance of tight spreads that cannot be supported by capital and towards a transparent structure that ensures execution quality.

Leading with Transparency

As Daniel Lawrance, our CEO, recently stated: “Aligning pricing to the current market environment is essential to sustaining consistent, high-quality liquidity provision.”

We are not simply updating a price sheet; we are strengthening our risk management framework. By adjusting our spreads on XAU and GC futures, Scope Prime ensures that when clients need to enter or exit the market during a volatility spike, liquidity is available and reliable.

The period of cheap, static leverage in precious metals may be slowing as the asset class moves into a higher valuation range. This can be a healthy development for the market, provided brokers and liquidity providers are open about what is required to service this flow safely.

At Scope Prime, we remain committed to setting the standard for institutional-grade reliability, placing the security of operations, clients, and partners above all else.