XTB revealed a fundamental change in how its clients are deploying capital, according to preliminary results for 2025 released yesterday (Thursday). Stocks now represent the largest asset class on the platform by nominal value, overtaking contracts for difference that built the company's business over the past decade.

XTB Client Assets Shift Away from CFDs

Client-held stock positions reached 15.1 billion zlotys (around $3.8 billion) at year-end, nearly doubling from 7.9 billion zlotys twelve months earlier. Exchange -traded funds climbed even faster, jumping 110% to 12.1 billion zlotys. Combined, these two long-term investment products now account for 60% of total client assets.

- Multi Asset Broker XTB Launches American Style Options Under CySEC Supervision

- ING Bank Securities in Poland Plans Investment Retirement Account Push to Challenge XTB Dominance

- XTB Trading Volumes Jump 76% as Poland's Bull Market Roars

CFD positions grew just 26% to 12.7 billion zlotys, falling to third place in the asset breakdown. That's a sharp reversal for a product that generated most of XTB's revenue through 2023 and once dominated client portfolios.

XTB Client Assets in Nominal Value (in PLN millions) at Period End:

Category | 2025 | 2024 | 2023 | 2022 | 2021 |

Stocks | 15,139 | 7,908 | 4,095 | 2,362 | 1,846 |

ETFs | 12,145 | 5,774 | 2,053 | 1,083 | 606 |

CFDs | 12,654 | 10,027 | 8,911 | 7,354 | 7,858 |

Cash | 5,864 | 3,751 | 2,267 | 1,939 | 1,787 |

TOTAL | 45,802 | 27,460 | 17,326 | 12,738 | 12,097 |

The figures came from XTB's preliminary 2025 results, which painted a mixed picture: profit fell 24%, but the company laid out aggressive product expansion plans for 2026. Judging by the stock's performance, investors focused on the growth story rather than the earnings miss. Moreover, the results turned out to be better than analysts' median forecasts.

First Trades Tell the Story

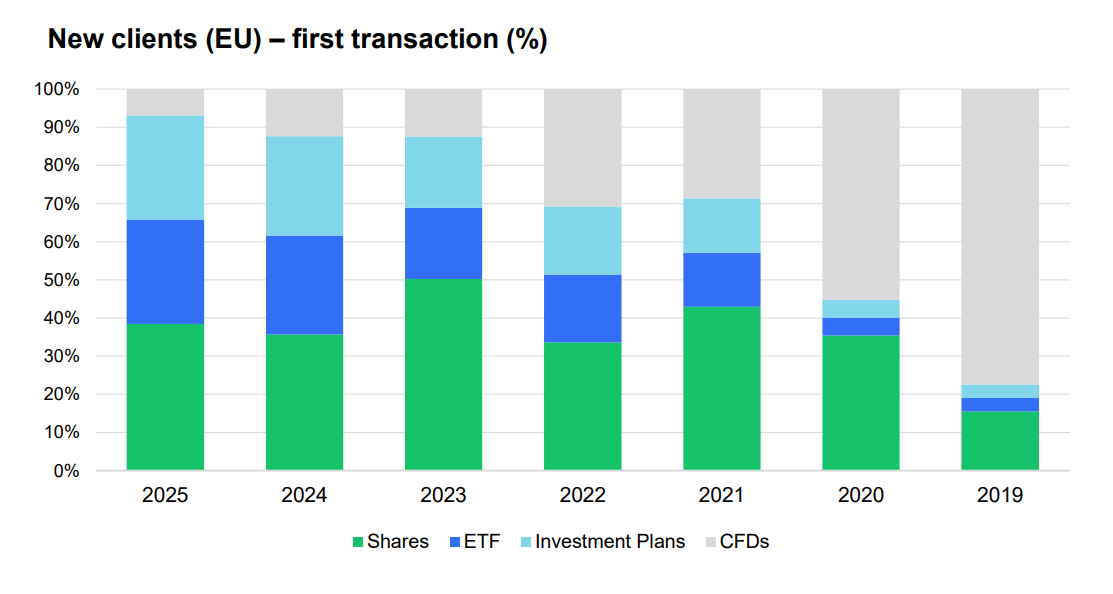

The shift becomes clearer when looking at what new clients do first. In 2019, 80% of new European Union customers opened their first position in CFDs. By 2025, that figure dropped to just 7%.

“The transformation of XTB from a CFD broker to a modern FinTech entity providing a universal investment application has been progressing in recent years,” the fintech commented in the statement. “This transformation will continue into 2026 and beyond.”

Stocks captured 38% of first trades last year, with investment plans at 28% and ETFs at 27%. The trend accelerated from 2023, when CFDs still represented 13% of initial transactions.

XTB has been pushing this transformation since 2024, adding tax-advantaged retirement accounts in Poland (IKE and IKZE), Britain (ISA), and France (PEA). The company now manages over 174,000 of these long-term savings accounts, up from effectively zero two years ago.

Revenue Mix Stays Tilted to Derivatives

There's also visible gold fever among retail traders. Gold-linked CFDs alone accounted for 38% of all derivative trading volume in 2025, followed by the Nasdaq 100 index at 28%.

Total client assets under custody hit 45.8 billion zlotys, up 67% year-over-year. Cash balances grew 56% to 5.9 billion zlotys, suggesting clients are parking more money on the platform between trades.

The company processed 53 million transactions on stocks, ETFs and investment plans in 2025, nearly triple the prior year's volume. That compares with 8.9 million CFD contracts measured in lots, using the broker's standardized unit.