Retail brokers have been marketing their services via sports sponsorship deals for a number of years now. From boxing and polo to Formula One and football, it’s not uncommon for sports fans of all stripes to see Plus500, AvaTrade or eToro logos blazed across their screens as they settle down for some weekend entertainment.

Most of these sponsorship efforts are framed in rather vacuous terms. Execution is compared to punching someone in the face and algo trading is used as an analogy for Ronaldo smashing a football into a goal-net.

Beyond the PR smokescreen, however, there is certainly huge value in sports sponsorship. After all, brokers would not be splashing out millions of dollars on sponsoring teams and players if they didn’t think they would be getting something in return.

What exactly is that return? To find out, Finance Magnates spoke to a number of brokers and specialists in sports sponsorship.

Brand Exposure

As is to be expected of any marketing strategy, brand exposure is a key goal of sports sponsorship deals.

In fact, it seems to be the at the top of a broker’s wishlist when sponsoring a sports team or player. A quick look at sports’ viewership numbers gives an immediate indication as to how much exposure brokers are getting.

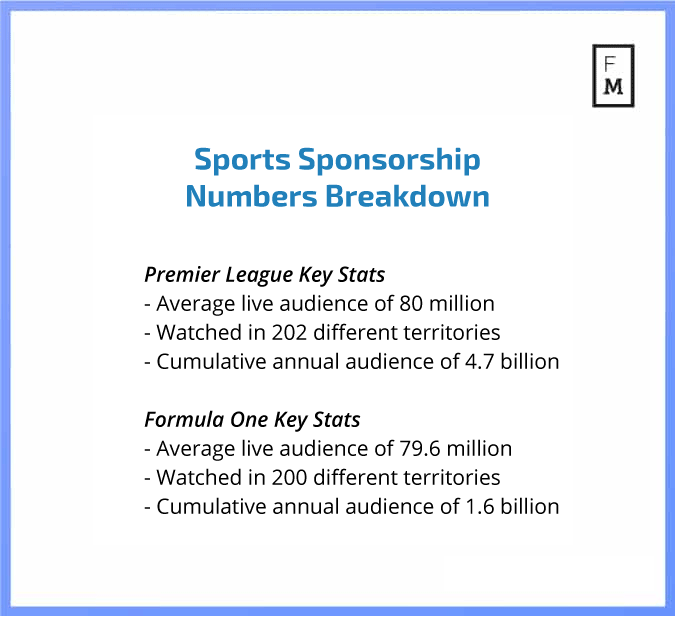

For football, the numbers are mind-boggling. Cumulatively, the English Premier League has an audience of 4.7 billion people across 202 territories. That means that, in a given year, over 60 percent of human beings on earth will watch a Premier League football game.

On top of this, the average game is watched live by over 80 million people. So next time you are watching Jurgen Klopp leap into the air or Raheem Sterling miss his 10th chance of the game, remember that more than one percent of mankind is likely watching with you.

Source: Van Hawke Sports

“The Premier League is followed by a huge group of people from all kinds of demographics all over the world.” Iqbal Gandham UK Managing Director at eToro, told Finance Magnates, “For a global company like eToro, it is therefore a great way to reach both current and new potential customers across the 140 markets we are currently active in, as well as new prospective markets.”

Sunny Singh, Founder and CEO, Van Hawke Sports

The numbers are also staggering for Formula 1. An average of 79.6 million people watch each race and, cumulatively, 1.6 billion people, from 200 different territories, watch its drivers zip around the various Grands Prix held across the globe each year.

“In terms of brand awareness, there is no other market out there that has such a broad reach.” Sunny Singh, Founder and CEO of sports marketing agency Van Hawke Sports, told Finance Magnates, “So it’s becoming a more and more popular option for brokers. It’s even embedded - permanently - in some brokers’ marketing plans now.”

Expanding with the Team

The global reach that sports sponsorship can provide is particularly beneficial to firms with operations around the world. It can also come in handy when firms are looking to expand.

Dáire Ferguson, AvaTrade CEO (left) and Damian Willoughby, Senior Vice President of Partnerships at City Football Group (right)

AvaTrade, a broker that sponsors football team Manchester City, has managed to tap into the club’s global audience. That will come in handy as the broker looks to expand in Asia and Africa.

“In China and Asia, AvaTrade and Man City have now become synonymous across the football and financial trading landscape.” Said AvaTrade’s CEO, Daire Ferguson, speaking to Finance Magnates, “And of course in the Middle East - due to its Abu Dhabi ownership structure - Man City has a massive fan base.”

Other brokers may not have such grandiose plans. Nonetheless, sports sponsorship is still a means by which they can spread knowledge of their services, whether that’s within their regulated jurisdiction or abroad.

“We received a lot of feedback from new clients saying they wished that they were aware of our presence earlier.” Nauman Anees, Co-Founder and CEO of ThinkMarkets, told Finance Magnates, “Sponsoring Amir Khan, a boxer with a very strong name both in the UK and across the globe, has come at the perfect time for us as we extend our presence on the CFD market with an aim to be a top-ten provider in the next five years.”

Dodging the Regulators

Manchester Utd manager Jose Mourinho giving a post-match interview. The eToro logo is clearly visible in the background.

Exposure to fans via sports events can also help brokers get around existing regulations. Online advertising may be forbidden in China but there is nothing to prevent people in the country seeing an eToro logo at a Manchester United game.

This issue actually popped up in May of this year when Robert Ophèle, president of the Autorité des marchés financiers, launched a scathing attack on Plus500. In a speech that also targeted Cryptocurrencies and binary options brokers, he said the contracts-for-differences (CFDs) broker “specializes in toxic products.”

His reason? Atletico Madrid, a Spanish football team, had just played the final of the Europa League in Lyon with the Plus500 logo emblazoned across their players' chests. As I’m sure our readers are already aware, it is illegal for CFD brokers to advertise in France.

Targeting Clients

Aside from annoying regulators, brokers can also target more niche audiences with their sponsorship efforts.

“There isn’t a one size fits all model. At Van Hawke Sports we actively work with brokers to determine which sporting asset is going to work for them best.” Noted Singh, “Brokers are looking keenly at what their return on investment is going to be.”

Boxer Amir Khan shakes hands with ThinkMarkets CEO Faizan Anees

For many brokers that ROI is attracting a more high-end clientele. ICM Capital, for example, has sponsored the England Polo Team, an extremely bougie cycling event and Fulham Football Club - probably the poshest football club in the world.

ICM did not respond to Finance Magnates for comment but it seems very probable that their sponsorship of ‘high-end’ events and teams is aimed at attracting a posher client base.

ATFX, another retail broker, has pursued similarly opulent sports sponsorship opportunities. Just last month, the broker announced that it was sponsoring the Duke of Edinburgh Cup, a charity golfing tournament started by Queen Elizabeth’s husband, Prince Philip.

“Through our sponsorship efforts we hope to improve the lives of young people all around the world.” ATFX told Finance Magnates, “Alongside this, the event can help us leverage our brand.”

Sports Sponsorship - Here to Stay

“Improving the lives of young people” may sound like a PR-spin but it’s worth noting a couple of positive macro effects of sports sponsorship efforts. Firstly, if firms genuinely do sponsor charities, that money does go to charitable organizations.

ATFX at a Duke of Edinburgh Cup event

This calls to mind Sam Harris’ bravery paradox. You can’t fake being brave because even if you fake acting bravely, you are still acting bravely.

Similarly, brokers such as ATFX or ThinkMarkets may be using charitable donations for the positive PR. Nonetheless, they are still giving money to charities and so charities will benefit from their money.

For the industry as a whole, sponsorship efforts raise awareness about retail brokers. When Plus500 is splashed across Europa League football fields, people will be curious as to what it is they do.

Some brokers even claim that this is part of their goal. Again, the bravery paradox applies.

“We hope that our sponsorship of the Premier League will increase awareness of bitcoin and the potential of cryptoassets and Blockchain .” Gandham told Finance Magnates, “eToro believes that blockchain technology could offer ways to improve the football experience for everyone.”

Whatever the case, sports sponsorship looks here to stay. The viewership numbers in and of themselves are enough to justify sponsorship of sports teams.

When you add regulatory loopholes, the ability to expand with a team that has global reach and any positive PR that may come with such deals, it’s easy to see why so many brokers are keen on them.