After a 40% increase in 2024, Litecoin (LTC) remains overshadowed by Bitcoin (BTC). While Bitcoin is testing new all-time highs (ATH) this week, Litecoin seems largely unaffected. Moreover, technical analysis indicates that Litecoin's price could potentially drop by as much as 50% from its current levels, revisiting the lows from August 2024.

Will Litecoin go up? Or is it headed for a steeper decline, possibly returning to the $50 range? Let's delve into the factors influencing its trajectory.

Will Litecoin Ever Go Up? LTC Price In Consolidation

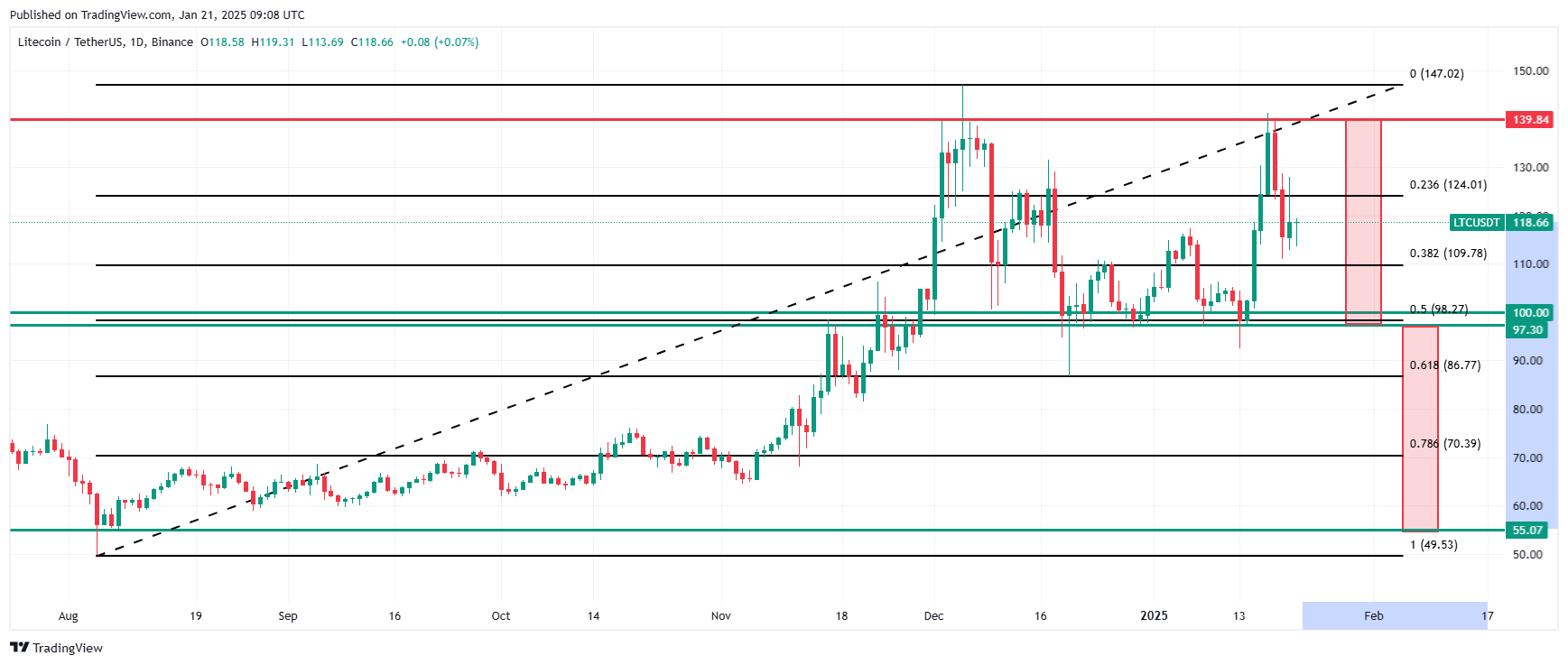

As of January 21, 2025, Litecoin is trading at approximately $117, reflecting a 5.03% decrease from the previous day. At the end of last week, the price of the second-oldest cryptocurrency was testing levels above $140, aligning with the local highs from December 2024. Together, these levels form a double-top pattern, which will be discussed further in this analysis.

Litecoin's recent price movements have been influenced by speculation regarding the potential approval of a Litecoin exchange-traded fund (ETF). Reports suggest that Nasdaq has filed an application to list a Litecoin ETF, which, if approved, could attract institutional investors and significantly impact LTC's price and adoption.

On-chain metrics also indicate a bullish outlook for Litecoin. Notably, 72% of LTC addresses are currently in profit, suggesting widespread gains for holders. This profitability often correlates with sustained bullish sentiment, as market participants are less likely to sell at a loss.

⚡️📈 Litecoin has decoupled from other altcoins, jumping +16.1% in market cap in just the past 11 hours. Just as we saw in early December, the key driver appears to be whales and sharks holding at least 10K+ $LTC. They have accumulated 250K coins since Jan. 9th. 👀 pic.twitter.com/zCmu7tGKJl

— Santiment (@santimentfeed) January 15, 2025

Interestingly, the latest all-time high (ATH) for Bitcoin , triggered by the emergence of Donald Trump's new token and his inauguration as president, did not spark significant market enthusiasm for Litecoin. Let’s examine why.

"Some of the cryptocurrency bulls were disappointed there was no announcement yet on what many had thought would be an opportunity for the incoming administration to opine or issue EO relating to digital assets," commented Paul Howard, Senior Director at Wincent. "The realization for many is the awareness they find themselves living in a crypto echo chamber whereas the reality is there was enormous messaging already in the actions over the weekend with the launch of $TRUMP and $WLF. Our OTC desk was very active in the former since launch."

Why Litecoin Is Not Going Up? Technical Analysis of LTC Price

Technical analysis may not bring encouraging news for Litecoin enthusiasts. My recent review indicates that Litecoin's daily chart shows a double-top formation, a pattern that often signals a trend reversal.

The double-top was formed around the $140 mark in December and was retested in mid-January, encountering strong selling pressure both times. Currently, Litecoin is expected to decline toward the lower boundary of the two-month consolidation range. This boundary aligns with the psychological $100 level and local lows near $97.

If this range is breached, it would confirm the bearish formation, with its target coinciding almost perfectly with the August lows around $55. This "coincidence" is certainly intriguing for proponents of market geometry theories.

Breaking below the $100 level, the lower limit of the consolidation, may not be straightforward. This level is reinforced by the 50% Fibonacci retracement measured from the upward trend between August and December 2024, during which Litecoin's price surged by 200%.

If my bearish scenario materializes, Litecoin could decline by more than 50% from its current price, testing its lowest levels in over six months.

Litecoin Price Predictions 2025

Litecoin was once dubbed the "silver of the cryptocurrency market" and intended to be a direct competitor to Bitcoin. Over the years, however, with increasing competition, its role in the cryptocurrency market has diminished, along with its position among the largest tokens.

Currently, with a market capitalization of $8.8 billion and a daily trading volume of $1.2 billion, Litecoin ranks as the 20th largest cryptocurrency according to CoinMarketCap. Although many investors have shifted their focus elsewhere, Litecoin remains a noteworthy player.

Analysts have provided various forecasts for Litecoin's price in the coming years:

- 2025: Predictions suggest that Litecoin could exceed the $150 mark, with some estimates reaching up to $200.

- 2030: Long-term forecasts are more optimistic, with potential prices surpassing $700, and some estimates reaching up to $1,200.

"The +/-10% moves we have witnessed over the last 5 days are reassuring that once more specific announcements come (eg. an SBR expected by moderate bulls or changes to banking regulations anticipated by the most bullish), we can expect to see some outsized price moves," Howard added.

While Litecoin has demonstrated significant growth and shows potential for further appreciation, the cryptocurrency market remains volatile. Factors such as ETF approval, miner activity, and broader market trends will continue to influence LTC's price trajectory. Investors should conduct thorough research and consider market dynamics before making investment decisions.

Litecoin Price, FAQ

How high will Litecoin be in 5 years?

Based on multiple analyst forecasts, Litecoin is expected to trade between $320.88 and $809.33 by 2030. Conservative estimates suggest a minimum price of $199.56, while more optimistic predictions point to potential highs around $707.39 on average. The most realistic target appears to be in the $400-500 range, with a peak forecast of $410.55.

Will Litecoin reach $10,000?

Reaching $10,000 is considered impossible by market analysts and technical forecasts3. Even the most optimistic long-term predictions for 2030-2031 stay well below $2,000, with the highest forecasts ranging between $1,200 and $1,500.

Is Litecoin going up in value?

Current technical analysis indicates an upward trajectory, with predictions showing steady growth potential. The cryptocurrency is expected to reach $151.47 by February 17, 2025. A critical threshold exists at the $132.78 Fibonacci retracement level, which could trigger further upward momentum if broken.

Will Litecoin ever reach all time high?

Most analysts' predictions suggest Litecoin will gradually appreciate but remain below its previous all-time high in the near term. By 2030, several forecasts indicate potential prices between $320.88 and $809.33, which could approach historical peaks. However, this growth is expected to be more gradual and sustainable compared to previous bull runs.