On February 24, 2025, Dogecoin (DOGE), the popular memecoin, is experiencing a significant price slump, currently trading at $0.2330.

A drop to the lowest levels since early November—over three months—has traders wondering: Will Dogecoin crash? In this article, we examine why the DOGE price is going down and what the DOGE price predictions and technical analysis suggest about its future.

Why Is Dogecoin Price Down Today?

As of 07:57 AM CET on February 24, 2025, DOGE is priced at $0.2330, based on data from CoinMarketCap. This figure reflects a decrease from recent highs, with a 24-hour low of $0.2264 and a high of $0.2474, indicating stronger volatility .

The decline aligns with broader market trends, particularly within the memecoin sector, which has seen increased selling pressure. This is evident from the 24-hour trading volume and market cap data, suggesting a bearish sentiment among traders.

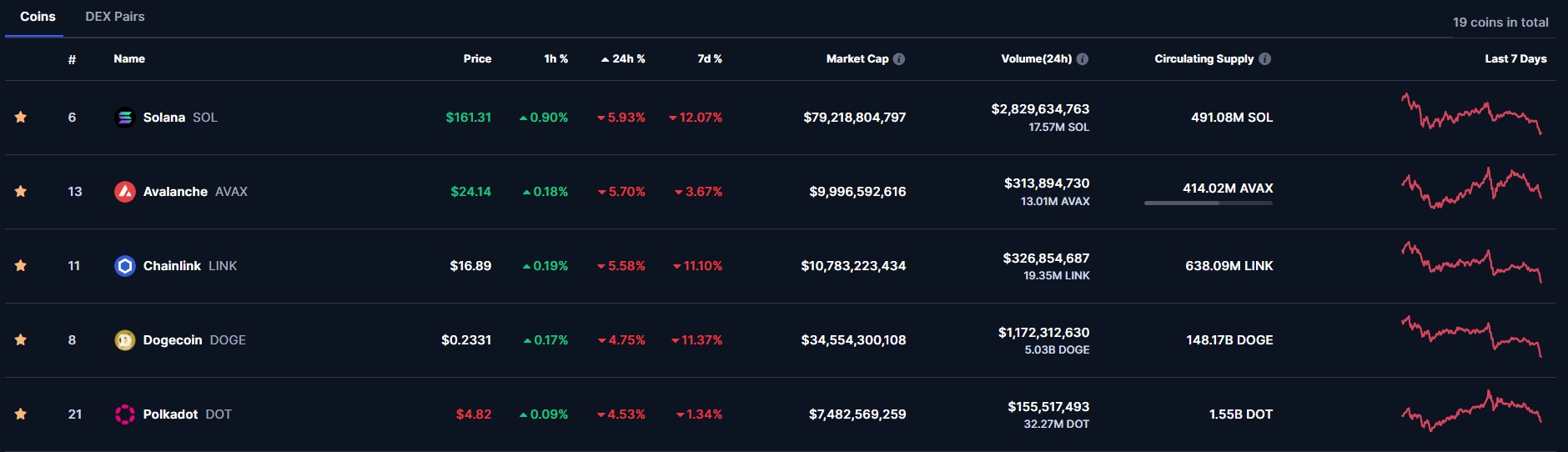

Over the past 24 hours, the cryptocurrency market has been dominated by declines. Leading the losses is Solana (SOL), down more than 6% to $161. Dogecoin is also among the top decliners, dropping nearly 5%. Avalanche (AVAX), Chainlink (LINK), and Polkadot (DOT) are also experiencing significant declines.

You may also be interested in: Will Dogecoin Reach $10? DOGE Current Price and Predictions for 2025

Why is Dogecoin Crashing: Analysis of Price Drop Causes

The primary driver behind DOGE's price drop is the recent failure of the LIBRA token, a memecoin promoted by Argentine President Javier Milei. This event saw LIBRA surge to a $4.5 billion valuation following Milei's endorsement before crashing by over 90%. The crash was triggered by insiders cashing out $107 million and the development team withdrawing $87 million from liquidity pools, leading to allegations of a pump-and-dump scheme.

This failure, occurring around February 15, 2025, has had a ripple effect across the memecoin market. The LIBRA token's collapse triggered an intensive sell-off.

Additional factors include macroeconomic pressures, such as rising Treasury bond yields and potential new tariffs. These factors have created valuation pressures for cryptocurrencies, including DOGE, amplifying the impact of the LIBRA token failure.

Dogecoin Technical Analysis: Next Downward Target at $0.20

Looking at Dogecoin's current technical chart, we can see that on Monday, the price formed local lows at $0.2265. While the price dipped lower on February 3, briefly reaching around $0.20, based on closing values, the current level marks the lowest since early November—over three months ago.

At the moment, the Dogecoin price is breaking below the support zone near $0.2418, which was established by the early February lows. If the price closes Monday below this level, it could pave the way for further depreciation, potentially toward the psychological threshold of $0.20.

However, zooming out and analyzing the chart from the first half of 2024, we can see that the current lows around $0.23 align with the highs from late March. This level may provide additional short-term support.

In my opinion, the bulls will only be able to breathe a sigh of relief once Dogecoin’s price returns to $0.30, where a key resistance zone is located.

Check my other Dogecoin analysis: Will Dogecoin Reach $1? DOGE Latest Price Surge and 2024–2025 Predictions

Bitcoin Price Predictions and Analyst Insights

Looking ahead, various platforms and analysts have provided predictions for DOGE's price in 2025 and beyond, offering a range of scenarios:

Source | Prediction for 2025 | Notes |

CryptoNewsZ | Maximum $0.39, Minimum $0.25 | Expects new ATHs due to Bitcoin Halving impact. |

CoinPriceForecast | End of year $0.1228, Mid-year $0.1131 | Conservative estimate. |

DigitalCoinPrice | Maximum $0.20, Minimum $0.17 | Reflects cautious growth. |

Coinpedia | Potential $1.07, Average $0.845 if momentum | Driven by FOMO and influencer endorsements. |

Changelly | Maximum $0.2348, Minimum $0.1897, Average $0.1966 | Suggests possible drop. |

CoinCodex | Predicted to reach $1.364212 by April 2025 | Uses machine learning. |

InvestingHaven | Minimum $0.244, Maximum $1.445 | Revised upward with new ATH expected. |

You can find my in-depth analysis of the price prediction for Dogecoin for 2025 and 2030 in this article.

These forecasts highlight a spectrum of possibilities, from conservative growth to significant increases, depending on factors like market adoption, technological advancements, and community sentiment.

Will Dogecoin Crash? Conclusion

The current slump in Dogecoin's price, trading at November lows on February 24, 2025, is primarily driven by the LIBRA token failure, which has triggered a sell-off in memecoins. This event, coupled with broader macroeconomic pressures, has led to a bearish outlook in the short term.

However, future predictions for 2025 suggest potential recovery, with some analysts forecasting prices up to $1.07, offering hope for investors. As the market evolves, stakeholders should monitor these trends closely, considering both the risks and opportunities presented by DOGE's volatile nature.

Dogecoin News, FAQ

Why does Dogecoin keep going down?

The persistent decline in Dogecoin's value stems from a complex interplay of market factors. The recent collapse of the LIBRA token, which saw a devastating 90% crash after reaching a $4.5 billion valuation, has created widespread skepticism in the memecoin sector. This event, coupled with significant withdrawals by insiders totaling $107 million and development team extractions of $87 million from liquidity pools, has triggered a broader market selloff.

Will Dogecoin ever go back up?

While some projections remain conservative, others suggest significant potential upside. Technical analysis indicates that a breakthrough above the $0.30 resistance level would be crucial for renewed bullish momentum. Market forecasts range from modest estimates of $0.20 to more optimistic projections reaching $1.07 by the end of 2025.

Why did DOGE crash?

The recent market downturn for Dogecoin can be attributed to several converging factors. The cryptocurrency has fallen victim to a broader market selloff, with major altcoins like Solana experiencing substantial losses exceeding 6%. Technical analysis reveals that DOGE has broken below critical support at $0.2418, suggesting a potential further decline toward the $0.20 psychological threshold.

Should I sell my DOGE now?

Investment decisions regarding Dogecoin require careful consideration of current market conditions and individual risk tolerance. The cryptocurrency's current trading level of $0.2330 represents a significant decline from recent highs, with increased volatility evident in the 24-hour trading range. While some analysts maintain optimistic long-term projections, the immediate technical outlook suggests continued downward pressure.