Several major publicly-traded Bitcoin (BTC) miners from Wall Street have reported decreased production for August, highlighting ongoing challenges in the cryptocurrency mining sector.

Wall Street Bitcoin Miners Report Lower August Production

Argo Blockchain (NASDAQ: ARBK) reported that it mined 38 Bitcoin in August, down from 48 in July, due to more frequent economic curtailments and a lower hash price. HIVE Digital Technologies (NASDAQ: HIVE) mined 112 Bitcoin, which is 4 less than the 116 Bitcoin reported the previous month.

“We remain focused on our strategy of maintaining the lowest G&A expenses per Bitcoin mined, maximizing cash flow return on invested capital, and achieving high revenue per employee while minimizing share dilution,” commented Frank Holmes, Executive Chairman of HIVE.

Meanwhile, TeraWulf (NASDAQ: WULF) produced 184 Bitcoin at an average rate of 5.9 per day, a decrease from the 155 reported in July. The company also noted an increase in the energy costs for self-mined BTC to $36,346.

Marathon Digital Holdings (NASDAQ: MARA), one of the largest publicly traded Bitcoin miners, saw a 3% decrease in production, mining 673 Bitcoin in August compared to 692 in July. The company's CEO, Fred Thiel, noted, “Block wins during the month declined 2% from July while BTC production decreased 3% to 673 BTC.”

Industry experts attribute the production declines to several factors, including increased network difficulty and higher power costs during the summer months. The global Bitcoin mining difficulty reached an all-time high in August, making it more challenging for miners to earn rewards.

This corresponds with data released earlier in the week by other publicly listed miners. CleanSpark (NASDAQ: CLSK), which bills itself as “America's Bitcoin Miner,” saw its Bitcoin production drop 3.2% from 494 in July to 478 in August. Similarly, Bitfarms (NASDAQ: BITF) experienced a more significant 7.9% decline, mining 233 Bitcoin in August compared to 253 in July.

Less Bitcoin, Less Dollars

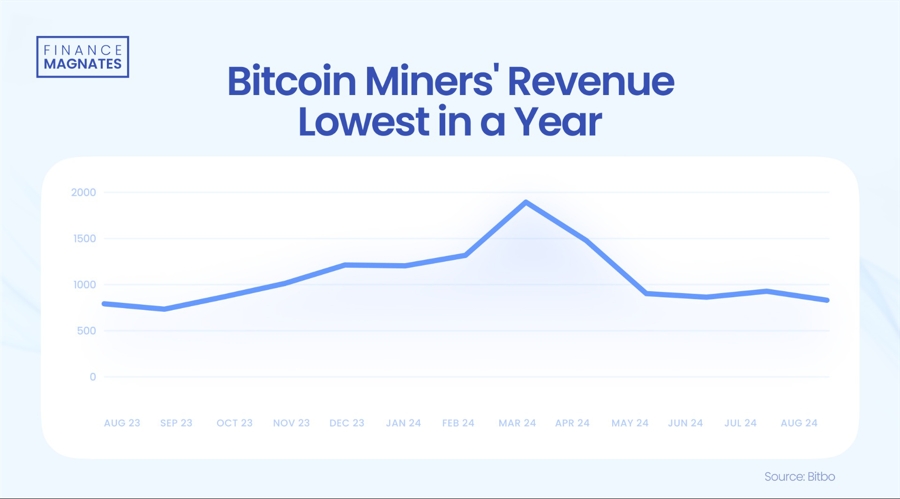

The cryptocurrency mining sector faced a significant downturn in August 2024, marking its least profitable month in recent years. Miners' earnings plummeted to $828 million, the lowest since September 2023 and a stark 57% decline from the peak earnings of nearly $2 billion recorded in March 2024.

Several factors contributed to this challenging environment. The mining difficulty reached an unprecedented 89.47 trillion in August, up from 86.87 trillion in July. Simultaneously, the number of mined Bitcoins decreased from 14,725 in July to 13,843 in August. This combination of increased difficulty and reduced output has created a perfect storm for miners, squeezing profit margins and necessitating adaptive measures.

In response to these adverse trends, publicly listed Bitcoin mining companies are exploring alternative revenue streams. Many are turning their attention to high-performance computing (HPC) and artificial intelligence (AI) as potential growth areas. Investment management firm VanEck predicts that this strategic pivot could potentially unlock $38 billion in value for mining companies by 2027.