What is MyEtherWallet?

MyEther Wallet is an example of a client-side wallet, which in effect means that instead of the wallet being stored on an exchange with the other companies, you as a user have a private key and are the only one that can access it.

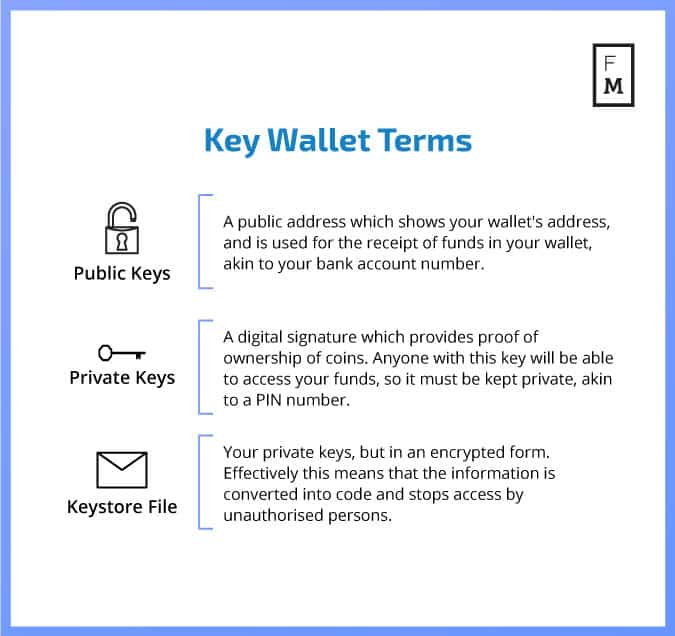

This means that the chances of being hacked by someone are significantly lower, as you’re the only individual with the private key. On the flip side, if you were to misplace your private key, then it would inevitably mean losing access to all your funds.

MyEtherWallet can store cryptos such as ETC, ETH, Testnet ETH, RSK, UBQ, and all other ERC20 tokens. ERC20 is simply the technical standard with which blockchain smart contracts are utilized to make tokens.

MEW allows for the change of unencrypted private keys into encrypted private keys, which can be achieved using their Chrome Extension.

History and About

MyEtherWallet was first made available to the public in 2015, having been founded by Kosala Hemachandra and Taylor Monahan. However, earlier this year Monahan went her separate way and formed MyCrypto.com.

Though the reasoning for their split has not been detailed, and the pair said the decision was mutual, litigation filed by Hemachandra against Monahan in regards to the company books likely has something to do with it. After her departure, Monahan also took most of the original team with her, along with the official Twitter accounts whose handles have now been altered to the MyCrypto handle.

Kosala Hemachandra spoke to Finance Magnates on the 26th of April, 2018, speaking about the recent security attacks that have occurred on the site. He talked about the development of new apps to ensure user security, promising to reimburse victims of phishing attacks as well as providing some advice for users to be safe when it comes to crypto spaces. “The cryptocurrency space is not any different from real life," he said. "Just like there are bad people in real life, there are bad people in the cryptocurrency world. So, you have to listen to yourself”.

How Safe is MyEtherWallet?

MyEtherWallet does not require complex ID verifications to utilize it. Password and emails are all that are required, with the private key providing the users with the security that they may need. The encrypted private keys create another level of security for users.

As it is an online wallet, it ultimately becomes extremely vulnerable to hacking, which is evidenced by the recent attacks that occurred on the 24th of April. At least $150,000 was stolen, from users. However, as the founder of the company stated, to avoid these problems it is essential to only use correctly certified sites, with SSL certificates. What this means is that your fully updated browser will let you know if there is an invalid certificate and you can leave your page without becoming a victim of any phishing scam.

On the whole, the handling speed of transactions entirely depends on the volume of requests at a given time. MyEtherWallet generally processes transactions as quickly as possible, and at worst it may take a few hours to process one.

MEW also has a thorough support page with questions and answers for customers and those that use the platform. If the answers are not to be found, then the customer support team can be contacted via email.

Does MyEtherWallet Have Fees?

To look into the concept of fees, one needs to understand the concept of Ethereum, which is what the wallet is most effective for. Ethereum is the overall network which is fueled by Ether or ETH. When you undertake various tasks on the given network, you may be required to pay for the undertaking of Blockchain operations. Examples include sending ETH or tokens. These Payments are computed through the concept of “gas”, and the payments would be made in Ether.

For example, if you were to purchase 3 liters of water and paid $3 for them, the liters would be the gas, whereas the dollars would be Ether. On the Ethereum network payments are made regardless of whether a transaction is successful or not, to justify the work of those that mine Ether. Another factor to consider is the TX fee which is equivalent to Gas Limit multiplied by Gas Price. By using MyEtherWallet, the gas price can be adjusted. A token normally takes between 50,000 and 100,000 gas which makes the overall price go up to 0.001 ETH or 0.002 ETH.

How to Use MyEtherWallet Securely

Step 1: Visit the MyEtherWallet Site

Ensure you Bookmark the page, due to the cases mentioned above of phishing sites that mirror MEW’s site. To be safe, you should also look at the URL and look for MYETHERWALLET LLC [US] Certificate to authenticate that this is the original MEW site.

Step 2: Create The Wallet

Make a new wallet by entering a secure password at the default home page. The longer the password with more characters, the better. Click on “Create New Wallet” to go to the next step.

Step 3: Save Your Keystore File

Download the Keystore file and ensure it’s safe by making a backup to avoid loss. A Keystore file is essential to recover or restore your wallet. You can also utilize it to access your MEW wallet together with your password. After the backup click on “I Understand. Continue”.

Step 4: Save Your Private Key

Private keys are what gives you access to the wallet, so it is vital to ensure that you’re the only person to have access to your private keys. Keep it in a folder together with your Keystore File and encrypt it for greater security.

Step 5: Unlock Your Wallet

Your public keys represent the address that you share with others to receive ETH or ERC-20 coins. You can select from a list of options on how to access your wallet. If you’re a beginner or lack a hardware wallet, it is strongly recommended to pick “Keystore File (UTC/JSON).” This means that every time you want to access your wallet, you should input your Keystore file and your password. A Keystore file is the encrypted version of your private key and offers more security.

Choose the Keystore file (UTC) that you earlier downloaded and enter the password.

Step 6: Back-up Everything

Ensure that you’ve backed-up all the aforementioned things and that you are storing them in secure locations. Once you’ve unlocked your wallet, then you’ve finished and can use MEW.

How to Access MEW Securely

If you can open your wallet and send Ether out of it, you will have access to all the funds you send to it.

Step 1: Click on the Send Page.

Step 2: iSelect your keystore file or your private key.

Step 3: f the wallet is encrypted, a text box will appear. Enter your password.

Step 4: Click “Unlock Wallet.”

Step 5: Find your account address, next to the colored circle. This is a visual representation of your address.

Step 6: Share your address with others so they can send you Ether. Your account will not be vulnerable as long as you only share your Public Wallet and not your private key.