Data published by crypto analytics firm Kaiko last week demonstrated some surprises when it came to the rankings of centralized crypto exchanges, as determined by their respective global market shares. Arguably, the most recognizable exchange names are Binance and Coinbase, but right now, it’s Bybit that is catching attention, as the numbers showed it leapfrogging Coinbase to take the number two spot behind market leader Binance while also significantly outperforming Binance in terms of market share changes.

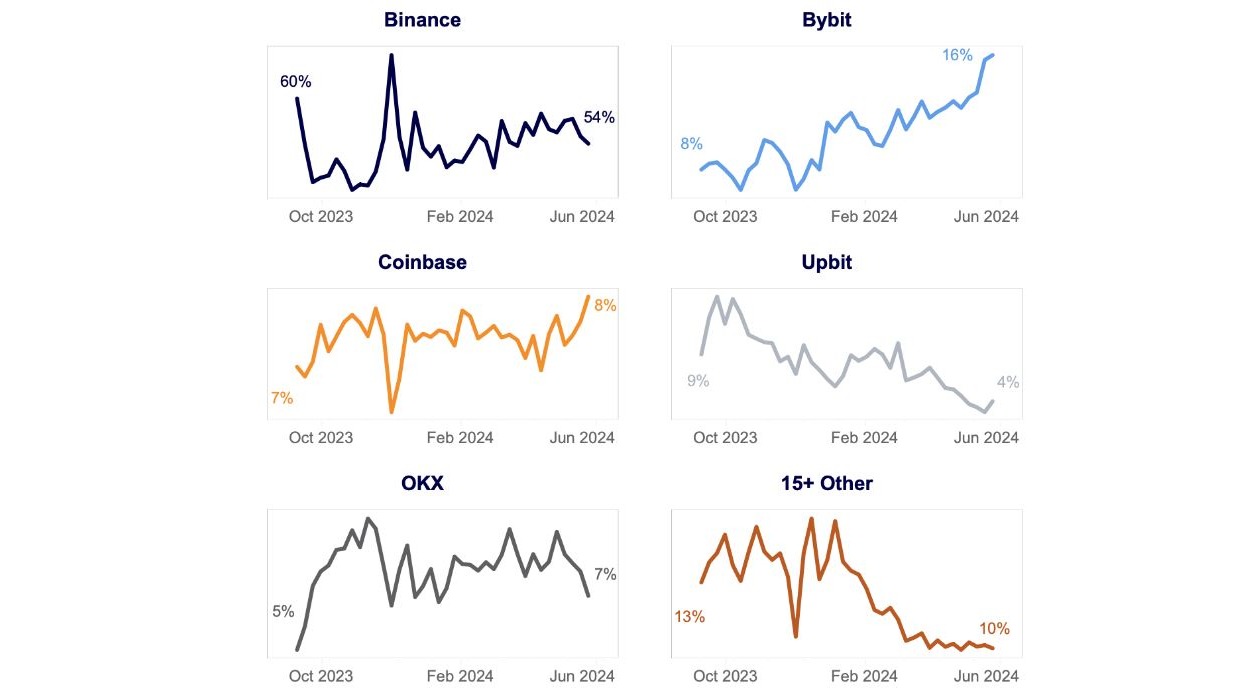

In detail, Bybit–which is headquartered in Dubai and was founded in 2018–has, from October last year to this June, seen its market share double from 8% to 16%, while Binance’s share has dropped over the same time period from 60% to 54%. Coinbase registered a modest 1% gain, rising overall from 7% to 8% (meaning, as respective market shares fluctuated, that Binance climbed above Coinbase in March), and OKX experienced a 2% gain from 5% to 7%. Simultaneously, Upbit dropped from 9% to 4%, and over fifteen smaller exchanges endured a collective drop from 13% to 10% of market share.

Market Share of Volume, charts from Kaiko

The standout shifts, then, are Bybit’s large gain coupled with Binance’s loss, raising questions about the driving forces behind these recent trends. Bybit COO Helen Liu responded to Finance Magnates’ questions on this topic by identifying Bybit’s innovative trading facilities as a key factor, explaining,

“Bybit's growth was fueled by its industry-leading Unified Trading Account (UTA) and robust spot listing policy. UTA, central to Bybit's platform, streamlines asset transfers within exchanges, calculates margins across positions and balances, and optimizes capital efficiency and risk management. This system supports seamless trading across Spot and Derivatives markets, ensuring transparency and security.”

And Liu added,

“Bybit has streamlined its spot-listing process to swiftly capitalize on crypto market trends, offering competitive trading opportunities ahead of rivals.”

It appears also that Bybit is focused on offering new products, with notable incoming developments including, according to Liu, a “Futures Combo bot” that “allows users to build a portfolio of long/short positions that automatically rebalances as the market moves”, and there is also the Bybit card, which “recently integrated with Google Pay and Apple Pay, meaning that our clients can use their crypto balances to pay for any fiat purchases they like, easily. The whole time, their idle funds automatically earn an attractive yield”. Furthermore, there are plans to roll out the card “in more countries in the near future”, and Liu also highlighted Bybit’s annual World Series of Trading event, a crypto trading competition offering substantial prizes.

BTC and ETH Trading Makes Gains on Altcoins

Returning to the initial data, we can also find some telling differences between Bybit and Binance when it comes to which coins make up the bulk of their trading volumes. On Bybit in 2023, altcoin trading made up a huge 82% of volume, and BTC and ETH were at only 10% and 7%, respectively. However, it’s a different story in 2024, with altcoin trade dropping to 44% of volume, and BTC and ETH now making up 31% and 22%, respectively.

This comes as Binance has experienced the opposite, with–according to Kaiko’s report–“a stronger increase in altcoin volume”, while volumes on BTC and ETH combined have fallen from 59% to 43%. This seems relevant since altcoins have underperformed this year, while seasoned crypto traders discuss whether an altcoin season–a regular feature of past cycles when alts outperform BTC–might be incoming soon, or whether this cycle, now that BTC has spot ETFs and can attract institutional buyers, might unfold along different lines.

NEW: Modus Advisors ($432m AUM) has a $4.8m #Bitcoin ETF holding in FBTC

— Julian Fahrer (@Julian__Fahrer) July 2, 2024

That puts them in the top ~5% of holders by AUM% pic.twitter.com/RxiMOhyRNu

Effectively Navigating Crypto Turbulence

There are also questions around Binance’s clashes with regulators, along with its changes at the top as new CEO Richard Teng–formerly the Global Head of Regional Markets–stepped up while founder, former CEO, and all-round influential character Changpeng Zhao (widely known as CZ) was sentenced to four months in prison for money laundering violations.

Perhaps–post-FTX and with Sam Bankman-Fried serving 25 years for fraud and conspiracy charges–the crypto world is acclimatized to courtroom drama, and CZ’s sentence is relatively light anyway, but still, it’s plausible that the Binance founder's legal wrangles could have affected public perceptions of the exchange he is synonymous with.

What's more, as part of CZ and Binance's plea deal, the US Department of Justice last October announced that it was imposing a $4.3 billion settlement charge on Binance, which could have been interpreted in two ways. On the one hand, it’s one of the largest criminal fines in US history and at the time, Attorney General Merrick Garland stated that, “Binance prioritized its profits over the safety of the American people.” However, at the same time, the settlement signified closure on a period of turbulence and uncertainty, a perception further underlined by the change of CEO at the company as CZ departed.

With regard to Binance, Helen Liu told Finance Magnates that “Bybit emphasizes collaboration with industry leaders to enhance crypto accessibility globally, avoiding adversarial relations”, but for the moment, Bybit appears to have navigated volatility in the crypto world more effectively than its competitors, with well-executed trading features apparently core to its growth.