Gold price hit a fresh all-time high of $5,311 per ounce on Wednesday, January 28, 2026, marking its seventh consecutive session of gains. The yellow metal is trading at $5,200.73 at time of writing, up 1.8% on the day, as the US dollar plunged to four-year lows ahead of a crucial Federal Reserve meeting.

In this article, I examine why gold is surging and checking what the XAU/USD chart shows.

Gold Price Today: Historic Rally Accelerates

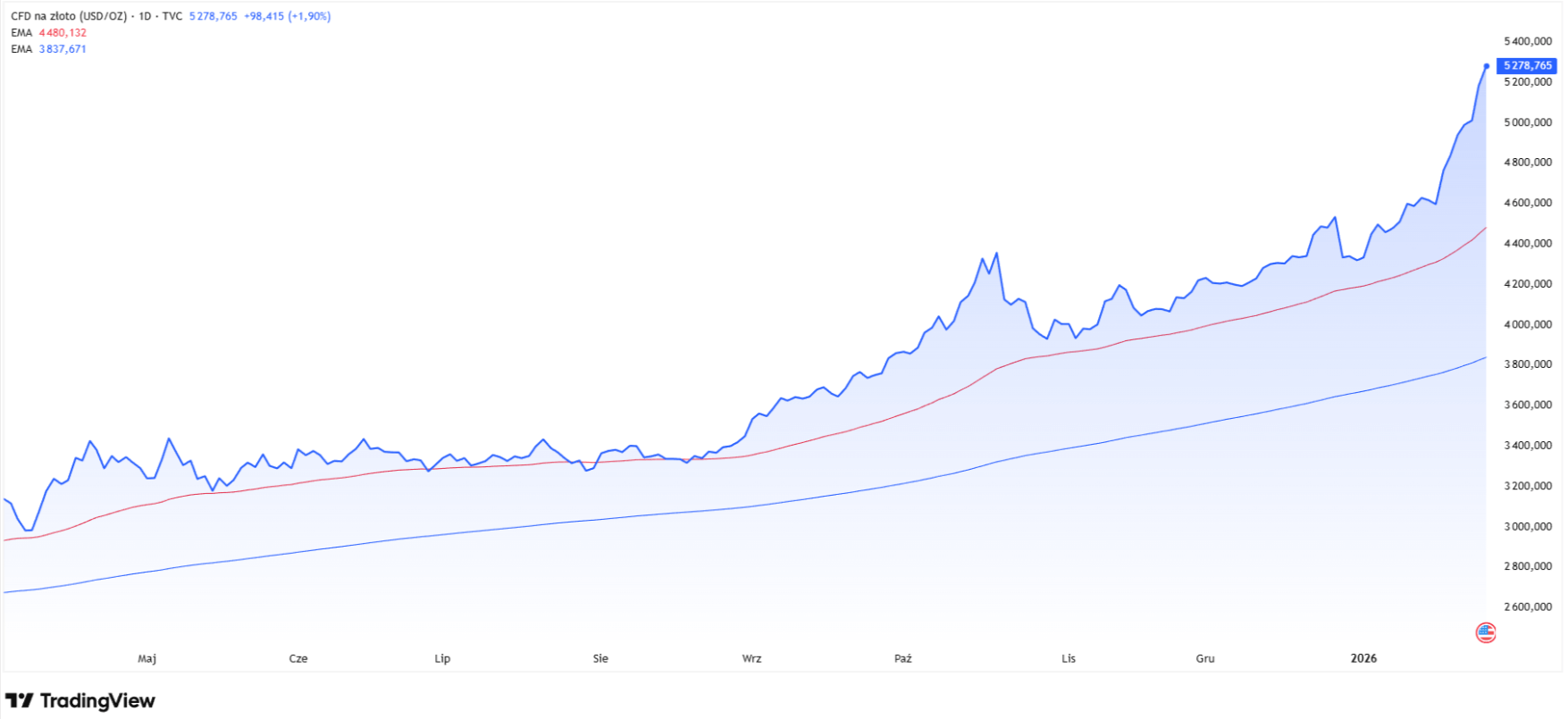

Over just seven trading sessions, gold has surged more than 15% - nearly matching the entire 2025 return of the S&P 500 index. The metal is now up 22% over the past month and has gained 91% since the start of 2025.

This rally has pushed gold nearly 30% above its 200-day exponential moving average, a level that typically separates bull markets from bear trends. While prices normally revert to their moving averages under normal market conditions, the current geopolitical tensions and dollar weakness make timing any correction extremely difficult.

Why Gold Is Surging?

Dollar Crisis Fuels Safe-Haven Demand

The primary driver behind today's surge is the US dollar's "crisis of confidence" as it struggles near four-year lows. President Donald Trump's comments suggesting a "broad-based consensus within the White House to have a weaker greenback going forward" accelerated dollar selling and sent gold prices soaring.

"(Gold's rise) is due to the very strong indirect correlation with the dollar," explained Kelvin Wong, senior market analyst at OANDA. Dollar weakness makes gold cheaper to purchase in other currencies, increasing global demand.

US consumer confidence slumped to its lowest level in more than 11-1/2 years in January amid mounting anxiety over a sluggish labor market and high prices. Trump also announced he will soon reveal his pick for the next Federal Reserve chair, predicting interest rates would decline under new leadership.

- Gold Price Prediction 2026: WGC Warns of 20% Crash Risk

- Gold Is Surging And This New Gold Price Prediction Targets 35% Upside Above $5,500

- Why Gold Will Hit $10,000? This New Gold Price Prediction Sees the Yellow Metal Doubling

FOMC Meeting Creates Additional Uncertainty

The Federal Reserve's two-day policy meeting, which concludes Wednesday, adds another layer of uncertainty to markets. While the Fed is widely expected to hold rates steady, investors are watching closely for any signals about the "neutral rate" and future policy direction.

Trump's interference in Fed independence, combined with his preference for lower interest rates and a weaker dollar, has created what market analysts describe as a fundamental shift in how investors value gold. The metal is no longer being priced primarily on yield considerations, but on its ability to hedge systemic risks.

Systemic Shift Beyond Cyclical Factors

According to Linh Tran, Market Analyst at XS.com: "If one looks only at price movements, this rally could be attributed to familiar factors such as geopolitical tensions or interest rate expectations. However, when viewed within the broader context of the global financial system, it becomes clear that gold is rising not merely due to market anxiety, but also because confidence in the global monetary–fiscal order is shifting toward a more cautious stance."

Tran emphasizes this represents a structural change: "This does not appear to be a short-lived shock, but rather a process of re-positioning gold's role within the system."

Technical Analysis Shows Gold Extended Rally

From my technical perspective, the psychological $5,000 level was broken without resistance and now serves as critical support. Additional support levels include:

- $4,550 per ounce - December 2025 highs

- $4,360 per ounce - October 2025 peaks

The 200-day exponential moving average, which separates uptrends from downtrends, sits approximately 30% below current prices, an extraordinary deviation that would normally trigger profit-taking. However, the combination of geopolitical tensions and dollar weakness has kept buyers active despite the extended rally.

Near-term resistance for gold could be seen around $5,240 per ounce, according to OANDA's Wong. In the current price discovery phase, traditional technical analysis provides limited guidance, though the momentum clearly remains to the upside.

Follow me on X for more gold market analysis and trading insights: @ChmielDk

Goldman Sachs Raises Gold Price Prediction Target to $5,400

Major investment banks continue raising their gold forecasts. Goldman Sachs recently increased its 2026 gold price target by $500, from $4,900 to $5,400 per ounceby year-end, citing central bank buying and private-sector diversification.

The bank's revised forecast assumes private diversification buyers who hedge "global policy risks" will not liquidate holdings in 2026. Goldman also expects Western ETF holdings to increase as the Federal Reserve cuts rates, while emerging-market central banks continue purchasing around 60 tonnes monthly [Finance Magnates].

Deutsche Bank went even further, stating Tuesday that gold could climb to $6,000 per ounce in 2026, citing persistent investment demand as central banks and investors increase allocations to non-dollar and tangible assets.

FAQ, Gold Price Analysis

What is the gold price today?

Gold is trading at $5,200.73 per ounce as of Wednesday, January 28, 2026, after hitting an all-time high of $5,311 earlier in the session.

Why is gold surging?

Gold is surging due to the US dollar plunging to four-year lows, Federal Reserve policy uncertainty, Trump administration comments favoring a weaker dollar, geopolitical tensions, and structural demand from central banks diversifying away from dollar assets.

How high can gold go?

Goldman Sachs forecasts gold reaching $5,400 per ounce by year-end 2026, while Deutsche Bank suggests $6,000 is possible, citing persistent investment demand and central bank buying.

Will gold continue rising?

The rally shows strong momentum with seven consecutive sessions of gains totaling over 15%. As long as gold holds support above $5,000 and the dollar remains weak, the uptrend is likely to continue, though significant profit-taking could trigger short-term corrections.

Is now a good time to buy gold?

While gold has surged nearly 30% above its 200-day moving average - an extended level that typically sees corrections - the structural drivers of dollar weakness, Fed policy shifts, and geopolitical uncertainty remain intact. Investors should consider their risk tolerance and consult financial advisors before making investment decisions.