Most companies struggle to understand their customers’ needs and fail to communicate effectively at each interaction during the customer journey.

These negative interactions can occur at any stage of the customer journey. In the early stages they result in missed acquisition opportunities and fewer conversions. However, following conversion they lead to uneven customer service, failure to upsell and increasing churn.

The challenge is to create positive interactions during every step of the customer journey. But what defines a positive customer experience differs from person to person, therefore, understanding those differences and the ability to deliver a personalised customer experience is critically important.

Artificial intelligence (AI) is the key to delivering personalisation at scale. Even businesses that service millions of customers can deliver a customer journey where individual preferences are reflected in every interaction.

Research shows nearly 40% of consumers in retail, banking, auto, insurance, telco and energy consider changing supplier after two negative experiences. Worse still, 82% of them then share their dissatisfaction with more than five people on social media.

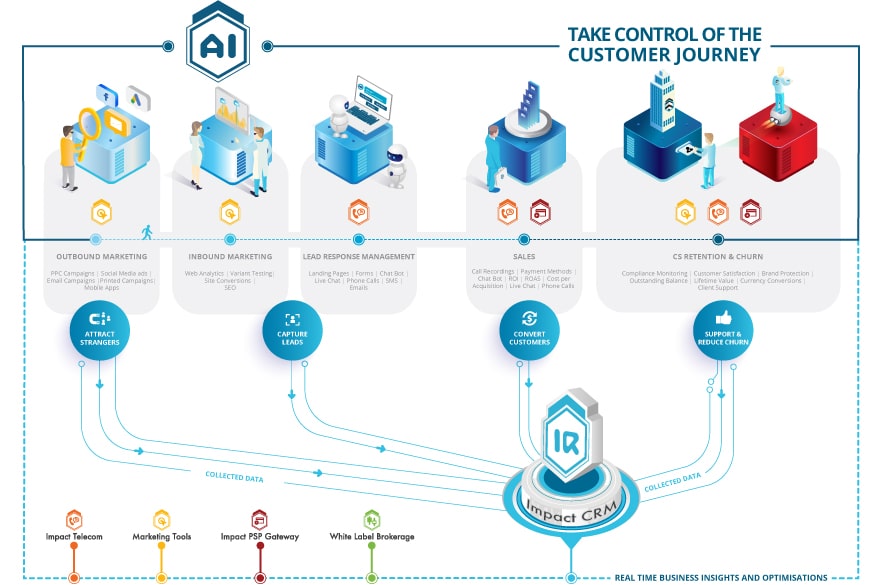

Making the most of the customer journey requires a unified platform that can process the data created at every touch point.

AI is highly effective at analysing huge data sets and providing customer insights. When AI is used as part of a unified customer engagement platform it can deliver insights that enable a business to optimise and personalise the entire customer journey.

It empowers managers with recommendations and suggestions to make the right business decisions and enable support teams to deliver a superior customer experience (CX) based on individual preferences at scale.

THE AI-DRIVEN CUSTOMER JOURNEY

A marketing campaign is the starting point for most customer journeys. The effectiveness of the campaign is reflected in the Cost Per Lead (CPL) and Cost Per Acquisition (CPA) which have a significant bearing on profitability.

This makes finding the most cost-effective campaign an ongoing challenge.

AI makes marketing campaigns more efficient and effective by processing the data from a campaign in real time. However, a complete understanding of the customer journey requires analysis of the data produced during interactions throughout the entire journey.

To achieve this requires having a platform that responds to every channel that customers use. It should capture the information when a form gets completed as well as interactions from landing pages, what is said to chat bots and during live chat, phone calls, SMS and emails.

Impact CRM is a fully integratable and scalable cloud-based platform that pulls together data in real time from across the business based on customer’s profiles. It uses machine learning to produce real-time insights which improves CX along every step of the customer journey.

Predictive Analytics anticipate the likely nature of a customer enquiry and connects them with a support agent with the skills and experience to respond most effectively to the query.

The sentiment analysis module reports the mood of the customer during interactions. It identifies positive and negative interactions to increase the understanding of what results in higher customer satisfaction levels.

It reveals the keywords that work best in sales and marketing and how customer segments react differently to variations in campaigns. There are also valuable insights found in the data available in the variety of channels customers use.

Time spent within a channel and which channel is used for what purpose are just two variables that reveal insights about preferences and customer intentions.

As more data is analyzed the level of personalized CX increases throughout the entire customer journey at scale.

AI-ASSISTED SALES

AI can accurately reveal customer needs; which lead is more likely to buy and who in your sales team is best-suited to make the sale.

ImpacTech’s automated lead scoring tool helps to select which Leads to approach by predicting with high accuracy* the leads most likely to convert. *(86.7% prediction accuracy on leads most likely to convert based on an average of 300,000 leads processed per month).

Traditional rule-based lead scoring methods are unreliable because the calculations are often highly complex and are further complicated by variations in weighting in relation to different demographic combinations.

The AI-driven tool is more accurate because it employs sophisticated non-linear models. The predictions are both interpretable and explainable and use a combination of ensemble learning, machine learning and continuous learning.

Automated lead segmentation uses similar technology to predict which member of the team is most likely to convert a lead.

An AI-driven chatbot using conversational AI can engage with prospects automatically. How the chatbot responds is the result of a hybrid approach that is fine-tuned through rule-based AI and machine learning.

It draws context from previous interactions and engages until they turn into a customer or opt out. As a result, your team focus on leads with high purchase intent and spend more time closing deals rather than prospecting which is how 80% of salespeople usually spend their working week.

Interactions with an AI-driven chatbot are also excellent at revealing customers’ needs. Chatbot conversations are often more valuable than data collected from websites because they reveal more detail about user preferences.

The CX is enhanced by collecting actionable detail like pain points and gauging the popularity of services.

REDUCE CHURN AND INCREASE LIFETIME CUSTOMER VALUE

Walmart founder Sam Walton said: “There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.”

Every time a customer decides not to purchase from your business again it adds to churn, and that loss needs to be offset by adding a new customer.

However, new customers are five times more expensive to acquire than selling to an existing customer.

Churn is most often the result of failure to meet customer expectations. Fragmented data from disconnected platforms and organisational data silos contribute to this failure and highlight the importance of tracking the post-sale customer journey.

By tracking the post-purchase customer journey with an AI-powered CRM, agents are aware of the experience – both positive and negative – clients have in real time. It can determine customer risk thresholds and identifies at-risk clients which creates the opportunity for your business to react before losing a customer to churn.

Failure to track customers’ post-purchase journey is why somany businesses struggle to pair their products with an existing customer need.

Impact CRM gives your business the information required to increase lifetime customer value. It uses sentiment analysis and information about preferences and buying triggers to improve the quality of post-purchase interactions.

It’s the difference between someone calling you about an exciting offer (standard CRM) and seeing something in your preferred social media channel that fits your needs based on analysis of your post-purchase customer data.

PERSONALIZATION IS KEY

A one-time purchase does not guarantee a long-term customer. And the occasional special offer only results in a repeat purchase some of the time. In fact, discount rewards sometimes end up backfiring.

Focussing on the most profitable and loyal customers after the sale increases customer LTV (lifetime value) and naturally sets up further business opportunities while lowering churn.

The more data your business analyses about your customers the greater value it will offer with every interaction.

Business growth often stalls because of an inability to deliver a consistently high level CX at every interaction. The key is to deliver a beginning-to-end experience that is both personalised and reacts to the data collected in real-time.

Only focussing on the last interaction, rather than the entire journey, results in inconsistency that does very little to reduce the number of customers that leave.

Personalisation ensures your company focuses on keeping your most profitable customers happy with offers that meet their expectations and reflect their value.

Knowing who is worth keeping and predicting the outcome of retention efforts results in more efficient use of resources.