As the start-date for European Market Infrastrucutre Reporting (EMIR) rules is fast approaching – with less than two weeks away – the latest solution to provide European firms with relevant reporting tools comes via a strategic synergy announced by Traiana and Cyprus-based Confisio Managed Services Ltd.

The synergy with Traina, an ICAP Group company, will enable Confisio to offer a middleware trade reporting solution to its clients in Cyprus – ahead of the February 12th start-date for the new reporting under EMIR rules, and with a sign-up deadline (with Confisio) of tomorrow as per a description on its website (but that might be extended - Forex Magnates' sources confirm).

The firm is expected to announce, as early as next week, the successful on-boarding of several of its clients on the EMIR reporting solution – so that they are fully ready ahead of the start-date.

50 Clients in Pipeline After 15 months, Nearly 20 Onboard

Andreas Roussos, Sales Manager, Confisio Group

Forex Magnates' reporters contacted Andreas Roussos, Sales Manager at the Confisio Group of Companies, who explained that although the Cyprus-based entity is just fifteen months old, it already has at least fifty clients in the pipeline and nearly onboard, including non-financial companies under EMIR obligations such as in energy and shipping related industries.

Mr. Roussos added during the call, "The February 12th start date for trade reporting under EMIR regulation is set to be the landmark date for the implementation of EMIR obligations. Even though corporate entities seem not to be completely ready it is my belief that with the correct guidance from legal advisors and with the assistance of IT experts the problems will be overcome."

At least 60% of Confisio's prospect customers are Forex and binary options brokers as well as non-FX financial companies such as CIFs engaged in the local securities markets, among others, as well as customers outside of Cyprus. Therefore, the service for EMIR reporting from Confisio is not limited to its Cyprus-based customers but rather can also be offered elsewhere in the EU.

The solution is described as a compliance tool for bull-side and sell-side firms under EMIR reporting obligations, and designed to automate the challenges around UTI sharing and LEI generation/tagging as well as delegated reporting for EMIR compliance. While Confisio is already setup to offer EMIR reporting direclty with the Trade Repository Unavista, the addition of connectivity through Traina's TR solution will help streamline and automate much of the process, rather than use data exported by reporting firms in csv/xls format.

The jointly developed middle-ware solution enables participants to keep trader repositories up to date across the trade lifecycle, and offers connectivity with data mapping/enrichment, and results in a robust matching/reconciliation service for vendor delegated and single-side trade reporting.

Confisio Supermarket Style Offering of Brokerage Solution Technologies

In addition to its data center offering and web hosting solution, the firm offers a suite of products that it has developed as well as solutions from 3rd party providers -many of which it lists as partners on its website - under a managed services offering which covers Forex brokers, among other providers.

![Managed Services [Source: fxonestopshop.com]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/01/Managed-Services.jpg)

Managed Services [Source: fxonestopshop.com]

These are provided via the URL fxonestopshop.com, which as the name implies aims to be a supermarket style diverse offering of in-house and out-house solutions. The theme of the Confisio offering concurs with the saying "If you can't beat them, join them," with regards to competing with other neutral brokerage technology providers, although the firm itself appears to have several unique angles in its own developed solutions.

Commenting in the official press release, Confisio's CEO, Christodoulos Papadopoulos said,“I am excited about this partnership with Traiana.”

Mr. Papadopoulos added in the announcement,"It is confirmation that we will always conduct our business in a way that not only meets but exceeds the expectations of both our customers and business partners. Traiana allows us to fully deliver the requirements set by ESMA for EMIR Reporting by giving us strong back-end capabilities and business foundation. We look forward to further expanding our pre and post-trade collaboration in the future.”

Synergy an Indirect Distribution Channel for Traiana

A synergy such as the one announced today, creates a distribution channel [via Confisio] where the developer can benefit from its solution indirectly adopted by end-users. This is just an analogy, such as when a white label provider benefits when end-traders of a brokerage trade on the tailored platform, Traiana's reach is extended by enabling Confisio to provide parts of its service to a wider audience (as compared to if only used for its own singular need -had it been a brokerage). In the end, such a strategic alliance could reap tri-party benefits, to all involved.

Roy Saadon, Traiana Co-Founder and General Manager, EMEA,

Commenting in the official press release, Roy Saadon, co-founder of Traiana said, “Traiana’s partnership with Confisio in Cyprus reflects our overall strategy to reach a broader range of clients across Europe to help them fulfill their new regulatory obligations. Confisio delivers a competitive and efficient solution for market participants that permits proper and timely EMIR reporting and we are very pleased to be working with them.”

According to information on Confisio's managed service offering of the EMIR related Trade Repository (TR) service, the following were noted to as potential key features:

- Provides risk mitigation via comprehensive matching and reconciliation.

- USI/UTI sharing, generation and management across all trading paradigms.

- LEI, UPI and trade detail enrichment from static data.

- Reports real-time, PET, valuation and position data.

- Comprehensive field, data and entity mapping capability.

- Support for multiple trade repositories on a cross-asset class basis.

- Single-sided; counterparty and vendor delegated reporting models.

In addition the following expected benefits were attributed to using the Traina co-powered TRService:

- Lowering technology costs by eliminating the need to connect to every Trade Repository.

- Integrated dashboard provides holistic view of all reports across all participants and TRs.

- Single solution, for all asset classes, across EMIR jurisdictions.

- Comprehensive reconciliation service allows participants to adopt delegated reporting.

- Management/generation/enrichment of USIs/ UTIs/LEIs and UPIs from static data.

Traiana Chosen for its Compliance Reporting Efficiencies

According to people close to the company, as explained to Forex Magnates' reporters, Confisio chose to use Traiana because it believed the company was already ahead of the curve when its solutions pre-dated Dodd-Frank and thus were able to deliver such solutions - like that of EMIR -in time for customer's compliance deadlines.

The enhanced middleware software offered by Confisio, as a result of the Traiana Synergy, will Leverage the technology behind Traiana's TR Connect platform.

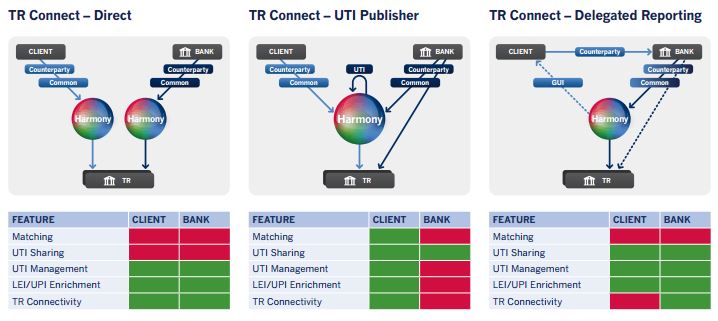

A diagram of the Traiana TRConnect Solution, excerpted below from the Traiana website, depicts aspects of the EMIR workflow faciliatated to Trade Repositories via the offered solution:

The announcement follows Forex Magnates' coverage of Traiana announcing it is ready with Four Trade Repositories Connected on its TR Connect platform.