While the perfect trading environment depends on a variety of factors, it is hard to deny that the events of the last few months have significantly enhanced the appeal of derivatives.

A recent study by Crisil Coalition Greenwich suggested a combination of political upheaval, geopolitical conflict and macroeconomic concerns were poised to fuel increases in derivatives trading activity as investors reposition their portfolios to better withstand volatility.

Political Instability Is Good for Derivatives

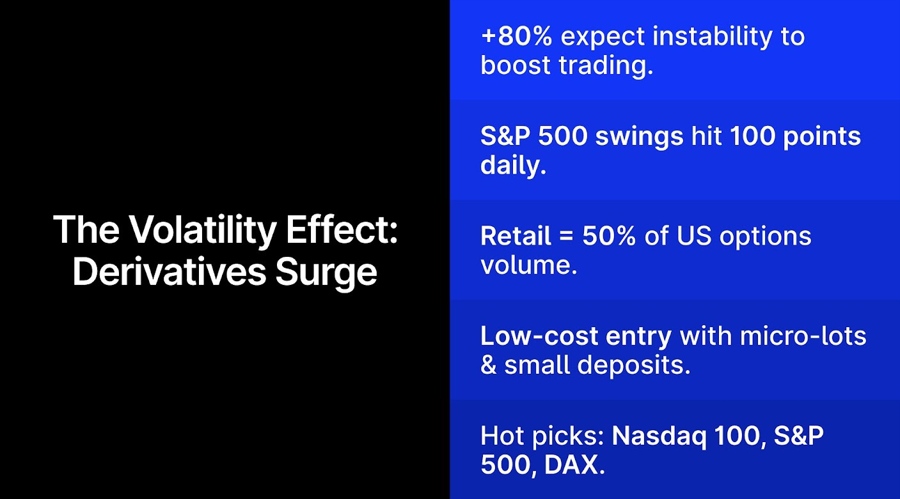

More than 80% of the 263 derivatives market participants and experts surveyed for the study believed political instability would drive growth in derivatives trading volume over the next two years.

In this context the observations of Dan Moczulski, managing director at eToro UK are typical of the brokers we spoke to. “On the whole, derivatives are used to profit from or hedge short-term price movements and take advantage of increased or decreased expected volatility, which is why these kinds of events highlight the benefits of CFDs, futures and options,” he says.

The divergence in performance between US and EU markets this year is highly uncommon and represents an opportunity for the EU to attract foreign investment that would have otherwise gone to the US suggests Tradu CEO, Brendan Callan.

“With all the craziness that this [US] administration seems to like to create we are seeing a lot of volatility, which is great for trading,” acknowledges Scott Sheridan, CEO of tastytrade. “We are seeing 100 point S&P moves on a daily basis, which is amazing for all trading and especially derivatives. So long as the VIX stays elevated relative to its average, I would expect the big swings to continue.”

Those who run automated and highly systematic strategies are currently benefiting from that approach as the barrage of tariff and policy related news has given off so many false signals. Being a slave to price and removing the emotional pull that comes from headline risk has been incredibly helpful.

That is the view of Chris Weston, head of research at Pepperstone, who says many short-term traders now have limited conviction to hold risk when they are not in front of the screens. “The propensity to day trade therefore increases and many look to increase the frequency of trading but enter into exposures in smaller size and with a wider stop,” he adds.

Clients Keen to Exploit Opportunities

Alpari has observed a significant uptick in stock index trading from clients keen to exploit opportunities in indices such as the Nasdaq 100, S&P 500 and DAX, while Interactive Brokers’ customers are using its ForecastTrader prediction market universe to hedge and speculate on environmental developments as well as economic indicators, election outcomes and government occurrences.

“Forecast contracts related to the debt ceiling, government shutdowns and US recessions are potential instruments correlated to political and economic volatility, enabling hedgers to take positions as insurance for other equity, fixed income and/or commodity holdings,” explains Interactive Brokers’ senior economist, Jose Torres.

David Morrison, senior market analyst at Trade Nation acknowledges that the conditions mentioned above can prove too combustible for some participants - as proved to be the case in the first quarter of 2020 at the start of the pandemic.

“But even then, companies offering derivatives to retail customers experienced a surge in trading volumes, helped by the huge intra-day movements on all types of financial markets,” he says.

Regulated Brokers Are Bringing Innovation to Retail Traders

The Crisil Coalition Greenwich study also referred to growing retail participation in derivatives markets due to innovation making derivatives markets more efficient and cost-effective for retail investors by lowering trading costs, generating scale and providing new features on listed products.

Regulated brokers have played a huge role in this shift by offering secure, user-friendly platforms that enable retail traders to speculate on stocks and commodities or trade real futures on exchanges like the CME suggests Kate Leaman, chief market analyst at AvaTrade.

“Technology, education and accessibility have made derivatives trading more mainstream than ever,” she says. “In addition, regulatory changes - such as the European Commission's retail investment strategy - are making derivatives trading safer and more transparent.”

Morrison refers to the presence of almost 100 ‘trusted brokers’ on TradingView and the availability of markets from individual global equities to through stock indices, FX pairs, commodity and bond futures and ETFs. He agrees that regulation has helped the industry, crediting the approach to leverage taken by industry bodies such as ASIC and the FCA with protecting those relatively new to trading on margin.

“Entry costs have become lower due to the elimination of high transaction fees and the introduction of mini contracts,” accepts Simon Morgenthaler, Swissquote Zurich branch manager. “However, it is crucial for retail investors to be aware of the risks and to inform themselves well, as derivatives are complex instruments.”

Ross Maxwell, global strategy and operations lead at VT Markets refers to estimates that retail traders account for almost half of options volume in the US.

“Along with access to low cost platforms, sophisticated analysis and much better educational materials, retail traders are also using much more sophisticated strategies,” he says. “This gives them flexibility to take advantage of short term price movements using futures and use of multi directional options strategies such as straddles and strangles.”

FXOpen UK chief operating officer, Gary Thomson, agrees that shifting customer behaviour has played a role in the market’s growth. “An increasing number of traders now favour short- to medium-term strategies, which offer greater flexibility and remove the need to buy and hold assets over the long term,” he says.

Futures and options can now be traded in micro-lots with low minimum deposits - reducing the barrier to entry for the retail trader, adds Maxwell. “Rules around issues such as margin have made derivatives products more transparent,” he concludes.