Long gone are the days when Discord was dismissed as yet another communication tool for your kid bonding over Minecraft servers. The platform has rapidly emerged as the hottest virtual hangout for an entirely different crowd, throngs of retail FX/CFDs and crypto traders gathering to exchange ideas, share signals, and ride market waves together.

Discord offers them a virtual trading floor minus the shouting and chaos. Here, they can chat over desktop or mobile in real-time as markets move. In many ways, it is unlocking retail trading's true potential to become social. And, this digital gathering force can no longer be ignored as new converts keep pouring in.

What Is Discord?

Discord is a free voice, video, and text communication platform that allows users to interact in real-time. Initially created for gamers to chat while playing, Discord has evolved far beyond gaming communities.

The service revolves around the concept of servers. A Discord server is essentially a virtual space where groups of friends, communities, businesses, and more can come together. Users can join existing public Discord servers through invite links or create their own private servers.

Once inside a server, members can access various text and voice channels for communicating and collaborating. Text channels allow seamless chat messaging between server members. Voice channels facilitate conversations, meetings, or casual hangouts using voice chat features.

Servers also support other forms of communication like video calls and screen sharing. This makes Discord an ideal platform for gaming and friend groups, remote work teams, online classes, clubs, and more.

An easy-to-use permissions system enables server admins to control access and functionality within their servers. Individual channels can be tweaked to only allow certain members. This allows large servers to create intricate platforms comprising multiple topic-specific chat rooms.

Safety is a critical part of our work at Discord.

— Discord (@discord) January 16, 2024

Our latest Transparency Report covers our work from October through December 2023. These reports provide information and resources about our work to make Discord the best place to hang out with friends.

Read the report here:… pic.twitter.com/KP6GRxd8Gc

According to BankMyCell, in 2016, the platform had 25 million users; in 2020, this number grew to 300 million, and currently, it stands at 614 million.

The Explosive Growth of Forex and Prop Trading Servers on Discord

Discord was launched in 2015 as a voice and text chat app aimed at gamers. But, over the past few years, it has surged in popularity among retail traders seeking to connect with like-minded investors. Approximately 15% of the 26.5 million daily active Discord users visit finance servers. These servers cover various trading themes, from day trading and options to cryptocurrencies , with users numbering from a few thousand to over 10,000 on the most popular channels.

According to Yohay Elam, the Product Manager at FxStreet, there are four main reasons why retail traders opt for Discord.

“First, many of them have been used to seeking advice – and commiseration – in online forums, and Discord provides an upgraded experience thanks to its ease of use,” Elam commented. “Secondly, there is a significant overlap between the gaming world, where Discord originated, and the trader world. The users share many of the characteristics. Retail traders became familiar with Discord via gaming, and using the platform in their community was a smooth transition.”

Third, the cryptosphere embraced Discord before it became dominant as a community platform. While crypto and FX/CFD traders have a limited overlap, the use of Discord propagated. And, finally fourth, FXStreet’s data shows that “most traders have a day job at an office. The growing use of Slack – which has a remarkably similar interface to Discord – is another factor making the transition easier.”

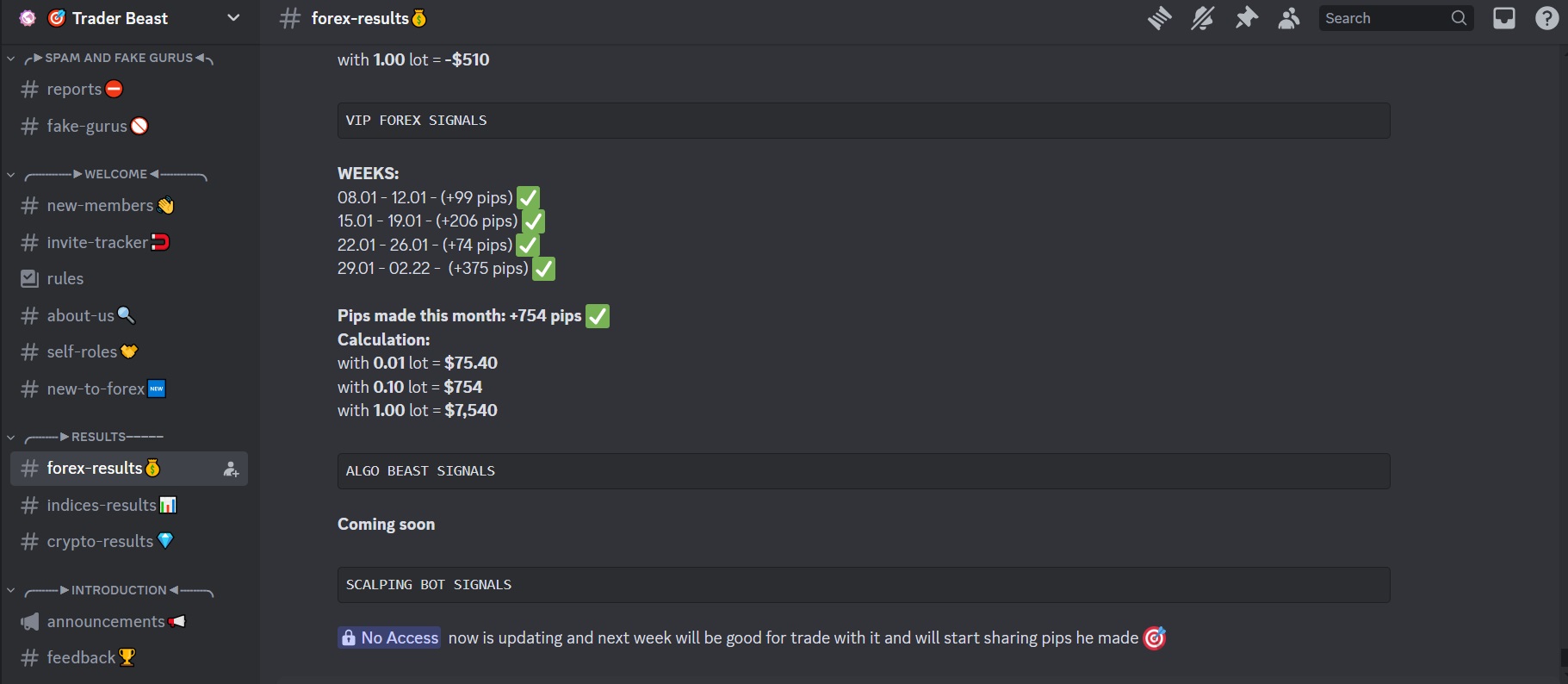

Discord, similar to Telegram, has emerged as a hub for services offering trading signals. According to the website Discord.me, there are over a thousand servers tagged as "Forex" and more than 1,500 tagged as "Crypto." An example of such a group is Trader Beast, which has over 10,000 registered users, with hundreds online at any given time of the day, utilizing automatically generated signals by trading bots.

It turns out that Discord is highly popular among retail proprietary trading and trader funding firms, where the numbers are even larger. For instance, MyFundedFX, which recently faced regulatory issues, gathers over 120,000 people on Discord. The recent earthquake in the industry, which began in February, showed how important Discord is in prop trading. Many pieces of information about suspending operations or planned server migrations appeared first and foremost on the Discord servers of various companies, or appeared there exclusively. This demonstrates that today, without Discord, a trader may not have access to all the necessary information.

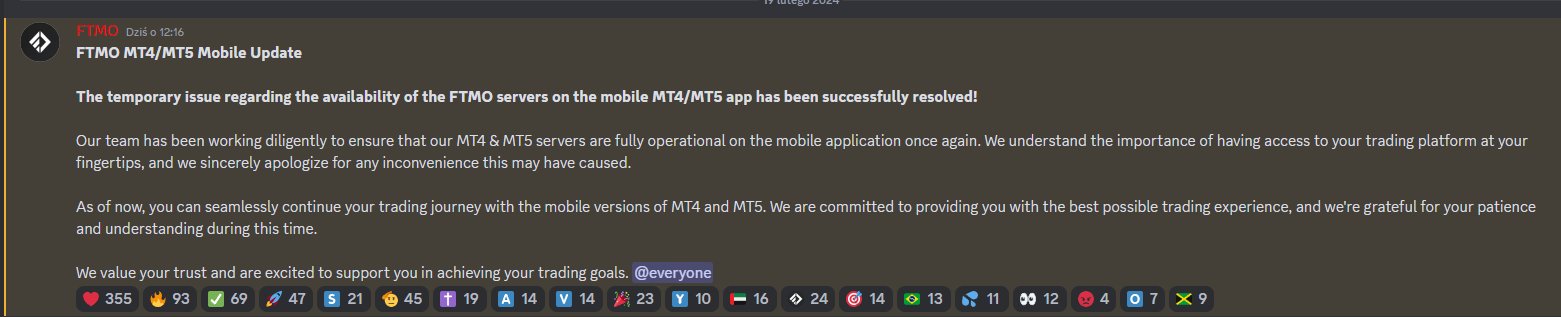

An example of this was seen in mid-February when the prop firm FTMO announced that it was restoring functionality to the blocked MetaTrader. However, this information appeared only on Discord.

The experts we spoke with stated that Discord possesses several important advantages, allowing for collaborative learning, rapid information sharing, and vetting of ideas. We have compiled the most important ones for retail trading in the form of an infographic.

However, Discord servers also have a more darker side in the retail trading industry.

Discord’s Pump & Dumps, Scams, and Misinformation

The anonymity and private channels of Discord enable trading schemes on the shady side. The platform has become notorious for pump-and-dump schemes where influencers build hype around low-volume assets before dumping their positions once prices spike.

U.S. SEC SAYS IT CHARGES EIGHT SOCIAL MEDIA INFLUENCERS IN $100 MILLION STOCK MANIPULATION SCHEME PROMOTED ON DISCORD AND TWITTER

— *Walter Bloomberg (@DeItaone) December 14, 2022

Scammers directly target naive traders by sharing phony screenshots of their account balances to peddle get-rich-quick services. Without oversight, Discord allows potential manipulation along with the spread of misinformation not grounded in facts.

Even well-intentioned trading advice on Discord can steer newcomers down wayward paths if the mentor needs more proper expertise. Always verifying credibility is key before following signals blindly.

“What we and our users find lacking is Discord’s broadcasting capabilities,” said the Project Manager of FxStreet, commenting on Discord’s cons. “While holding a webinar or a live market coverage works well for most users, occasional sound and video lapses when using the desktop browser version of Discord caused us to pause a full migration of events to the platform.”

What Discord Means for You and Your Company

For brokerages and fintech firms, the rise of Discord trading channels marks a vital shift in social media preference among retail investors. Maintaining an active presence on Discord has become crucial for customer engagement, brand building, and understanding client needs.

While signal groups and trading bots are popular on Discord, trading platforms and brokers themselves rarely have their own servers there. But, maybe it is time to change that?

“Brokers are generally more conservative in their choice of communication channels, but as they have eventually embraced advertising on mobile phones, they are gradually warming up to Discord. Brokers go where traders are, especially when it comes to acquiring customers,” said Elam.

Firms can directly address customer feedback and complaints on their own Discord servers. And, monitoring wider trading conversations grants valuable perspective on investor sentiment, pain points, and which offerings excite users most.

While Discord currently lacks oversight around market manipulation and misinformation, its meteoric rise among traders is inevitable. As more retail investors establish footholds on the platform, retail trading firms should follow.

I almost forgot the most important thing that instantly will make you install this booming app. On Discord, you can raise your virtual pets!