Leverate Joins the Rapidly Growing MT5 Crowd

- The broker technology provider is deploying the fifth generation of MetaQuotes solution.

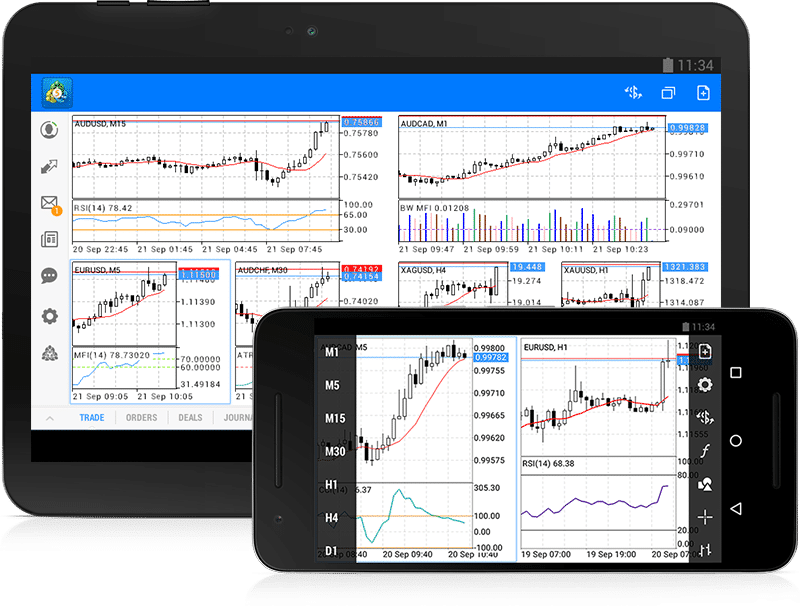

Broker technology provider Leverate is jumping on the growing MetaTrader 5 bandwagon after signing a new cooperation agreement with MetaQuotes. The tech companies have worked together to bring the latest version of the Trading Platform Trading Platform In the FX space, a currency trading platform is a software provided by brokers to their respective client base, garnering access as traders in the broader market. Most commonly, this reflects an online interface or mobile app, complete with tools for order processing.Every broker needs one or more trading platforms to accommodate the needs of different clients. Being the backbone of the company’s offering, a trading platform provides clients with quotes, a selection of instruments to trade, real In the FX space, a currency trading platform is a software provided by brokers to their respective client base, garnering access as traders in the broader market. Most commonly, this reflects an online interface or mobile app, complete with tools for order processing.Every broker needs one or more trading platforms to accommodate the needs of different clients. Being the backbone of the company’s offering, a trading platform provides clients with quotes, a selection of instruments to trade, real Read this Term to institutional and white label clients of Leverate.

Metaquotes has been actively pushing the fifth generation of its MetaTrader product since last year. The company stopped non-critical updates of MetaTrader 4 and enabled hedging in MT5, therefore eliminating a key obstacle for the popularisation of the platform.

The take up of MT5 has been material in recent quarters with many leading brokerages adopting the solution. The versatility of the product and its multi-asset trading focus are the key advantages for brokers making the switch.

Leverate is aiming to deliver to its clients the versatility of the newest MetaQuotes offering. With the addition of MetaTrader 5, brokers will be able to provide a truly multi-asset solution. MetaTrader 4 allows for only 1024 assets in total, a limitation that has been removed in MT5.

Modern traders are rapidly demanding more assets for trading. With the popularization of CFDs on indices, commodities, stocks, and Cryptocurrencies Cryptocurrencies By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the netw By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the netw Read this Term, the versatility of MetaTrader 5 is rapidly gaining popularity with clients, brokers and technology providers.

Broker technology provider Leverate is jumping on the growing MetaTrader 5 bandwagon after signing a new cooperation agreement with MetaQuotes. The tech companies have worked together to bring the latest version of the Trading Platform Trading Platform In the FX space, a currency trading platform is a software provided by brokers to their respective client base, garnering access as traders in the broader market. Most commonly, this reflects an online interface or mobile app, complete with tools for order processing.Every broker needs one or more trading platforms to accommodate the needs of different clients. Being the backbone of the company’s offering, a trading platform provides clients with quotes, a selection of instruments to trade, real In the FX space, a currency trading platform is a software provided by brokers to their respective client base, garnering access as traders in the broader market. Most commonly, this reflects an online interface or mobile app, complete with tools for order processing.Every broker needs one or more trading platforms to accommodate the needs of different clients. Being the backbone of the company’s offering, a trading platform provides clients with quotes, a selection of instruments to trade, real Read this Term to institutional and white label clients of Leverate.

Metaquotes has been actively pushing the fifth generation of its MetaTrader product since last year. The company stopped non-critical updates of MetaTrader 4 and enabled hedging in MT5, therefore eliminating a key obstacle for the popularisation of the platform.

The take up of MT5 has been material in recent quarters with many leading brokerages adopting the solution. The versatility of the product and its multi-asset trading focus are the key advantages for brokers making the switch.

Leverate is aiming to deliver to its clients the versatility of the newest MetaQuotes offering. With the addition of MetaTrader 5, brokers will be able to provide a truly multi-asset solution. MetaTrader 4 allows for only 1024 assets in total, a limitation that has been removed in MT5.

Modern traders are rapidly demanding more assets for trading. With the popularization of CFDs on indices, commodities, stocks, and Cryptocurrencies Cryptocurrencies By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the netw By using cryptography, virtual currencies, known as cryptocurrencies, are nearly counterfeit-proof digital currencies that are built on blockchain technology. Comprised of decentralized networks, blockchain technology is not overseen by a central authority.Therefore, cryptocurrencies function in a decentralized nature which theoretically makes them immune to government interference. The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the netw Read this Term, the versatility of MetaTrader 5 is rapidly gaining popularity with clients, brokers and technology providers.