Today, the Commodity Futures Trading Commission (CFTC ) has announced that it has taken action against the accountant responsible for conducting audit procedures within Peregrine Financial Group (PFG) by issuing a permanent ban against Jeannie Veraja-Snelling for failing to properly audit the company.

Regulatory reform surrounding how OTC derivatives are traded has become a sizeable discussion point among government officials in the United States over recent times, giving rise to lengthy directives such as the Dodd-Frank Act, brought about by not only the 2008 financial crisis, but also a series of factors which led to high profile corporate failures, resulting in astronomical liabilities to customers.

The United States has always championed the cause of customer protection, and in bringing to book those responsible for the demise of companies by making them personally responsible, the nation's financial markets regulators can ensure that they demonstrate to the industry that proper precautions must be taken.

Regulator Extends Liability To External Auditor

The CFTC took action against Ms. Veraja-Snelling, of Veraja-Snelling & Company, a certified public accountant and sole practitioner from Glendale Heights, Illinois, barring her from practicing before the Commission. The CFTC’s Order charges Veraja-Snelling with failing to audit PFG in accordance with CFTC Regulation 1.16.

Veraja-Snelling & Company was the auditor for PFG, a registered Futures Commission Merchant (FCM) at the time of the company's demise. Although just over a year has passed since the PFG was put into liquidation, the government authorities continue to seek rectification in holding all parties concerned responsible.

Cooking The Books

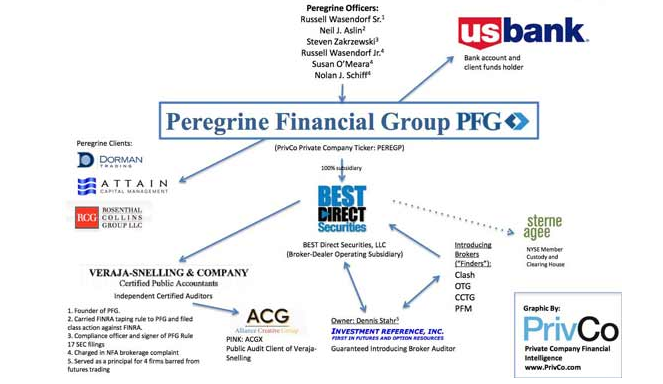

On July 10, 2012, the CFTC charged Peregrine and its sole owner and chief executive officer, Russell Wasendorf, Sr. (Wasendorf), with fraud, among other violations, within 24 hours after the discovery that Mr. Wasendorf had misappropriated millions of dollars in customer funds. The company was wound up by the National Futures Association and the same day Mr. Wasendorf attempted to commit suicide.

Just two days later, financial investigations company PrivCo discovered that PFG's financial auditing had been entrusted to Ms. Veraja-Snelling and that the company that she represented encompassed herself only, and that she operated from a private residential address.

Among the violations that were discovered, PFG’s 2011 certified financial statements filed with the Commission were fraudulently overstated by more than $215 million. According to the CFTC’s Order entered today, Mr. Wasendorf deceived Ms. Veraja-Snelling and others by manufacturing bogus bank statements that overstated Peregrine’s bank balances and by forging documents sent to Veraja-Snelling that purported to provide bank confirmation of the overstated balances.

According to the Order, Mr. Wasendorf was able to perpetrate and conceal his fraud in part because PFG lacked proper internal accounting controls and was not subject to audits performed in accordance with CFTC Regulations. The Order finds that Ms. Veraja-Snelling’s audits of Peregrine’s financial statements were not performed in accordance with generally accepted auditing standards (GAAS) and did not include appropriate review and tests of internal accounting controls and procedures for safeguarding customer assets, as required by CFTC Regulation 1.16.

David Meister, the CFTC’s Director of Enforcement today made a statement regarding the ruling: “As the Peregrine debacle shows, the importance of the independent accountant’s gatekeeper function cannot be overstated. FCMs and, most importantly, their customers, rely on auditors to approach each and every auditing assignment professionally and with due care. There is no place in the CFTC-regulated world for below-standard audits or auditors who do not have a sufficient understanding of the futures industry.”

The Order finds that Ms. Veraja-Snelling lacked the necessary technical expertise needed to audit an FCM, failed to adequately staff and plan the Peregrine audits, and failed to exercise due care in performing the Peregrine audits. Among other failures, Ms. Veraja-Snelling’s review and testing of PFG’s internal controls during the PFG audits did not identify that Mr. Wasendorf had exclusive control over the customer segregated account and its financial reporting, which reflected a material inadequacy in PFG’s internal controls, according to the Order.

In addition, the Order finds that Ms. Veraja-Snelling improperly conducted the process to confirm bank account balances, which generally entails an auditor sending a confirmation form to a bank for a bank officer to sign and return to the auditor. Here, Ms. Veraja-Snelling relied on PFG’s accounting staff to prepare the confirmation request and identify the proper recipient. After Peregrine’s accounting staff provided the confirmation request and envelope to Ms. Veraja-Snelling for mailing, she sent the confirmation request to a post office box that was secretly controlled by Mr. Wasendorf.

Mr. Wasendorf responded to the request by forging the signature of a bank employee on the form, confirming the false balance amounts.

The Order concludes that Ms. Veraja-Snelling’s failure to conduct the Peregrine audits in accordance with Regulation 1.16 constituted improper, unprofessional conduct, and the Order permanently bars her from appearing or practicing as an accountant before the Commission. In addition, the Order requires her to relinquish her right to receive payment for performing the 2011 audit.

PFG Auditor Jeannie Veraja-Snelling

Operated From Residential Home

In Glendale Heights, Illinois

In related actions, the CFTC filed a Complaint on June 5, 2013 against U.S. Bank National Association for unlawfully using and holding Peregrine’s customer segregated funds. Mr. Wasendorf was also criminally charged by the United States Attorney’s Office for the Northern District of Iowa, pled guilty, and on January 23, 2013 was sentenced to 50 years in prison and ordered to pay more than $215 million in restitution. United States v. Russell Wasendorf, Sr., 12-cr-2021-LRR.

The CFTC Division of Enforcement appreciates the assistance of the CFTC Division of Swap Dealer and Intermediary Oversight in this matter.

Outsourcing Of Responsibility- PFG's Reliance On External Companies