The Financial Conduct Authority (FCA ) launched a consumer verification tool this week as new data reveals 800,000 people in Britain lost money to investment and pension scams over the past year.

FCA Launches “Firm Checker”

The regulator's research covering the 12 months through May 2024 found social media and phone calls led as the primary contact methods for fraudsters.

- FCA Tests Industry RegTech Solution for Disclosure Standards

- ClearToken Gets FCA Nod to Launch Regulated Crypto Settlement Platform

About 17% of victims who experienced Authorized Push Payment fraud or unauthorized investment scams first encountered the schemes through social media promotions, while an equal share received initial contact by phone. Another 16% were approached via text message, WhatsApp, or other messaging platforms.

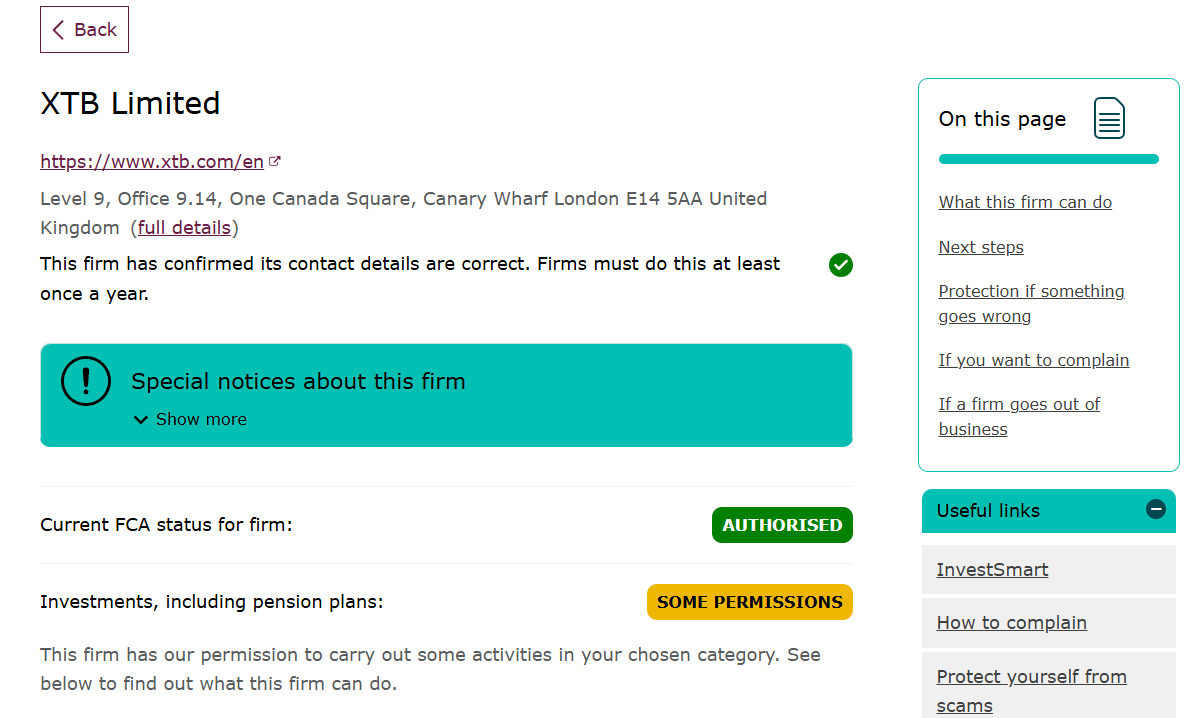

The new Firm Checker tool allows consumers to verify whether financial services firms hold proper FCA authorization and permissions before engaging with them. Nearly all UK financial firms must carry FCA authorization or registration to operate legally.

"Ruthless fraudsters are constantly evolving their tactics so they can steal money from innocent victims," said Sheree Howard, executive director of authorizations at the FCA. "Whether you're considering an investment, pension opportunity, loan or other financial service, use Firm Checker to confirm the firm is authorised and help fight financial crime."

This is a follow-up to the announcement made three weeks ago, when the FCA said it could reduce transaction reporting costs by more than £100 million by adjusting its requirements. The changes are expected to lower expenses for retail brokers and support more consistent market data.

Questions Remain About Tool's Design

The regulator said it designed and tested Firm Checker specifically with consumers to ensure effectiveness and ease of use, but hasn't detailed the tool's full functionality or technical specifications.

Lisa Mckinnon-Lower, a partner at law firm Spencer West, raised concerns about the limited information available. She pointed out that fraud victims often lack the digital skills to navigate verification systems, especially when fraudsters apply real-time pressure during pitches.

"Even where consumers do check authorization, cloned firms and misleading permissions could continue to create confusion and a false sense of security," Mckinnon-Lower said. "If designed well and used correctly, this tool could be extremely useful at tackling fraud, perhaps beyond the scope currently envisaged."

The Firm Checker won't confirm Financial Services Compensation Scheme or Financial Ombudsman Service coverage for specific products. The tool also excludes certain firm details available on the full Financial Services Register, including published restrictions on crypto activities, historical fines, financial promotion approval rights, and client money handling capabilities.

Broader Regulatory Pressure on UK Firms

The launch follows the FCA's recent moves to tighten oversight of retail brokers, including doubling reporting requirements for all FCA-regulated entities starting in 2027. The regulator also flagged CFD firms in November for inconsistent charges and inadequate consumer protections.

The FCA notes the tool's information may take up to 24 hours to update and disclaims liability for errors in firm-provided data. Consumers must still conduct independent checks to verify product suitability and protection coverage.