Among developments in the binary options platform industry at the moment there is a large focus on readiness for the Japanese regulatory changes which have now been finalized by the Japanese Financial Services Agency (JFSA) in conjunction with a working group comprising both the JFSA and the Financial Futures Association of Japan (FFAJ).

The FFAJ released its proposals to revolutionize the method in which binary options can be offered to clients in Japan back in April this year, citing a summer date for implementation. The working group has now concluded and the final rulings are in place, and the platform providers are now readying their compliant solution for Japan.

MarketsPulse To Go Large

At this year’s Forex Magnates Tokyo summit due to be held on July 17, MarketsPulse and TRADOLOGIC are set to launch their respective solutions for the Japanese market.

Shay Hamama, VP of Business Development at MarketsPulse, today explained the firm’s approach in detail to Forex Magnates: “We have developed new Japanese option products within the guidelines stipulated by the authorities in Japan, and are going to showcase these at the Forex Magnates Summit at the Mandarin Oriental Hotel in Tokyo next week”.

Mr. Hamama has confirmed that there are two methods by which it will be demonstrated to industry participants and prospective clients. Firstly, it will be demonstrated on the MarketsPulse booth. The firm considers the Japanese market to be strategically important, therefore has a double booth at the Summit.

Secondly, the firm will run a workshop at 17.00 in the Oak Room at the Mandarin Oriental Hotel to discuss different aspects of the new regulations and to demonstrate the operational functionality of the new options for the Japanese market.

CEO of Japanese FX company FXTrade Financial Co Mr. Y. Tsuru, an industry professional who also served as Chairman of the working group which implemented the binary options regulatory structure will also be present at the Tokyo Summit.

Big In Japan

Ilan Tzorya, CEO of TRADLOGIC, informed Forex Magnates yesterday that “the option type that TRADLOGIC is going to launch at the upcoming summit in Tokyo is fully compliant with the Japanese regulatory requirements and is called the Binary 100”.

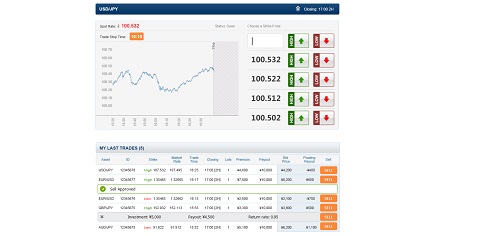

Example Of MarketsPulse Japan-Compliant Platform

Showing Pricing Sets

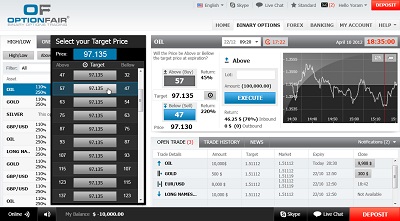

The FFAJ has ruled that the minimum trading period must be no less than two hours, and that the high/low option is to be outlawed in favor of offering traders a series set of prices which can be seen displayed on the above example of a Japanese-compliant platform, among a host of clear rulings that are intended to create a framework within which the binary options business can operate long term.

Far from considering the extra investment and time required in ensuring conformity to these new standards a nuisance, Mr. Hamama’s view is quite the contrary. He sees the regulator’s actions as a positive step for the entire binary options industry that he would like to see set in place internationally.

“If a process of regulatory structure such as the Japanese one is implemented around the world, the result would be a regulated market which would provide clear guidelines to all market participants, it will encourage brands to stay in business longer and see the entire market as a long-term commitment, which is good for platform providers”, he explained.

Tal Anish, MarketsPulse Sales Manager concurred with this by adding “such a structure would create efficiency in marketing to potential enterprise clients. If firms wishing to set themselves up as a binary brand take a long term view, it means that there is less need to keep investing in marketing to new brands which don’t stay in the market, and instead invest more to help a brand start up, and then develop their business over a long period. Short-term business is very expensive and inefficient”.

Eyal Rosenblum, Co-CEO of TechFinancials today explained to Forex Magnates that the firm has completed the development stages of its Japanese compliant platform and is in the process of uploading it to its production environment.

Zacky Pickholz,

CEO, CTOption

Mr. Rosenblum explained to Forex Magnates today that it offers ” Fixed strikes options for the new JFSA regulation, and that there will be a single, unified financial offering for the mass, meaning single wallet, single platform, unified experience.”

In welcoming the moves by the FFAJ, Mr. Hamama believes platform providers will all benefit from the future-proofing of the industry on the Japanese market which will come into place due to the new rulings.

"A company which now wishes to establish itself in Japan knows that the rules will not change for the foreseeable future and therefore can enter the market with confidence that the development period will work toward a long-term goal”, stated Mr. Hamama.

He continued: "The new option is more like a classic financial product with a look and feel that is appealing to the Japanese market".

The User Experience Evolves

Until recently, the platform providers had become almost ubiquitous, for over a year there was what could be considered a ‘big four’ offering their solutions to brands.

TechFinancials FFAJ Compliant Platform

Pricing Sets Replace High/Low

Newcomer CTOption now has its business underway, and CEO Zacky Pickholz announced some up and coming additions to the firm’s platform offering.

According to Mr. Pickholz, binary options trading is gaining more popularity among first-time traders, and as a result, educational tools are becoming an important aspect. CTOption has launched its Trading Simulator product which challenges the user with real life financial scenarios in order to become familiar with responding to them.

Mr. Pickholz explained to Forex Magnates that “as many brands rely on the same platform providers, it is difficult for them to differentiate themselves in the eye of the client.”

“Therefore lately brands have increased the emphasis on the surrounding visual aspects, as to compensate for the similarity in the trading area. On this basis, we are engaged in enhancing our user interface to meet this demand.”

Mr. Pickolz concluded by emphasizing his firm’s perspective on the importance of effective feed quality and option pricing: “As in any industry, the customers are becoming more educated and now look at the price feed quality as well as the options pricing.”

“Quality feeds such as Panda TS's, as well as precise fair-value option pricing based on a Black Scholes model variation, are important and should not be overlooked” he said.

TRADOLOGIC has developed a new interface, which incorporates a system whereby traders can choose between a series of trade rooms, designated BX Trader, BX Pros, and BX Game.

BX Trader is a web-based Trading Platform , featuring charts and a series of tradable instruments. This allows a trader to conduct all activity on one screen.

BX Pros provides a smaller chart and a series of detailed information relating to the instruments, whereas BX Game provides a simplified chart and singular large, clear asset view.

MarketsPulse will also be launching advanced charting tools at the Tokyo Summit, in response to requests from clients for more detailed charting tools. The new solution enables the user to change the display to show a line, Japanese Candlestick, or real time indicator which highlights volatility.

On The Move

Mobile applications play a large part in brokers being able to boost their binary options volume figures as a lot of short term trades are placed during the day, therefore by its very nature the mobile device is significant.

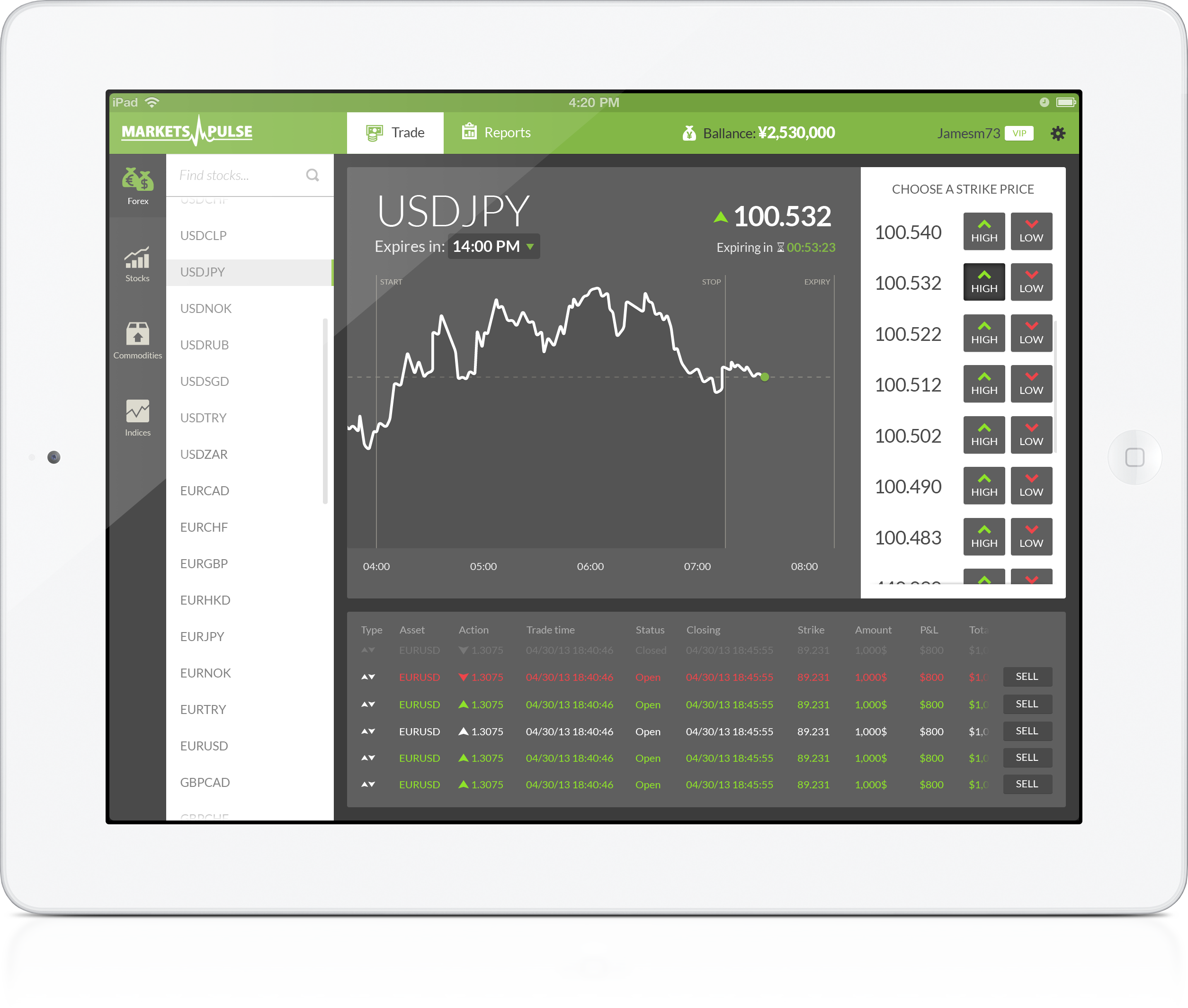

MarketsPulse will unveil the ability to trade the new option on the firm's iPad application in Japan, a market in which 33% of all volume is from mobile trading.

The new iPad application takes into account Japanese regulation, and will be followed in due course by iPhone and Android versions.

MarketsPulse Will Launch Japanese iPad App At Forex Magnates Tokyo Summit

US Market

Subsequent to last month’s high-profile warning placed by the US Commodity Futures Trading Commission (CFTC) warning US citizens against participating in off-exchange binary options, and reiterating that firms which offer such services are operating illegally in the United States, there have been no further developments this month with relation to providing a platform for binary firms to operate in the US.

Such a platform would require compatibility with placing trades through an exchange such as NADEX, and although TRADOLOGIC is taking a cautious approach, and detailed to Forex Magnates last month that it will only take its products onto the US market if the firm can be absolutely certain that it has a totally compliant solution and that the development input is worthwhile.

TechFinancials is currently working in conjunction with a regulated firm in the US in order to assist with the development of a US market platform. Last month, Mr. Rosenblum detailed to Forex Magnates that the solution will be available “within the forthcoming months”.

CTOption is engaged in development along the same lines: “We are currently preparing our system for on-exchange integration, and have initiated discussions with NADEX for this purpose” explained Mr. Pickholz in an interview with Forex Magnates last month.

The general consensus as far as this is concerned is that currently most of the platform providers are more concerned with maintaining their presence in Japan, a nation with a large client base and regulatory structure which still allows firms to offer an off-exchange OTC model.