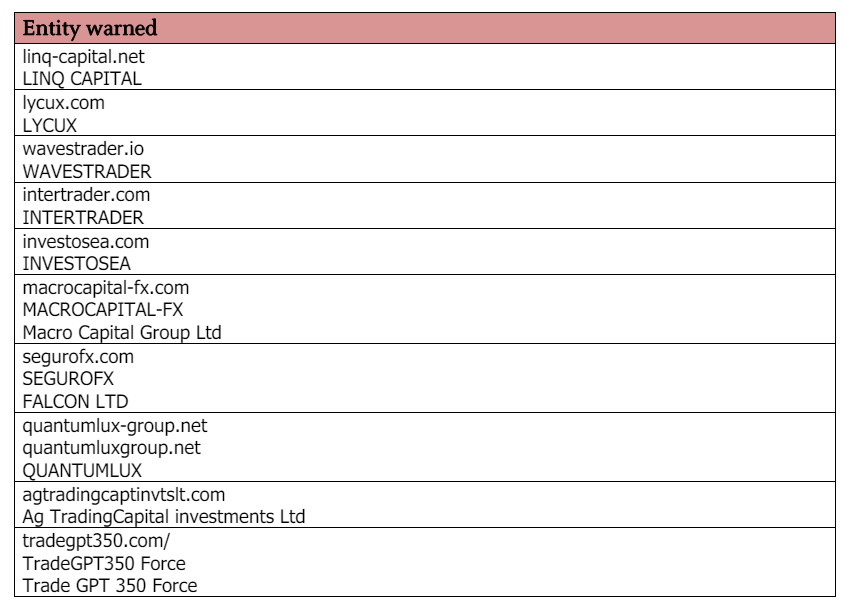

The Spanish financial market regulator updated its warning list on Monday, adding ten new entities. One company in particular draws attention, as this is not the only warning it has received in recent months.

Linq Capital Added to CNMV's Warning List

On May 27, the Spanish National Securities Market Commission (CNMV) added ten new entities to its warning list, including Linq Capital, which offers FX/CFD trading with a surprisingly high leverage of 1000:1.

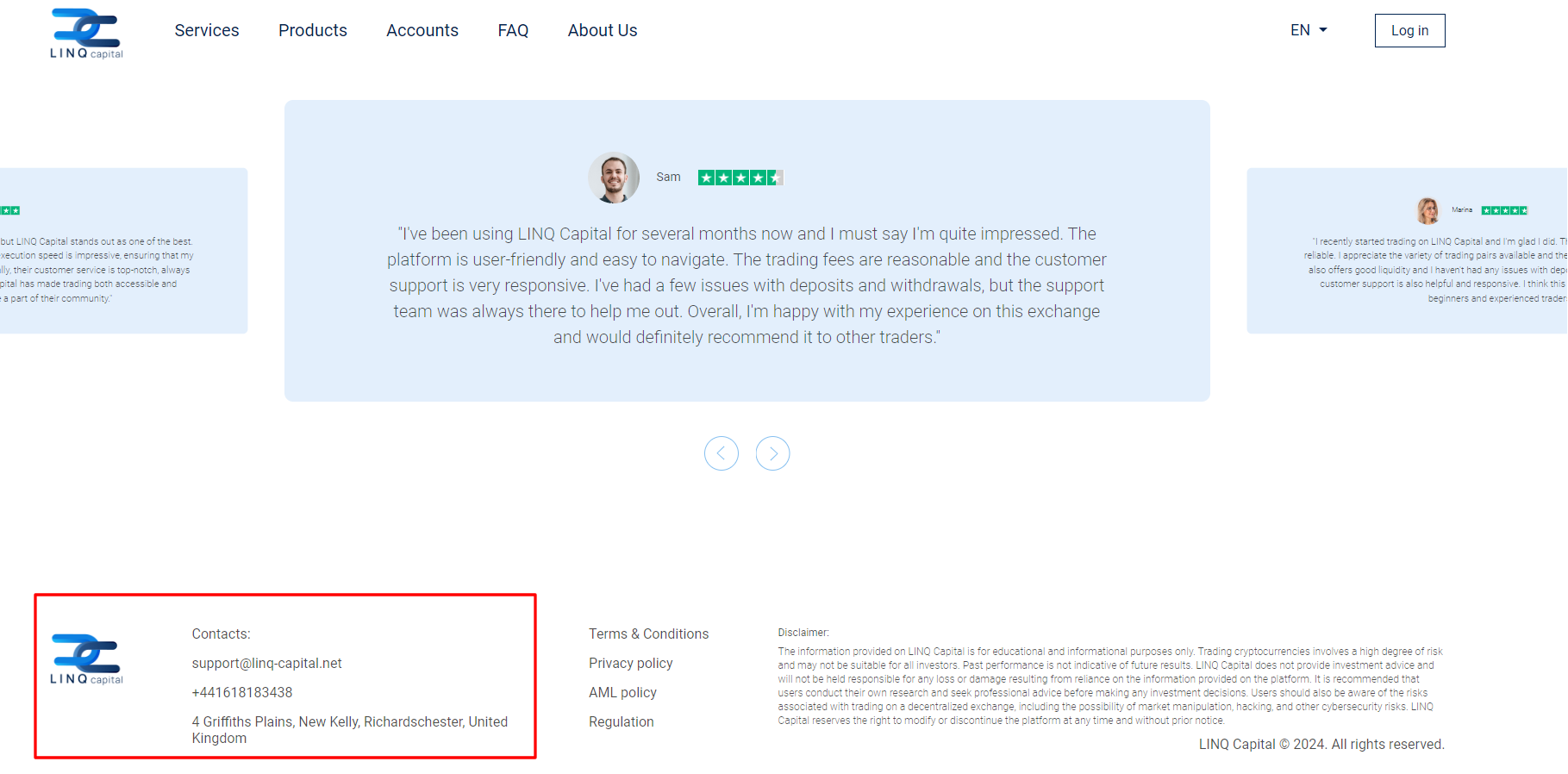

The company claims to be registered in the UK, and its representatives allegedly suggest through cold calling that it holds regulations from popular European supervisory commissions.

However, the city where Linq Capital is supposedly headquartered, Richardschester, does not exist. Moreover, the German regulator BaFin also placed the company on the warning list in February.

BaFin had warned that it operates without the necessary regulations. Everything indicates that Linq Capital is not regulated in Germany, Spain, or, most likely, in any other jurisdiction.

“According to CNMV records, these institutions are not registered in the corresponding registry of this Commission and, therefore, are not authorized to provide investment services or other activities subject to the CNMV’s supervision,” commented CNMV.

The fake address of the company's main headquarters suggests that its business model is a potential fraud.

Recent Regulatory Actions

A week ago, the German market watchdog has issued another warning, regarding the website pepperstone.vip, a clone of retail broker Pepperstone GmbH. CNMV flagged similar clone of the Pepperstone FX/CFD brokerage back in 2023.

In the meantime, BaFin imposed EUR 9.2 million fine on neobanking company N26 due to deficiencies in reporting suspicious activities in 2022.

Finance Magnates last reported on the newest CNMV’s actions few months ago, when the Spain regulator issued alert on 18 unregiestered investment firms, including a mix of FX/CFD and crypto services providers.