Prop Trader Trust Has to Be Earned

FXStreet recently revealed the results of a survey of prop traders in 10 markets across North and South America, Africa, Asia and Europe. One of the key findings was that even when traders have had a firm recommended to them by someone they trust, they tend to seek other opinions before committing.

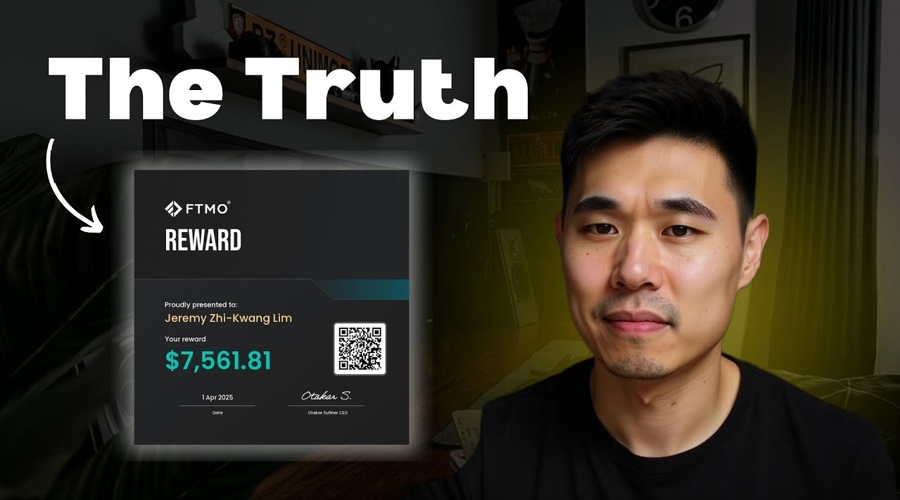

Many of those interviewed said their main source of reassurance was YouTube because they wanted to hear about other traders’ experiences with a specific firm. They also tended to check YouTube comments as well as user feedback from other social media sites such as X and Reddit.

The importance of YouTube has been highlighted by a number of recent developments including Spotware Systems announcing the launch of an official YouTube channel that it says will connect trading industry professionals through real stories and clear conversations.

In November, IC Markets made season six of IC Your Trade available. Episodes of the thought leadership and market insights series (created in collaboration with Bloomberg Media Studios) are broadcast on YouTube as well as other popular streaming platforms.

Earlier this month, an updated version of PropTraderEdge.com – an online hub aimed at helping funded traders understand markets, risk and psychology – was introduced. The platform combines long-form analysis with short video features and includes YouTube interviews where Kathy Lien, managing director of FX strategy at BKTraders and PropTraderEdge, speaks with traders and industry figures in the prop trading space.

A story on prop trading in India published in September noted that The5ers launched a YouTube channel for India last March, sharing trading videos in Hindi. Although YouTube campaigns have only a 0.45 per cent CTR (Click-Through Rate), their view-through rates are strong.

- FTMO Comes to India: Opening Market It Previously Excluded

- ATFX Converted Over 10% Prop Traders to Brokerage in South America

- State of the Prop at FMLS:25 – The Easy Money Reckoning

Famous Bear Gives AI Hype Short Shrift

Michael Burry has been in the news again recently – not because film studios are planning a sequel to The Big Short but because he followed up the announcement that he was closing his hedge fund with a scathing attack on AI.

The reason he gave for liquidating Scion Asset Management was typically blunt, with Burry stating that “my estimation of value in securities is not now, and has not been for some time, in sync with the markets”.

His assessment of the AI sector was even more forceful and started with the creation of a chart with all the major AI players entitled “how Nvidia and OpenAI fuel the AI money machine” and the suggestion that every company listed has suspicious revenue recognition.

According to Burry, understating depreciation by extending the useful life of assets artificially boosts earnings, which he describes as “one of the more common frauds of the modern era”, and says this will understate hyperscaler depreciation by $176 billion by 2028.

Michael Burry of The Big Short fame gives first interview in over 10 years and says, “Bitcoin is not worth anything. It’s the tulip bulb of our time.” pic.twitter.com/ge1zteSVqS

— Documenting ₿itcoin 📄 (@DocumentingBTC) December 4, 2025

He refers to OpenAI as “the next Netscape, doomed and haemorrhaging cash” and says the idea of a useful life for depreciation being longer because chips from more than three to four years ago are fully booked confuses physical use with value creation. In other words, just because something is used does not mean it is profitable.

The outcome of the above (according to Burry) is that by 2028, Oracle’s earnings will be overstated by almost 27 per cent and Meta’s earnings will be inflated by almost 21 per cent.

His view that chips with a maximum three-year lifecycle are suddenly being expected to operate for twice that long in an environment with high use rates that are known to be tough on hardware is hard to challenge.

We have reported before on analysts drawing parallels between the tech/media/telecoms boom of the late 1990s and the massive increase in AI stock valuations.

Burry makes the point that when the dust settled on the dotcom crash, the use rate of the fibre optic cables installed in the US was less than 5 per cent. If artificial intelligence is getting ahead of itself in similar fashion, another film could be on the way. Perhaps it could be titled If AI is so smart, why didn’t it see this coming?

Trading on Supply Chain Dynamics

Fund managers are taking increasing interest in trade finance as they look to broaden their product offerings.

In September, HSBC Asset Management launched a trade and working capital solutions strategy in collaboration with its global trade solutions team that will invest in a broad portfolio of short-term trade finance and working capital assets including receivables finance, payables finance, trade loans, documentary trade and other instruments.

The ITFA (International Trade & Forfaiting Association) trade finance investment ecosystem working group noted last year that the trade finance asset class had begun to shift from being a relatively niche alternative to being recognised as an increasingly mainstream part of the wider private asset finance offering.

Read more: Switzerland Opens Door to 24/7 Stock Trading Through Tokenization

It observed that a number of well-known international asset managers have now raised direct lending working capital finance funds and investor interest is rising fast.

The appeal of real-economy transactions is that they benefit from low correlation to other credit asset classes and low sensitivity to market timing, allowing for more stable returns.

Panellists at ITFA’s annual conference held in Singapore in September pointed out that these characteristics enabled the trade finance market to withstand potential shocks such as the sweeping trade tariffs announced by the US government in April.

The main challenge for investors seems to be getting access to suitable investment vehicles. Banks acknowledge that demand for this asset class outstrips supply, particularly when credit spreads are viewed in the context of longer-term trends.