New Year, New UK?

Good news was thin on the ground in the UK financial markets last year. A number of embarrassing policy shifts damaged the credibility of the government’s chief financial officer, and patchy economic data did little to boost public confidence.

The travails of the IPO market are underlined by data suggesting that an investor who bought into every one of the 20 companies that listed in the UK last year, on the day they went public, would have been more than 3% down based on the year-end market closing level.

Various domestic and international factors contributed to this underperformance and undoubtedly persuaded other prospective listers to hold fire.

But the recent strong performance of the FTSE 100 provides grounds for optimism that 2026 could be the year when the UK’s IPO market emerges blinking from its lengthy hibernation. Coupled with encouraging data on inflation and interest rates, market analysts reckon the relaxation of the domestic listing regime should see more companies go public.

One of the most significant developments has been the temporary reduction in the stamp duty tax paid on transactions in shares of newly listed UK companies, which could become a permanent change if it is seen to have a positive impact on new share ownership.

Various reports refer to an increase in private companies meeting with potential investors to gauge interest before shares become publicly tradable.

In an interview in November, the head of Lazard’s UK investment banking arm suggested private equity exits represented a potential opportunity for investors, and that a sizeable number of mid-sized and large companies could go to market this year as they outgrow their current ownership model.

Real economy firms appear to have the greatest appeal, partly because they offer an alternative to tech-driven stocks and also because those in the UK tend to be undervalued compared with their US counterparts.

IPO growth could also come from businesses whose relatively small market capitalisation would fail to generate much excitement in overseas markets.

- Does the Kraken–Deutsche Börse Deal Simplify Crypto, or Complicate It Further?

- As the Year Turns: A Market Reckoning for 2025

- Are UK Equities Cheap - or Cheap for a Reason?

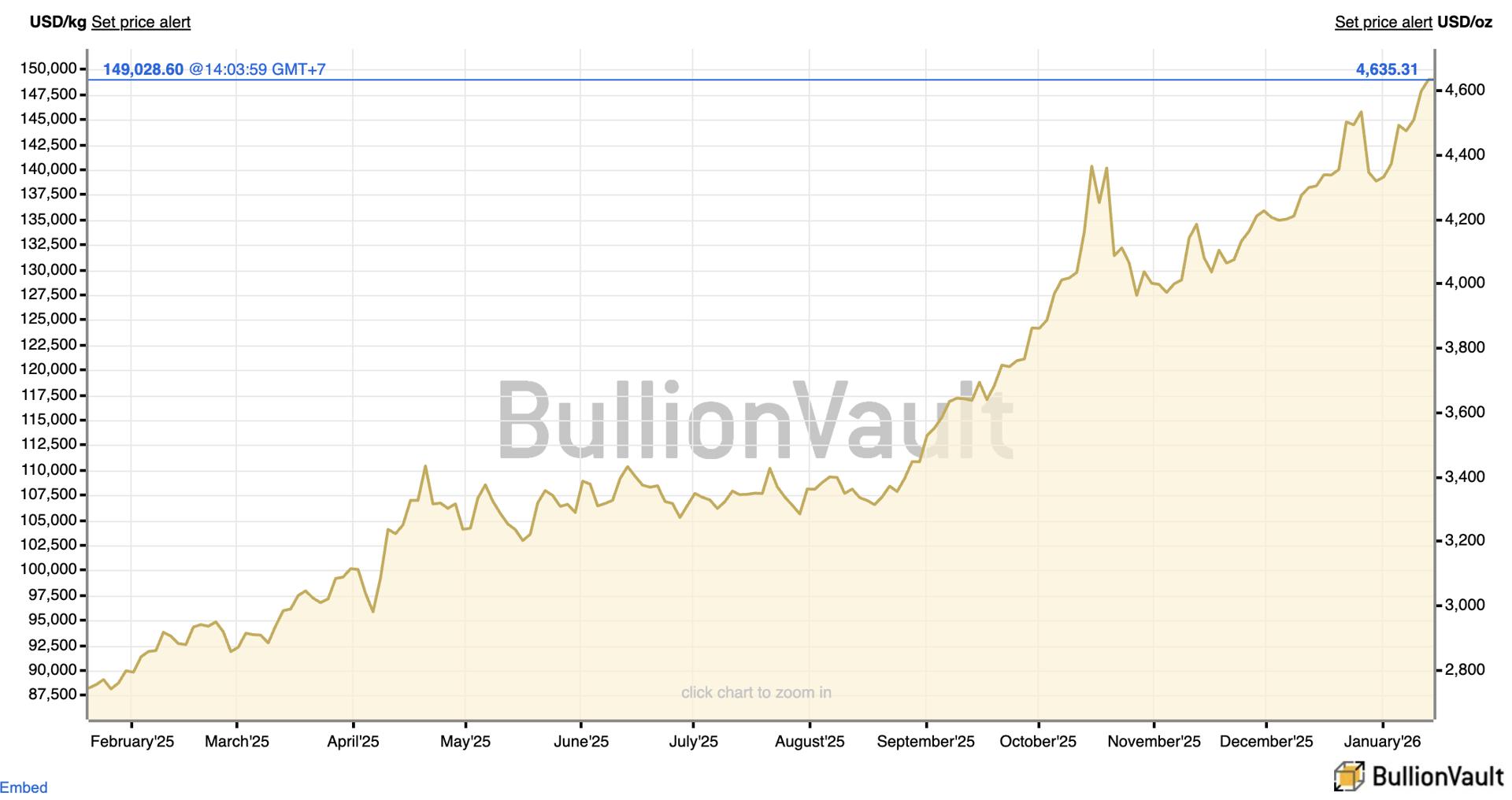

More Than One Way to Extract Value from Gold

The world’s most precious metal may have lost a little of its sheen towards the end of last year, but it is expected to continue its upward trajectory in 2026 and drag related assets along in its slipstream, as it did in 2025 for mining stocks, some of which recorded even higher returns than the product their business is based on.

Joachim Berlenbach, founder and CEO of Earth Resource Investments, is responsible for the investment strategy of the Earth Gold Fund UI EUR R, which achieved a return of 161% last year. He reckons demand is likely to remain high in 2026, especially as central banks have announced that they will continue to buy gold, and adds that even with stable prices, producers’ margins remain at record levels, which is providing tailwinds for the mining stock sector.

Read more: Why Gold Is Surging With Silver and Why Experts Predict $6,000 Price in 2026

“Mining stocks are especially interesting because of their leverage on the gold price,” he says. “This effect is particularly pronounced among smaller developers that are building mines and exploration companies. If the price of gold rises by 10%, for example, the valuation of such companies, measured in terms of discounted cash flow, can change several times over.”

It is this leverage that makes these investments attractive, although it works in both directions, of course.

Berlenbach’s investment strategy is to analyse what part of a company’s potential is not yet priced into its share value. If an ore body is high-grade and the environment is right in terms of geopolitical risks, management quality, and infrastructure, he often invests before new drilling results are published.

“Smaller stocks in particular often experience phases in which their value develops differently than expected in the short term,” he says. “In such cases, we deliberately act cautiously. These positions are low-weighted, usually accounting for 0.5% to 1% of the fund volume, and serve as calculated risk capital.”

The fund achieves the most significant value contributions with its high-conviction positions in larger-cap companies in which it has particularly high confidence. The portfolio is deliberately concentrated and usually comprises 35 to 45 hand-picked stocks.

More Than a Token Gesture – BNY Goes Digital

Tokenisation was high on the list of trends that captured the imagination last year, with advocates referring to the doubling of assets under management of tokenised money market funds as proof that it has taken major steps forward over the last 12 months.

Further evidence to support this view emerged last week when BNY announced that it was enabling the on-chain mirrored representation of client deposit balances on its digital assets platform. The bank believes tokenised deposits can help to reduce settlement friction, improve liquidity efficiency across collateral and margin workflows, and enable programmable payments and settlements.

There are now a number of banks offering tokenised bank deposits for institutional clients, with BNY joining the likes of JP Morgan, Citi and HSBC.

Implementing instant settlement on a digital assets platform is seen as a crucial step in tackling persistent inefficiencies in payments and capital markets, and is also indicative of increasing trust in tokenisation among institutions.

One fintech veteran described the pace of deposit tokenisation and its impact on real-time settlement as staggering, suggesting a shift from the promise of settlement to actual settled value, which translates into real-time visibility, reduced reconciliation pain, fewer trade breaks and improved cash availability.

Another market participant reckons BNY’s actions make it evident that the discussion has shifted from ‘if’ to ‘how quickly’ tokenisation will advance, and that with institutional cryptocurrency no longer focused on speculation and now revolving around genuine banking infrastructure, the rate of adoption is poised to speed up.

According to BNY’s country chief executive for France, until the same rails are adopted beyond BNY, this is another way of ensuring books and records are updated at BNY across collateral and other enabled flows, which would traditionally be done via a bookkeeping update when two counterparties are clients.

“The really exciting part should come with the next evolution of the digital transformation agenda,” he says.