Increased inter-dealer trading is one of the least surprising consequences of the return of volatility to the FX market after a lengthy period of stability as dealers looking to reduce risk.

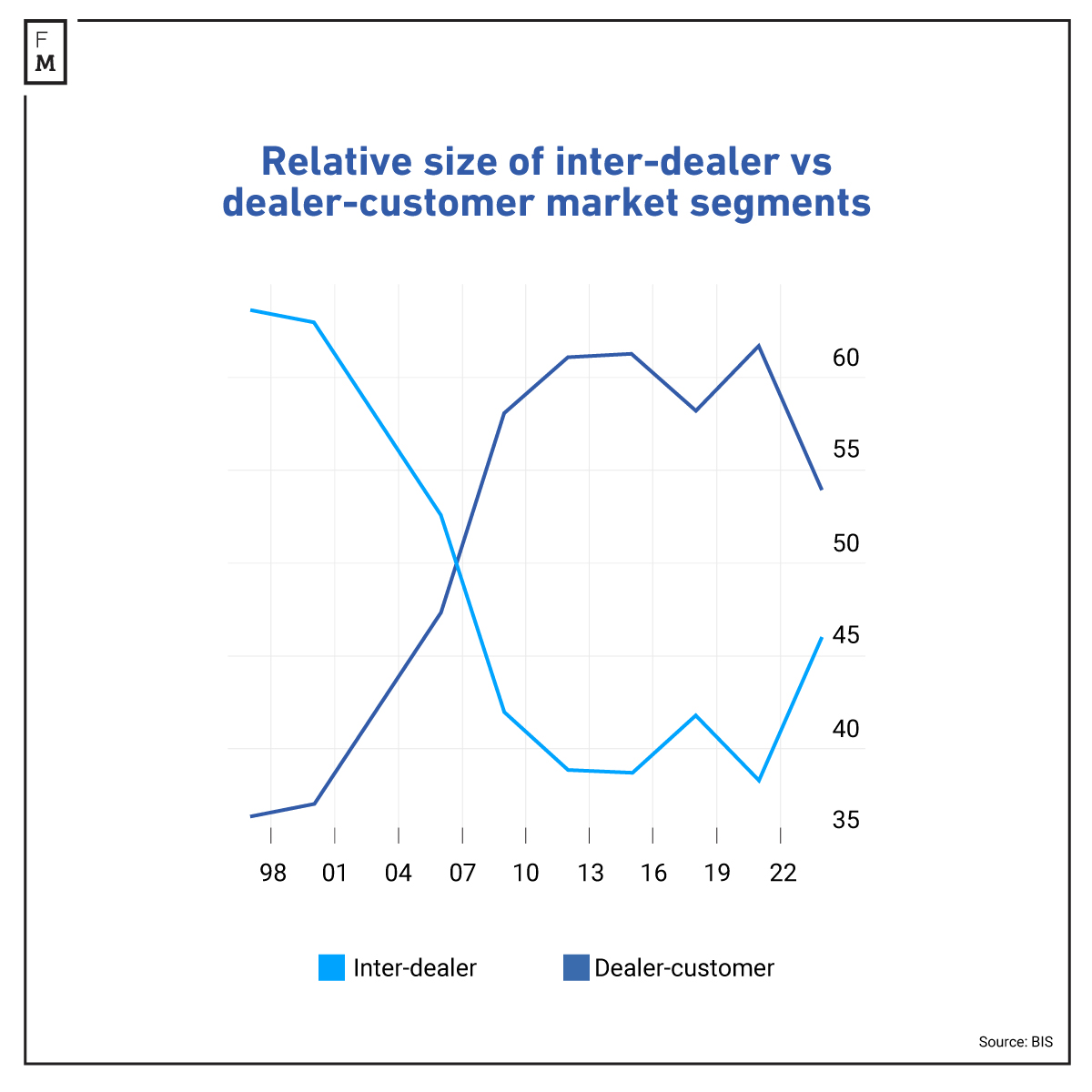

The most recent BIS triennial central bank survey found that inter-dealer trading had grown significantly between April 2019 and April 2022 to account for more than 45% of all FX trading volumes, reversing a period of decline that began in the mid-2000s. More than half of all swap trading was done between dealers.

The share of FX trading using various bilateral methods, where information about the trade remains private, also increased. As a result, in the inter-dealer market, trading volumes executed via electronic brokers (where trade attributes such as prices can be seen by all participants) continued to decline.

According to Vlad Sushko, a senior economist at the BIS, this implies a decrease in the transparency of the FX market. While accepting that this trend has so far not hampered market functioning, he says it could harm price discovery for the market as a whole.

Maxime Mordelet, an Institutional Digital Asset & E-forex Liquidity Manager at Swissquote agrees, observing that lower trading volumes on public venues reduces the amount of information available for market participants.

“In my opinion, the shift towards bilateral forms of trading has negative implications for price discovery since it reduces the source of information being available in primary and secondary sources of liquidity on which smaller banks or non-banks rely on to construct their own mid-price,” Mordelet stated.

However, Geoff Kot, the Global Head of Financial Markets Electronic Trading & Platforms at Standard Chartered reckons technology has mitigated many of the potential downsides of increased inter-dealer trading and greater fragmentation of FX market structure.

“There are now many technology solutions to aggregate pricing and deploy more sophisticated algorithmic execution strategies to optimise execution across various dimensions including price, speed and market impact,” Kot mentioned.

A leading global inter-dealer broker adopted a fully customized and managed unified electronic trading and voice communications solution, migrating all services to the Connexus Cloud financial ecosystem and Unigy platform. Full case study: https://t.co/zLZ7N9otuN pic.twitter.com/CY8DG4bNfO

— IPC Systems (@IPC_Systems_Inc) November 24, 2021

Where previously these technologies would have been bespoke implementations by the most sophisticated market participants, they are now cheaper and easier to access for a broader range of participants.

“At the same time the growth and availability of independent execution analytics services and mandatory transaction reporting for certain trade types means the information available to customers to make informed decisions regarding FX service provision is greater than ever,” added Kot.

Unlike many other asset classes, FX has never had a central exchange that represents a true picture of the market, so the idea of reducing transparency is relative. Inter-dealer trading and the lack of a central price discovery mechanism for FX can make it more difficult for market participants to get a clear picture of the supply and demand dynamics and this can limit their ability to determine fair value.

However, it is important to note that inter-dealer trading also provides significant benefits, such as increasing liquidity and offering more efficient price discovery. That is the view of Gerald Melia, the Head of Sales at StoneX Pro, who believes that the impact of inter-dealer trading on transparency may vary depending on the specific market and measures that are in place to promote transparency.

“For example, we have seen an increase in the popularity and demand for listed FX futures,” Melia pointed out. “FX Futures add more transparency so this indicates that this is what the market wants. We feel that the FX market operates optimally when OTC and listed FX futures co-habit in the same market.”

Melia is unconcerned about the potential impact of the shift towards bilateral forms of trading on price discovery, observing that professional FX clients are highly informed and that many have a background in treasury and finance.

“Additionally, markets have become less opaque with the availability of market data and industry benchmarks,” he says. “In saying that, we recommend that FX participants access and utilise consultants with FX, finance and capital market experience and leverage their experience and knowledge to maximise the benefits of new technology and trading venues.”

Sushko attributes the decline in dealer trading with customers to the risk-off environment. Mordelet agrees that this is a significant factor, although he also refers to a decrease in risk appetite from larger banks and more interest in reducing risk, either across internal desks or externally through interest-based quoting.

Fidelity and Standard Chartered have partnered with the world’s biggest inter dealer broker ‘TP ICAP’ to launch a #Bitcoin trading platform for institutions. 😱🚀

— Bitcoin Archive (@BTC_Archive) June 29, 2021

- The Economic Times

The BIS survey attributes some of the decline in dealer-customer trading to the contraction in international investment likely, resulting in a reduction in gross external portfolio positions. It further noted the decline in the market share of principal trading firms, which may be a function of these firms migrating to other asset classes with greater opportunities.

“However, it is also likely that the improvement of technology amongst dealers has also contributed to the decline in principal trading firms’ market share,” said Kot. “Pricing and execution algorithms have become more sophisticated, and the depth and persistence of liquidity from dealers is more highly valued during volatile market conditions.”

Most current forecasts for the economy and markets are negative or, at best, uncertain, and this drives investors from risk-on assets such as stocks, junk bonds and emerging market currencies to safer assets like government bonds, gold and developed country currencies.

“This can have a short term volume-increasing effect as investments move to safe haven assets, usually denominated in more stable currencies,” stated Melia. “Once this cycle of migration of capital has been completed, FX volumes naturally decrease.”

But, he acknowledged that this is not the full story since risk-off usually refers to the narrow spectrum of investments and risk management and ignores corporate investment. As the economic outlook worsens and uncertainty prevails, companies pull back on ordering raw materials and investments in projects to increase their international market share.

“This, in turn, can lead to changes in FX trading/hedging strategies as companies adjust their positions based on their outlook for different currencies and the perceived level of risk in those markets,” concluded Melia.