As we are approaching end of the 2025, this is a great moment to review the most important events of the year and there was plenty of them. The

Among many events, here are five most interesting from the perspective of the CFD industry evolution as this is what I track and comment on daily basis.

1. MT5 Overtook MT4

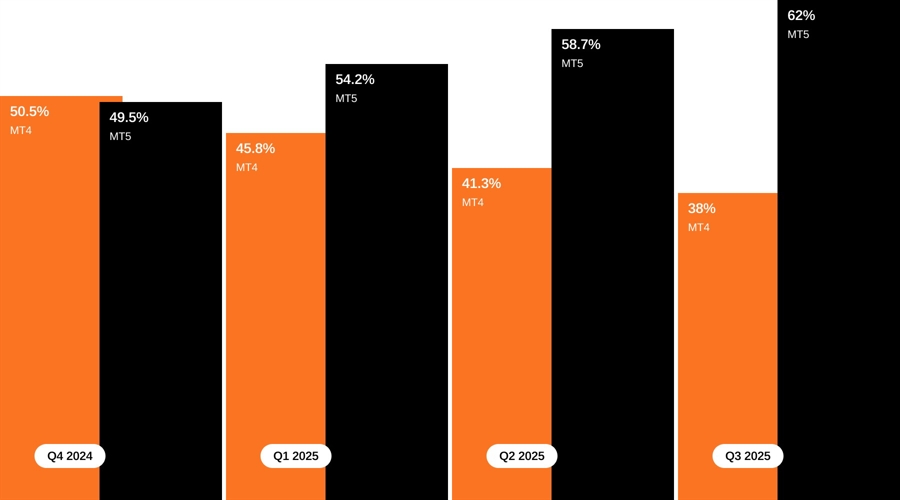

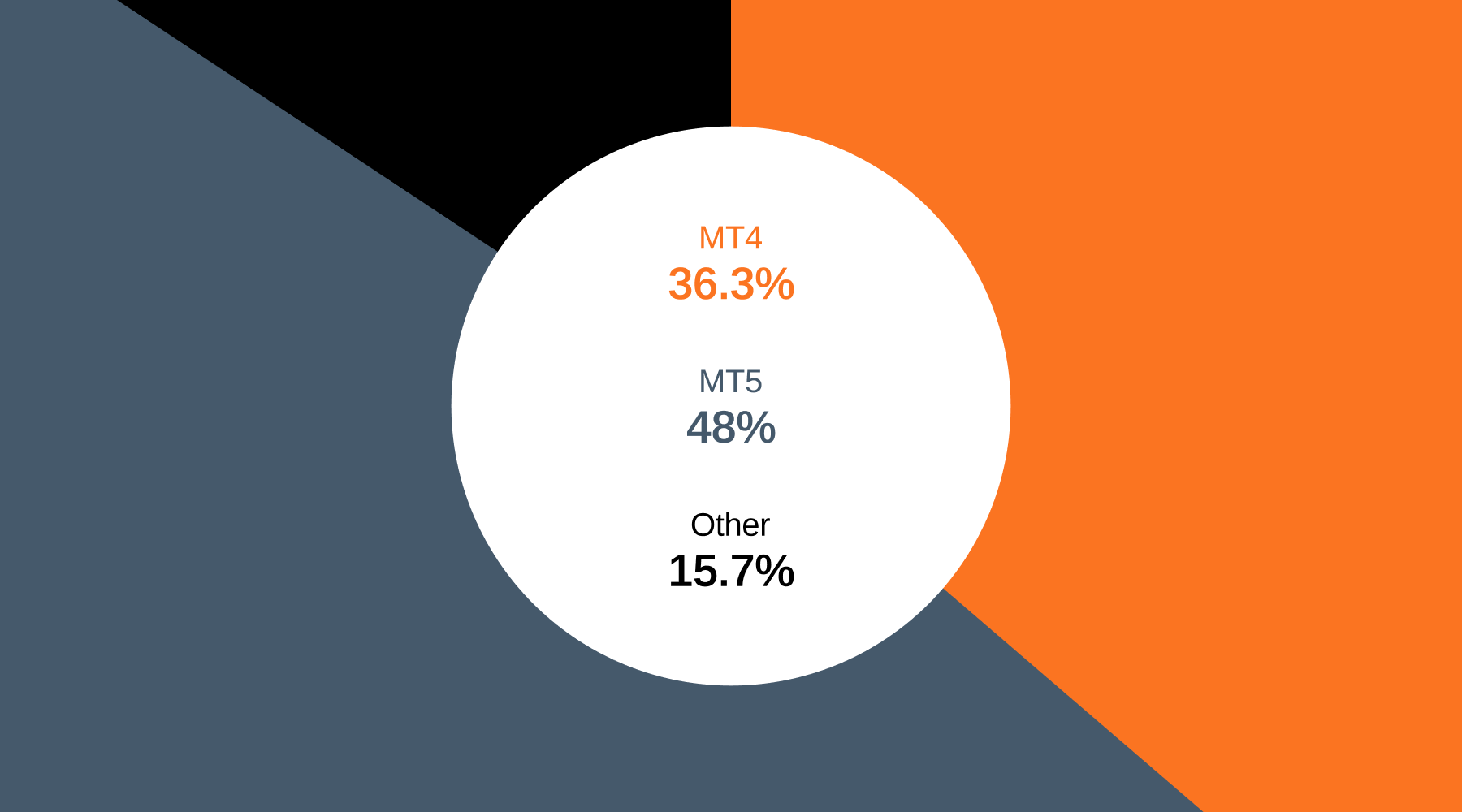

In 2025, one of the most notable industry milestones was MT5 finally surpassing MT4 in total trading volume.

The shift, recorded in the Q1 Intelligence Report, showed MT5 reaching 54.2% of the combined MT4–MT5 volume, while MT4 settled at 45.8%. The result exceeded the projections made at the end of 2024 and confirmed that MT5 adoption accelerated more quickly than expected.

MT4 had dominated the market since 2005, supported by its extensive third-party ecosystem, advanced charting, and strong broker alignment. But throughout 2025, MT5 continued to benefit from ongoing technological upgrades, broader instrument access, and MetaQuotes’ gradual reduction of MT4 support, which led more brokers to promote MT5 as their primary platform.

Alongside this shift, 2025 also marked a rise in platform diversification. Alternative platforms grew their share to 27% in Q1, up from just over 24% in Q4 2024. The year ultimately closed with MT5 holding its newly established lead and the broader market moving toward a more varied platform mix.

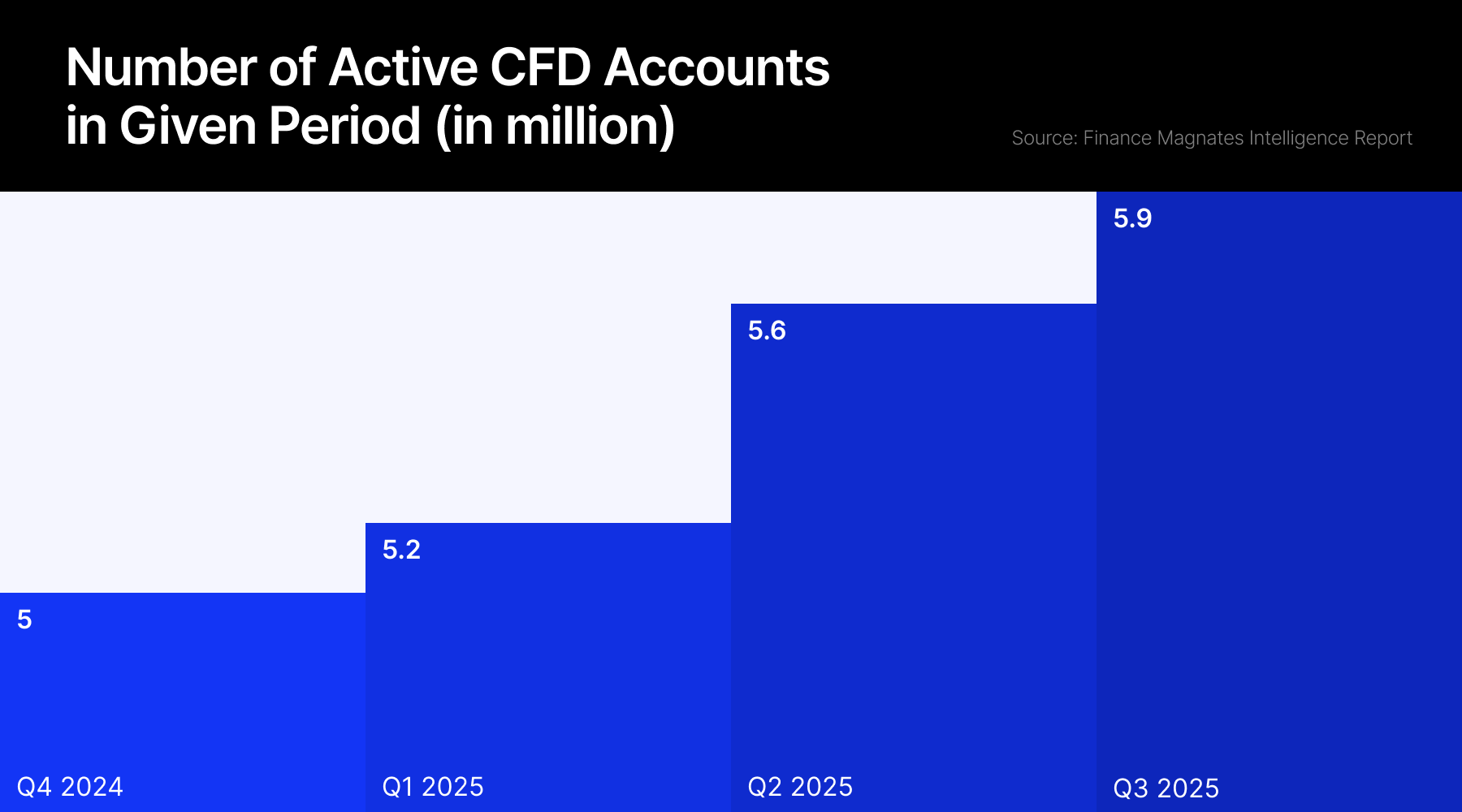

2. CFD Industry Approaches 6 Million Active Accounts

At the beginning of 2025, the industry confirmed a major milestone: the total number of active CFD accounts exceeded 5 million in the previous quarter, according to the Finance Magnates Intelligence Report. The data supported the steady expansion of the sector and indicated that growth remained consistent year over year.

By the end of 2025, those expectations proved accurate. Although final Q4 figures are not yet available, the Intelligence Report for the third quarter already showed 5.92 million active CFD accounts.

With only a small gap left before reaching the next threshold, it is highly likely that the industry has now crossed the 6 million mark. This puts 2025 among the most active years for CFD account growth to date.

A key driver of this expansion was the industry’s increased focus on new geographical regions. Asia remained the most active growth area throughout 2025, with India playing a central role in accelerating retail participation and contributing significantly to the near-6-million milestone.

- Exclusive: MT5 Overtakes MT4 in Trading Volume After 15 Years, Signaling the End of an Era

- Introduction to Our New Section: Heat Map. Where to Search for New Clients?

- CFD Brokers Can Now Get Dubai Licenses 33% Faster

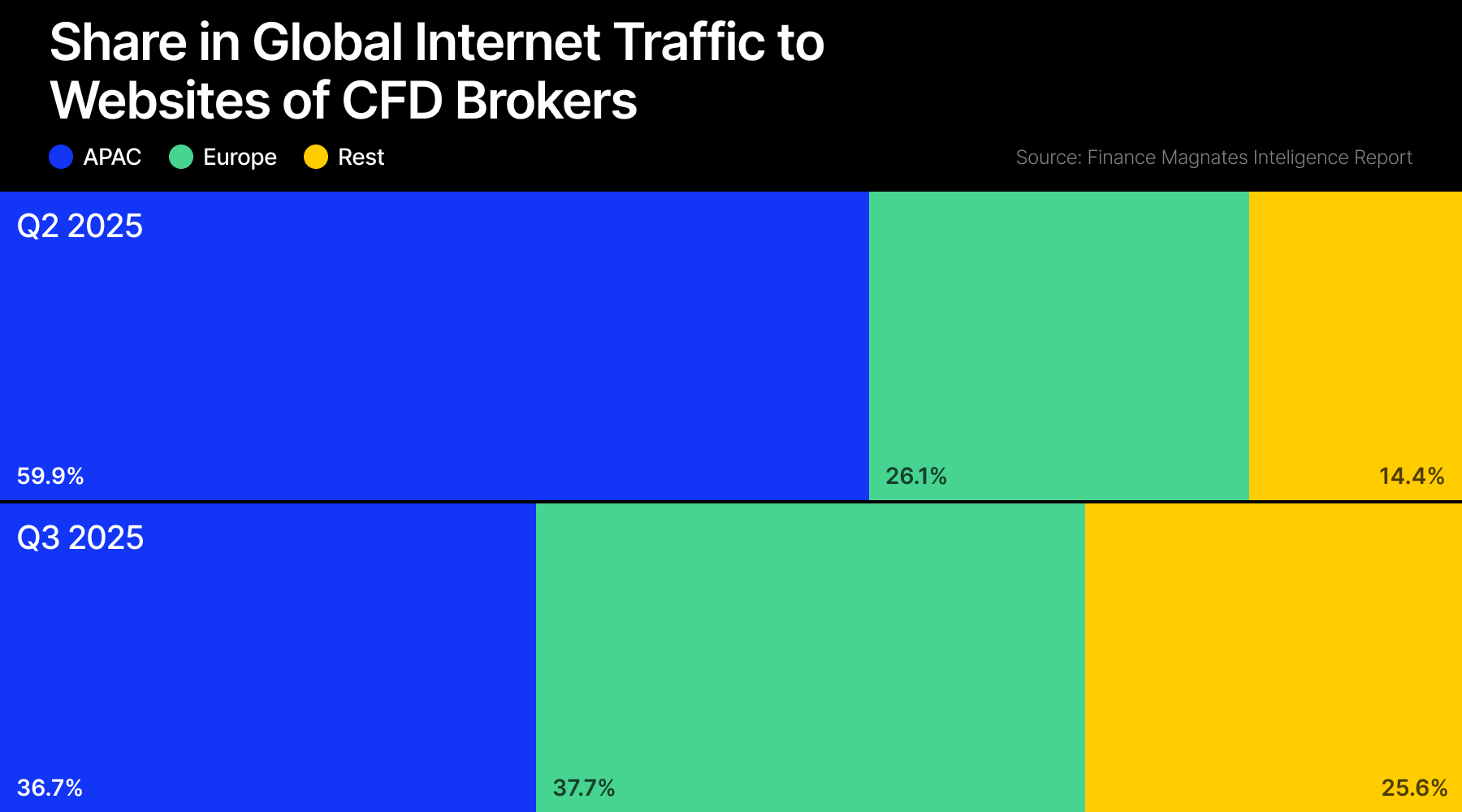

3. Asia Lost Its Dominance, but India Remains Strong

Asia remained a central region for CFD interest throughout 2025, but the year ultimately marked the end of its uninterrupted dominance on the Finance Magnates Global Heat Map.

In Q1, APAC still held the lead with 66.6% of all views to major FX/CFD platforms, down from 69.5%, while Europe increased its share to 18.4%, driven largely by traffic from the UK and Poland. In Q2, APAC accounted for 59.5% of total traffic, while Europe continued its rise to 26.1%.

The decisive shift came in Q3, when Europe moved ahead for the first time since 2023. Europe captured 37.7% of global traffic, while APAC declined to 36.7%, marking the first clear break in Asia’s two-year run as the leading region.

A key factor behind APAC’s decline was the situation in India, which has remained the single most influential market in Asia as a country.

In July, Exness, the largest retail CFD broker by number of accounts, stopped onboarding new clients in India. Local users were redirected to login-only pages with no registration option, which likely reduced total platform traffic. While Asia no longer dominates the heat map overall, India, as a country, continues to stand out as the strongest contributor within the region.

What does the CySEC Chair thinks about brokers moving offshore? "Naturally, there are offshore jurisdictions with looser regulations – but the level of investor protection there is very different to that which is provided in Europe."

4. Three Brokers Surpassed $1T in Monthly Volume

2025 marked a year of clear volume expansion across the retail CFD sector. In Q3, for the first time on record, three brokers in the Finance Magnates Volume Rank exceeded an average monthly volume of $1 trillion. The brokers crossing this threshold were IC Markets, IG Group, and EC Markets. While the ranking does not include every broker operating globally, the milestone reflects a new scale of reported activity across the leaders featured in the Intelligence Reports.

The combined monthly volume of these top three entities in Q3 represented nearly 15% of total retail trading volumes, excluding the Japanese market. This concentration highlights the continued strength of the largest players in the industry and shows that CFD trading remains active and expanding.

Equally notable was the performance of the brokers positioned directly below the top three. Both recorded average monthly volumes exceeding $800 billion. With only a relatively small gap remaining, attention is now turning to whether these two firms will join the $1 trillion group in the coming quarters. As 2025 comes to a close, the industry enters the next year with multiple brokers approaching or surpassing the highest volume thresholds previously observed.

5. DORA Sets a New Compliance Standard

A major regulatory milestone for the CFD sector in 2025 was the full enforcement of the Digital Operational Resilience Act (DORA) on 17 January. The regulation introduced a unified operational and cybersecurity framework across the EU, replacing fragmented requirements with mandatory standards for ICT resilience, incident reporting, and third-party technology oversight.

Finance Magnates Intelligence first outlined its importance in our March Compliance Report, highlighting that, unlike earlier rules, DORA did not offer guidelines but imposed binding obligations on all financial entities operating in or servicing the European market.

For CFD platforms, DORA reshaped operational priorities. Firms were required to monitor their infrastructure continuously, stress-test trading systems, maintain uninterrupted access to trading services, and document incident response procedures. The regulation also tightened broker relationships with IT vendors by requiring structured oversight of cloud providers, data centres, connectivity partners, and all outsourced services linked to trading continuity and security.

By the end of 2025, the impact was unmistakable. DORA not only pushed larger brokers to strengthen resilience measures but also placed significant pressure on smaller entities, some of which reduced operational exposure or scaled back expansion plans due to the cost and complexity of compliance.

Coexisting Regulatory Hubs in the CFD Industry

As we look ahead to 2026, the evolving balance between Cyprus and the UAE, particularly Dubai, stands out as one of the key developments to watch in the CFD regulatory space.

Cyprus remains the undisputed benchmark in terms of licensing scale and continues to serve as the primary reference point for Europe, maintaining its long-established role as the central destination for brokerage authorization and supervision.

At the same time, 2025 marked a noticeable acceleration toward Dubai as an alternative hub.

Over the past year, at least nine major CFD brands either opened offices in the UAE or obtained new licenses there. This indicates that Dubai is no longer merely a gateway to the Middle East but is increasingly a market center with growing operational and strategic relevance. For many brokers, the city now functions not only as a regional anchor but also as a prestige-driven location and a base for expansion into new jurisdictions.

Industry feedback reflects this shift. While Cyprus continues to host senior corporate structures, a rising share of day-to-day operations is quietly moving to Dubai. The year ahead will determine whether this becomes a permanent reallocation of regulatory gravity and whether Cyprus will introduce strategic responses to sustain its leading position as Dubai's influence increases.