Polish publicly listed broker XTB (WSE: XTB) has launched individual retirement security accounts, known as IKZE, giving clients access to tax-advantaged retirement investing after months of preparation.

XTB Launches Long-Awaited Retirement Accounts in Poland

The company began rolling out the accounts to customers today (Tuesday), with full availability expected within a week. XTB had originally planned to introduce IKZE accounts in the first quarter but pushed the timeline back to mid-2025.

The launch comes as Polish investors show growing interest in retirement planning. Government data shows more than 593,000 Poles held IKZE accounts by the end of 2024, with over 122,000 of those managed through brokerage accounts.

“Introducing IKZE was a natural step in further developing our offering,” said Omar Arnaout, XTB's chief executive. “After the success of IKE accounts, which met with great interest from clients, we clearly see that Poles are increasingly thinking about their financial future and want to invest consciously and effectively.”

The retirement accounts complement XTB's existing IKE individual retirement accounts, which the broker launched in late 2024. The company also offers similar tax-advantaged products in other markets, including ISA accounts in Britain and PEA accounts in France.

You may also like: From Warsaw's Skyliner, XTB's CEO Eyes Super App as 80% of New Clients Pick Stocks, ETFs

Mobile-First Approach

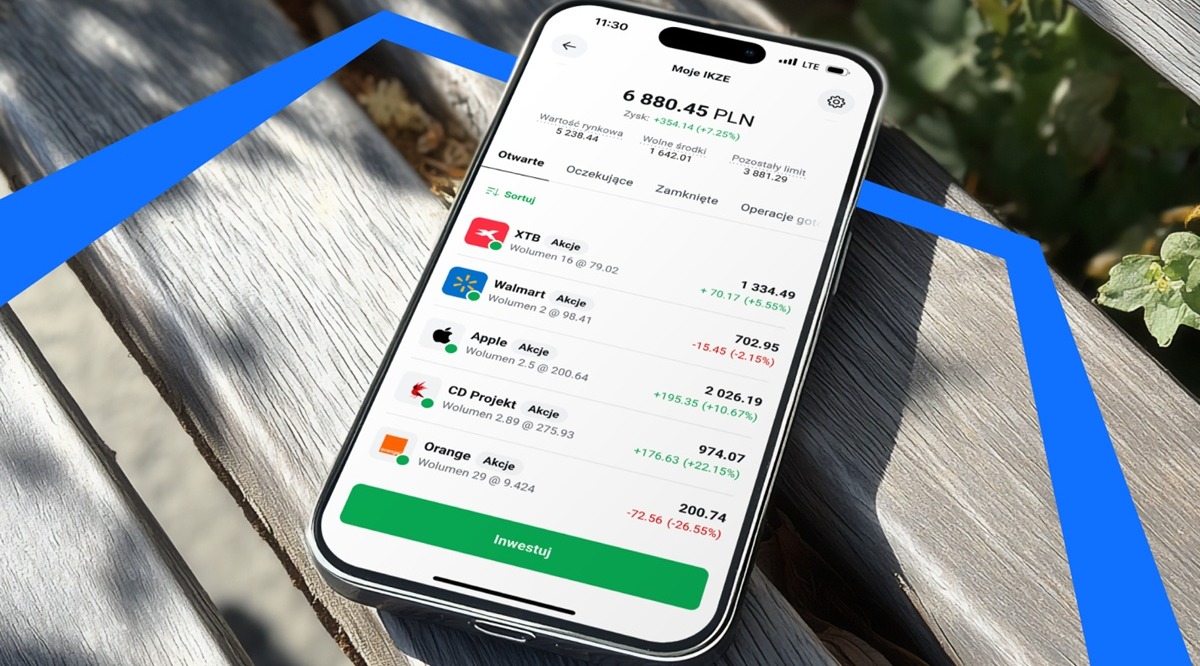

True to XTB's mobile-first strategy, customers can initially open IKZE accounts only through the broker's smartphone app. A desktop version won't arrive until 2026. The company is also limiting new account openings at first, with account transfers from other brokers becoming available gradually through the end of 2025.

IKZE accounts will offer access to XTB's standard lineup of Polish and international stocks and exchange -traded funds. The broker doesn't charge commissions on stock and ETF trades up to 100,000 euros monthly, then applies a 0.2% fee with a 10-euro minimum. Currency conversion fees of 0.5% may apply for foreign investments.

Like XTB's IKE accounts, IKZE balances are exempt from the broker's custody fees that apply to larger portfolios.

Related: XTB UK Posts 120% Jump in Annual Profit Despite Revenue Decline: “Transition from a Pure CFD Broker”

Tax Benefits Drive Appeal

IKZE accounts offer immediate tax advantages that IKE accounts don't provide. Investors can deduct contributions from their taxable income, reducing their annual tax bill. Investment gains can also avoid Poland's 19% capital gains tax if certain conditions are met.

To qualify for the tax benefits, investors must wait until age 65 to withdraw funds and make regular contributions for at least five calendar years. Withdrawals that meet these requirements face a flat 10% tax on the entire balance, often more favorable than standard income and capital gains taxes.

Annual contribution limits for 2025 are set at 15,611 zloty for business owners and 10,408 zloty for employees, based on projected average wages. An employee in Poland's higher tax bracket could save up to 3,330 zloty in taxes this year by maximizing their IKZE contribution.

The accounts charge a 200-zloty fee for withdrawals within 12 months of opening, matching XTB's policy for IKE accounts.