After the news that Fortress Prime's access to the services of its technology provider has been cut off and that the company's clients are not only not receiving their withdrawals but have also lost the ability to check their account balances, the dire financial state of Fortress Prime is now confirmed by the actions of one of the biggest brokerages in the industry.

A number of sources with knowledge of the matter have shared with Finance Magnates that FXCM has been a client of Fortress Prime, and an in-depth look into the company’s 10-K filing with the SEC and the firm’s earnings presentation uncovers that the brokerage has taken action which matches the timeline of events at the Dubai based brokerage.

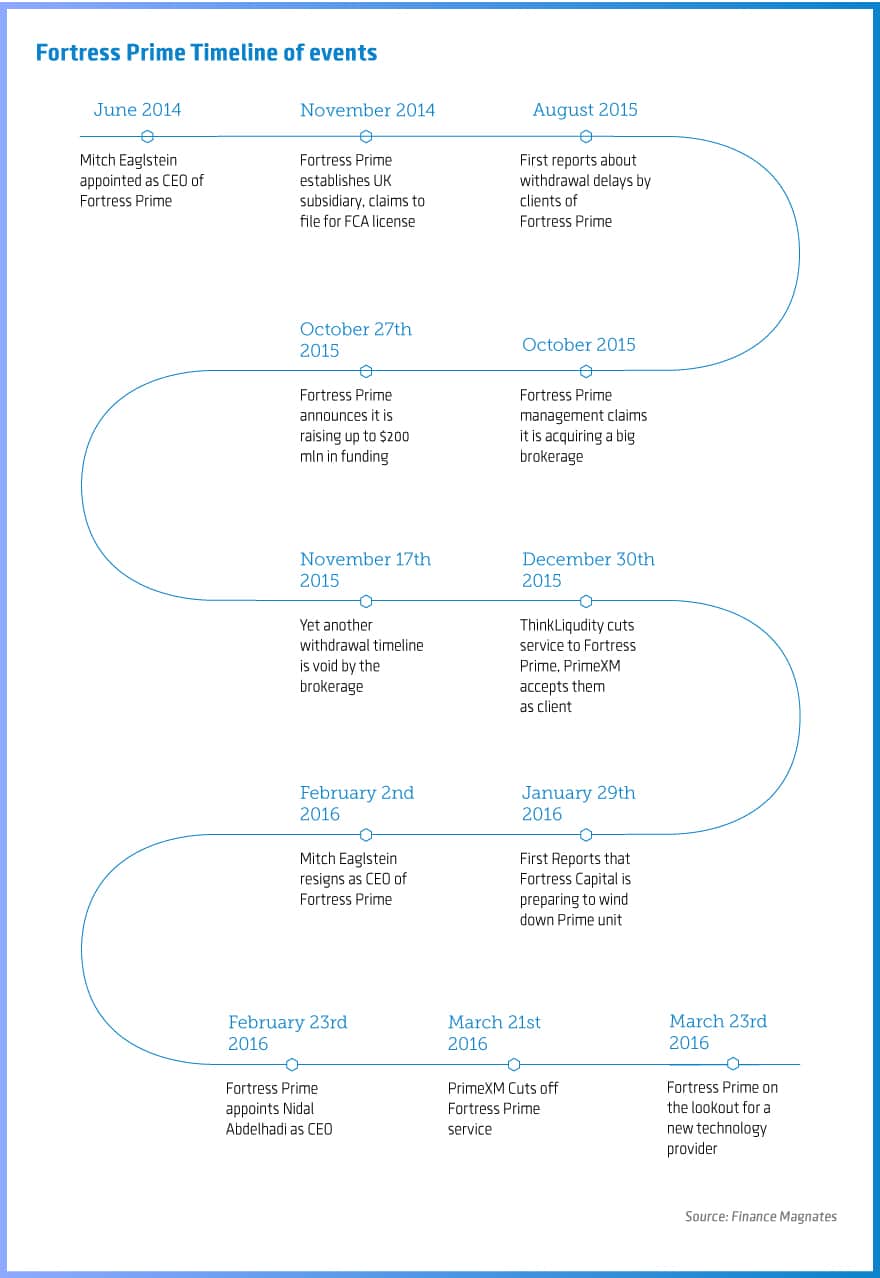

Timeline of events at Fortress Prime, Source: Finance Magnates

An FXCM spokesperson declined to give further information about the matter, however in the company’s publicly available fourth quarter earnings presentation, the association of FXCM with Fortress Prime is taking shape: FXCM has written off a number of items, including the “elimination of a $6.8 million reserve recorded against an uncollected broker receivable”.

After suffering heavy losses in the aftermath of the Swiss National Bank event, FXCM Inc. was forced to record another bad credit loss related to one of its counterparties. According to industry insiders familiar with the Dubai based firm, a number of brokerages have been using Fortress Prime to clear foreign Exchange and CFDs trades.

While there is no definite mention of the counterpart of FXCM to which the write-off is related, the provision is for up to $6.8 million. In addition, two FCA regulated firms have filed notice today with the U.K. watchdog, informing the regulator about their exposure to Fortress Prime.

A Tale of Royal Backing Exposed and an FBI Wanted Shareholder

Thorough investigation of the ownership structure of the company conducted by Finance Magnates has confirmed some rumors circulating across various online forums about the ownership of the company.

While Fortress Prime has been boasting the name of Sheikh Mohammed Bin Sultan Bin Hamdan Alnehayan and his involvement, the company has rarely spoken about its other shareholders. According to documents obtained by Finance Magnates that date to November 2014 (which is shortly after the company started its operations), there have been four shareholders.

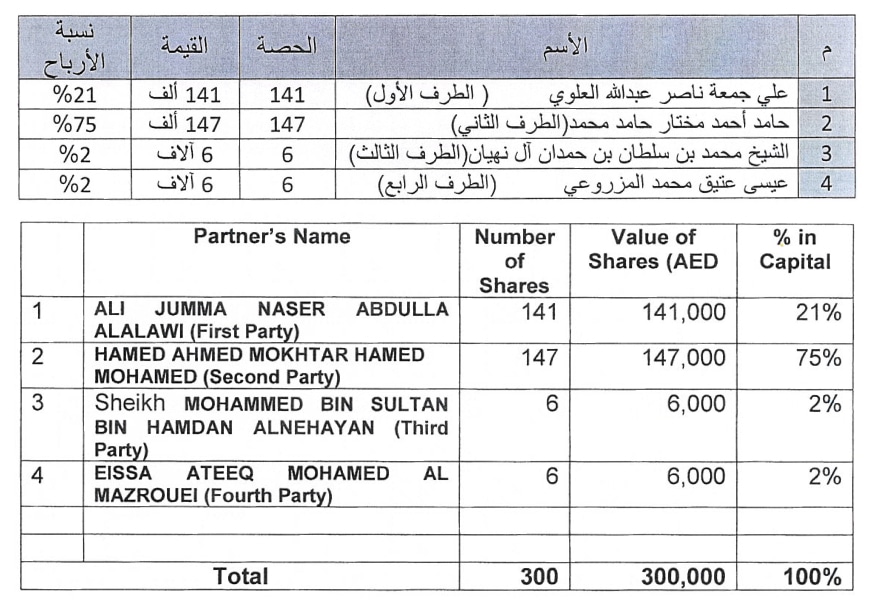

The owners of company shares are not proportionally represented in the capital of the company, Photo: Official registrar documents of Fortress Prime

Furthermore the company did not have the Sheikh onboard when it was established in October 2014. That changed in November of the same year when he purchased a 2 per cent stake.

It now appears that the move was made formal in order to aid the company in establishing a reputation in the industry. While the firm and its former management have been boasting about the involvement of a Dubai royal family member in the venture, the parent company of Fortress Prime Fortress Capital Investments LLC didn’t have the Sheikh as an official shareholder before November 2014.

The names of the partners in Fortress Capital LLC which were the sole owners of Fortress Prime after that date are Ali Jumma Naser Abdullah Alalawi, Hamed Ahmed Mokhtar Hamed Mohamed, Sheikh Mohammed Bin Sultan Bin Hamdan Alnehayan and Eissa Ateeq Mohamed Al Mazrouei.

At the establishment of the firm, the controlling shareholder of Fortress Capital Investments LLC was Ali Jumma Naser Abdullah Alalawi with 51 per cent of the shares, while Mr Hamed was holding the remaining 49 per cent.

Contrary to the marketing materials which were distributed at the time by Fortress Prime and its former management, looking at the share capital structure, Ali Jumma Naser Abdullah Alalawi owned 21 per cent of the capital of the company and 141 shares. Hamed Ahmed Mukhtar Hamed Mohamed is listed as holding 147 shares and 75 per cent of the capital of the company.

Sheikh Mohammed Bin Sultan Bin Hamdan Alnehayan and Eissa Ateeq Mohamed Al Mazrouei each owned 2 per cent of the capital and 6 shares.

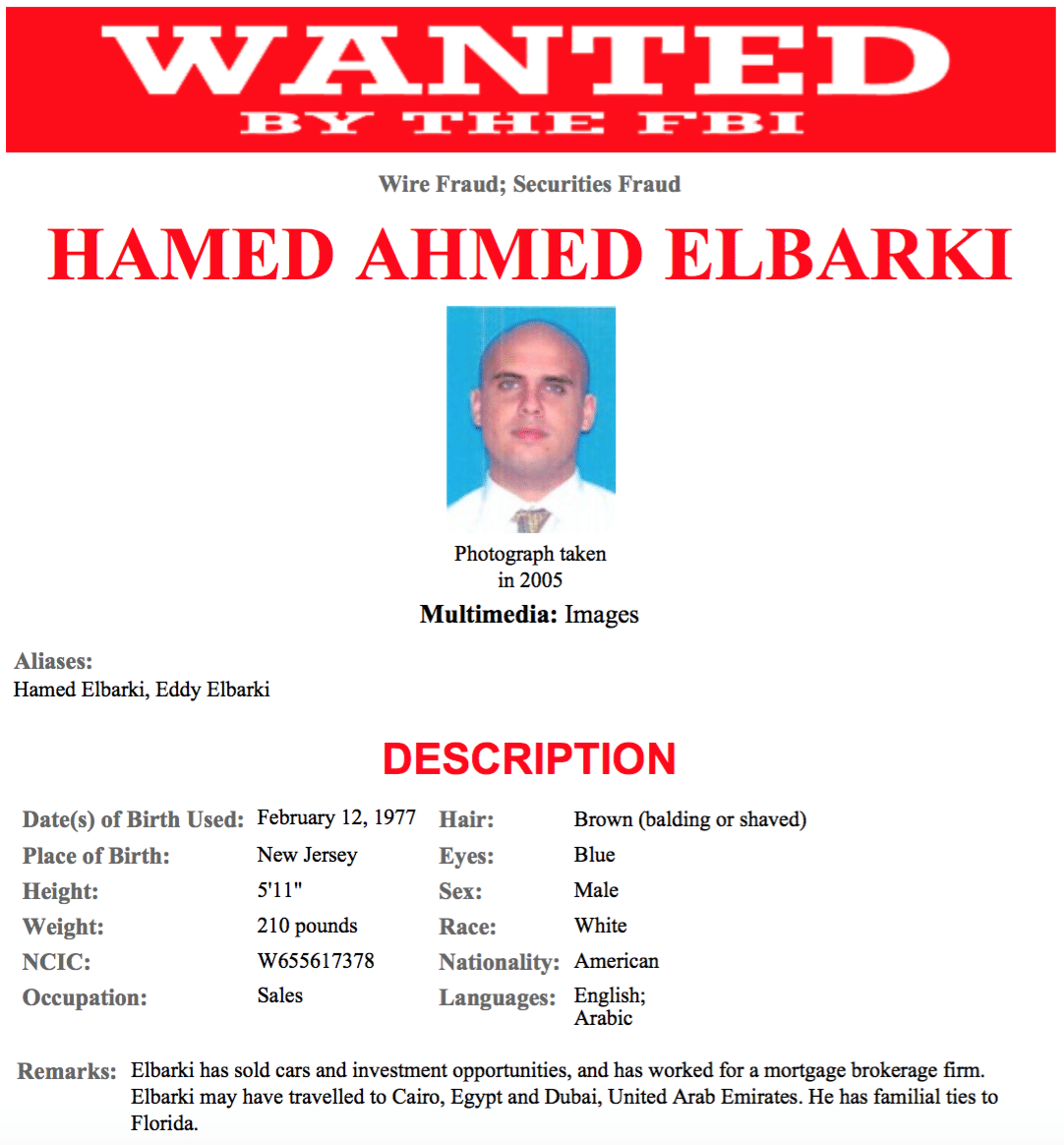

The FBI Wanted poster of Hamed Ahmed Elbarki, Photo: FBI

A number of brokers, clients of Fortress Prime, have been in contact with Hamed Ahmed Mokhtar Hamed Mohamed from Fortress Capital LLC, and they have all confirmed his visual resemblance to an FBI wanted conman named Hamed Ahmed Elbarki.

A crosscheck between an “FBI Wanted” poster and his official ID issued by Egyptian authorities reveals one more relevant point - the date and location of birth of both individuals are the same.

According to remarks made by the FBI, Elbarki has been selling cars and investment opportunities, he has also worked for a mortgage brokerage firm and is wanted in relation to an alleged involvement in a mortgage related scheme which defrauded investors of at least $2 million. The FBI states that Elbarki may have travelled to Cairo, Egypt and Dubai.

Conning the Conmen in Jail

Aside from the FBI, Hamed is also wanted by Interpol. The timeline of events suggests that after collecting capital from his previous actions while in the U.S., the individual has taken advantage of his Egyptian roots and has obtained a second passport under a slightly different name.

A New York Times report from August 2000, links Hamed Elbarki with a prison scheme where was conspiring with another inmate and a New York City police officer to defraud other convicts.

The main shareholder of Fortress Prime and an individual named George Gallego had been conning fellow inmates that they could reduce their sentence by conspiring with a Drug Enforcement Administration (DEA) official whom they knew. As a result the duo managed to scam numerous convicts and their families of thousands of dollars according to an indictment on this case.

As to the reasons why Mr Hamed was in jail in the first place, the report states that he was convicted of an armed bank robbery in West Milford, New Jersey. Hamed Elbarki was arrested by the FBI in a luxurious hotel in Manhattan in August 1996 and was sentenced to 56 months in jail.

Fortress Capital Investments and its Permits

Back to the company dealings, the firm had also stated at the time that it was regulated by Dubai authorities. Not only has the firm never been regulated by the financial authorities in the emirate, but its license to engage in commercial activities issued by the Dubai Department of Economic Development expired in October 2015.

While sources with knowledge of the matter said that an extension is easy, according to the documentation the sole license member which is listed on the paper is Mr Hamed. The Dubai Department of Economic Development did indeed authorize the firm to do business in the country, however financial services are not amongst the listed activities.

The Commercial License merely permits the firm to be engaged in the establishment, investment and management of commercial, agricultural, and industrial enterprises. In addition the firm may invest in Oil & Natural Gas Projects, Sport Enterprises, Water Projects, Healthcare Enterprises and Educational Enterprises - Fortress Capital Investments LLC was authorized to engage in some investment activities.

Litigation Challenges Looming

Numerous clients of Fortress Prime from Dubai and around the world have contacted Finance Magnates with their plans for litigation against Fortress Capital Investments. With his actions, Mr Hamed has led many brokerages to reconsider the way they approach their counterparty risks and to establish much more diligent procedures to check their Liquidity and clearing providers.