About 10 months after the bankruptcy procedure of Boston Prime began, the appointed special administrator Rollings Oliver is finally getting close to concluding the proceedings. Numerous obstacles have delayed the final payouts to clients - from the missing client funds, which Finance Magnates reported about in February, to lack of claims on the part of customers of the company.

A court ruling which is setting a final deadline for client claims submissions and clears the way for the repayment of some compensation to clients is showing some interesting details about Boston Prime’s bankruptcy.

Boston Prime, regulated by the U.K. Financial Conduct Authority (FCA), had been providing foreign exchange brokerage services mainly to professional clients. This automatically makes the attempts to recover funds from the Financial Services Compensation Scheme (FSCS) irrelevant, since the insurance of client funds is valid only for retail investors.

For the professional clients of the company who had been relying on the brokerage to carry on their dealings on the foreign exchange market, the fact that Boston Prime was an FCA regulated entity was enough. Unfortunately as we shall see in the coming paragraphs, there might be some serious reasons to doubt the reassurances which should come with this fact.

Special administration procedure and massive delays

After the sole director of the company, George Popescu, effectively acted as a whistleblower to the FCA, the special administrators from Rollings Oliver identified that a number of client funds were missing from the company.

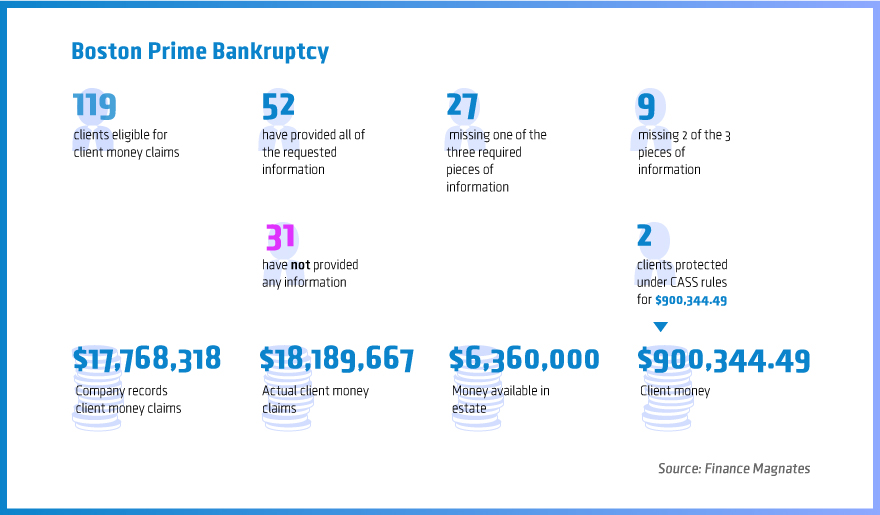

While attempting multiple times to get in touch with all the clients of the brokerage, the special administrators were forced to file a court case to permit the setting of a bar date for the submission of Client Money . This happened only after numerous attempts to contact all existing 119 clients of the company.

An issue surfaced after 31 of these clients did not provide any information to Rollings Oliver.

As a result the court issued an order on November 30th this year outlining that there will be a final deadline for the submission of client money claims, so the bankruptcy procedure can continue in an “orderly” fashion. The hard deadline has been set for 5pm GMT on the 5th of January, 2016. After this date, Rollings Oliver intends to complete the distribution of client money to clients within 4 months.

Distribution of what? Client funds gone rogue

Speaking of the client money pool, the special administrator has identified that there isn’t much to go after. One of the lawyers appointed by Rollings Oliver on the Boston Prime case explained in his witness statement that the company has identified that only $900,344.49 in client funds were present.

Coincidentally, only two claims from the client money pool have fallen under the definition of funds protected as client money under the FCA's Client Assets Sourcebook (CASS) rules. You can already guess what the total amount which these two clients were owed was - $900,344.49.

Of the 119 clients of Boston Prime, 52 have managed to provide all of the information that was requested by the special administrators and confirmed their claims in full. As for the rest, 36 have been partially missing some information to confirm their claims, while the aforementioned 31 clients never submitted any claims.

The raw numbers taken from the court case that special administrators from Rollings Oliver filed

After Rollings Oliver exhausted all possibilities of getting in touch with the clients, whose contact information was received from Popescu and Forexware LLC- which according to court documents was effectively operating the day to day business operations of the company- the special administrators failed to obtain any additional claims.

Currently, the company’s estate which is held by the special administrators totals about £4.2 million ($6.37 million). This amount includes the $900,344.49 which is already owed to the duo of mysterious clients that have been classified as protected.

In the meantime, the discrepancies don’t end here - the claims of those who have submitted their documents to Rollings Oliver total $18,189,667.21, while the company’s records state that the amount is $17,768,318.94.

The clients of Boston Prime, excluding the privileged duo, have not managed to submit the exact same amounts that the broker’s record show. The count is right only for the $900,344.49 once more. Could these be the only clients which have had adequate access to the company’s real records? Unfortunately, we are not likely to know this any time soon.

As for the rest of the clients of the company, the company’s records do not show them as having claims. They will be entitled to the total claims of the remaining funds, which are approximately $5.5 million, since the total figure of $6.37 million includes the magic $900,000, which gives them the prospect of receiving about 30 cents on every dollar they claim.

Credibility issues and food for thought

Some of the clients of Boston Prime might have incurred substantial losses to their operations, others are not willing to show that they have any claims, while having the legal right to do so. We may never know what the real reasons are behind the latter, but one thing is clear:

If such a case can happen at an FCA regulated Prime Broker , it can happen anywhere. The issues lately surrounding another prime entity, Fortress Prime, are raising a big question for the industry - how can brokers properly ascertain who they are really dealing with and how are their assets protected? What due diligence procedures must one follow to avoid similar situations…