XTB shares (WSE: XTB) tumbled over 6% this morning (Friday) after the Polish fintech broker published preliminary results that disappointed investors, despite setting new records for client acquisition and revenue growth. Although quarterly earnings appear satisfactory, they declined on a half-year basis by 11%. Nevertheless, analysts believe this may be only a short-term correction.

XTB Reports Net Income Below Analyst Consensus

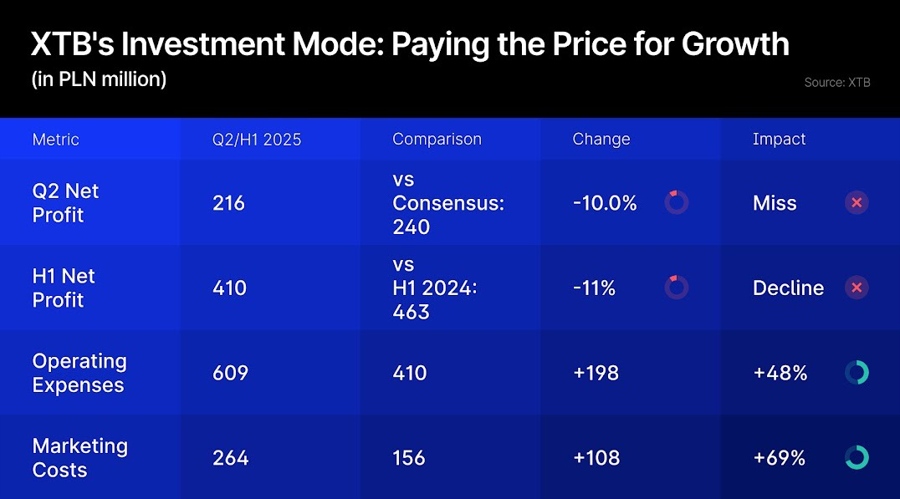

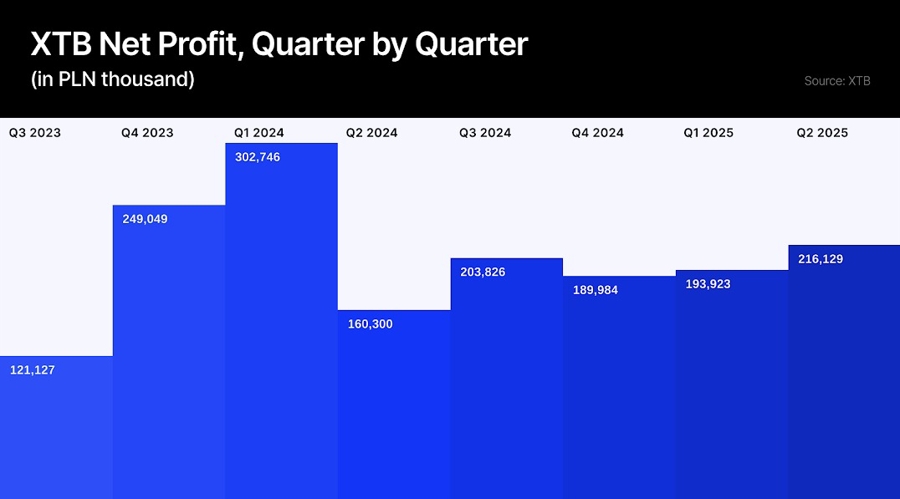

XTB reported net profit of 216.1 million PLN for the second quarter, higher than 160 million PLN in the same period last year; however, it fell short of analyst consensus estimates of around 240–250 million PLN. While quarterly profits increased compared to Q1 2025, the first-half results showed a 11.4% decline compared to H1 2024.

For the six-month period, consolidated net profit reached 410.1 million PLN, down from 463.0 million PLN in the first half of 2024. This drop occurred despite record operating revenues climbing 23.8% year-over-year to 1.16 billion PLN.

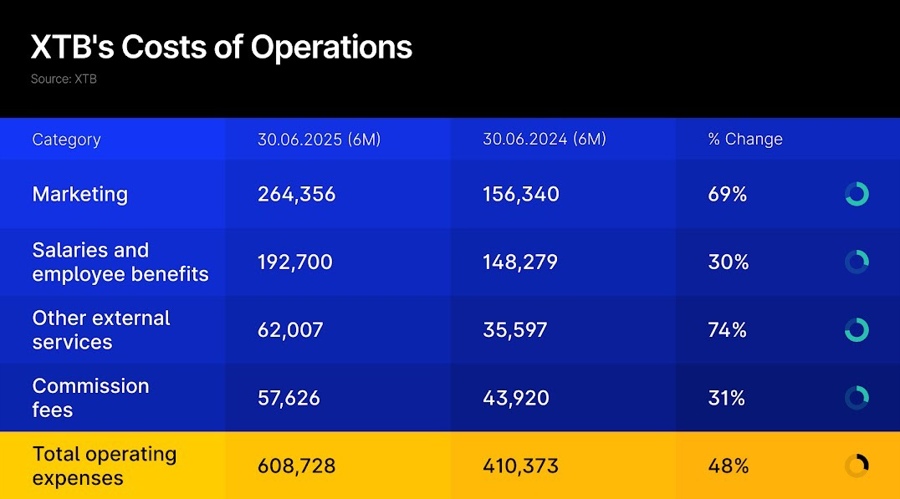

The broker's cost structure tells the story behind the profit decline. Operating expenses surged 48% to 608.7 million PLN in the first half, driven primarily by marketing investments that jumped 69% to 264.4 million PLN as XTB pursued aggressive client acquisition campaigns.

Record Client Growth Fails to Impress

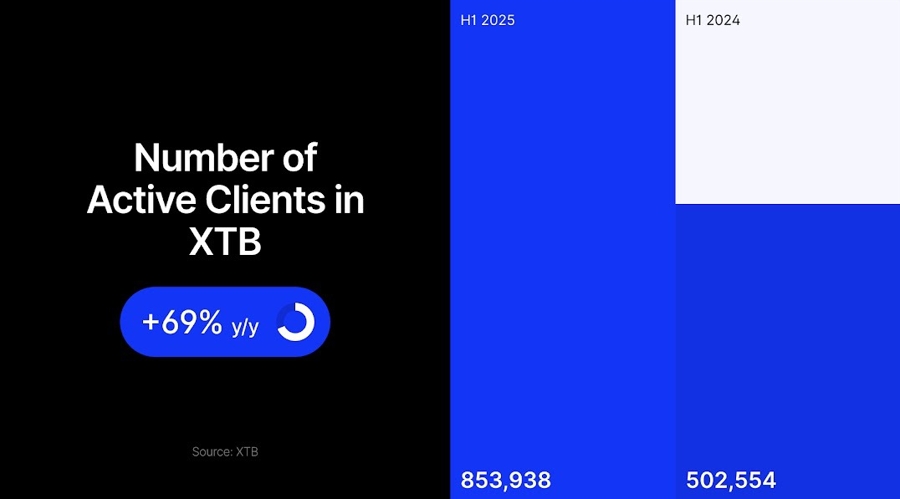

Despite missing profit targets, XTB delivered impressive client metrics that might normally excite investors. The company added 361,643 new clients in the first half – a 55.7% increase from the previous year. Active clients reached a record 853,938, up nearly 70% year-over-year.

July continued this momentum with over 61,900 new clients joining the platform in just 30 days, suggesting the second quarter's client acquisition pace of 167,339 wasn't an anomaly.

However, Maciej Marcinowski, analyst of the Polish brokerage house Trigon, noted that client acquisition slightly disappointed relative to expectations, with some suggesting XTB should return to adding 180,000–190,000 new clients per quarter in Q3.

“On one hand, our net profit forecast for 2025 needs to be revised down by 3–4 percent. However, if our assumption about a negative contribution from market making this quarter proves correct, our model indicates an upward revision of forecasts for the coming years,” Marcinowski commented on the preliminary results.

Market Making Margins Under Pressure

The revenue story also may reveal why investors remain concerned despite strong topline growth. Profitability per lot – a key metric for CFD brokers – declined to 251 PLN from 289 PLN in H1 2024, reflecting challenging market conditions for the company's market-making operations.

Marcinowski suggested that market-making revenues may have actually turned negative in Q2, a significant shift for XTB's business model. “We would risk saying that market-making revenues were even slightly negative this quarter versus our expectation of 58 million PLN,” he noted.

The decline in per-lot profitability occurred despite trading volumes surging 41.5% to 4.23 million lots, highlighting how market conditions can compress margins even as activity increases.

Currency Headwinds

Adding to profit pressures, XTB faced significant foreign exchange headwinds. Financial expenses ballooned to 85.1 million PLN in the first half compared to just 513,000 PLN in the prior year, largely due to negative currency differences of approximately 40 million PLN.

“Operating results are 7 percent below forecasts, while net profit deviates more significantly due to PLN 40 million in negative exchange rate differences (we had assumed PLN 20 million),” added Marcinowski.

This forex impact was roughly double what analysts had anticipated, contributing to the larger-than-expected miss on bottom-line results.

Investment Mode Continues

CEO Omar Arnaout emphasized that XTB remains in investment mode, prioritizing market share growth over short-term profitability. He is thus maintaining the strategy he mentioned during the interview I conducted when I visited XTB's headquarters last year. The company expects total operating costs could rise 40% in 2025 compared to 2024, with marketing expenses potentially increasing 80%.

“Despite significantly higher marketing expenditures both in Poland and foreign markets, we maintain the average cost of client acquisition at a similar level,” Arnaout said. “I am also convinced that we will exceed the threshold of two million clients this calendar year.”

Related: XTB Co-Founder Jakub Zablocki Continues Liquidation: Sold $194M Worth of Broker Shares

Technical Picture Weakens and Mixed Analyst Reactions

From a technical perspective, Friday's decline pushed XTB shares toward support at the 70 PLN level, representing the lower boundary of an uptrend channel that has contained the stock since May 2024. It created a visible downward gap on the chart as shares fell below the 200-day exponential moving average.

Analyst sentiment remains divided. While some view the results as neutral and see the selloff as a buying opportunity, others express concern about the trajectory of profitability metrics.

According to Arkadiusz Jóźwiak, a Polish financial journalist and analyst, investors tend to react negatively to XTB’s earnings reports, although the company usually rebounds shortly afterward.

“XTB has effectively reset all of this year's gains. However, if the stock doesn’t fall below the current level of around 70 złoty, it could present a buying opportunity at far more attractive prices than the over-90 złoty seen in May. Especially when we look at the company’s price history over recent years. Since the pandemic lows, its value has increased by more than 2,500%, with nearly uninterrupted growth,” Jóźwiak commented.

Mikołaj Lemańczyk from mBank noted that while client KPIs remained strong, “the results remind us that sometimes there are weaker quarters in terms of profitability per lot, and this must be taken into account in long-term company analysis.”

XTB's transformation from a traditional CFD broker to a comprehensive fintech platform continues, but Friday's market reaction suggests investors want to see this evolution translate into sustained profit growth alongside the impressive client metrics.

XTB shares were also negatively affected in early July by an alleged hack described by one of the platform’s clients. Although XTB did not confirm the incident, the company responded to the publicity by strengthening its security measures and announcing plans to introduce mandatory two-factor authentication (2FA).

You may also like: XTB Targets 7 Million PEA Long-Term Investors Over 30,000 CFD Traders in France