Solana has gained significant attention in the cryptocurrency market, thanks to its high-speed blockchain and low transaction fees. Many investors and analysts are speculating whether Solana, often referred to as SOL, can achieve the ambitious price target of $1,000. This article explores the factors that could influence Solana's price, expert predictions, and challenges it may face.

What Is Solana?

Solana is a blockchain platform known for its scalability and speed. It processes thousands of transactions per second, making it one of the fastest blockchains in the market. Its low fees and support for decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and other use cases have made it a popular choice among developers and traders.

SOL Key Features:

- High-Speed Transactions: Solana processes up to 65,000 transactions per second.

- Low Costs: Transaction fees are typically less than $0.01.

- Ecosystem Growth: Solana supports a wide range of applications, including DeFi, NFTs, and dApps (decentralized apps).

Current Solana Price and Market Trends

Solana's Price Performance

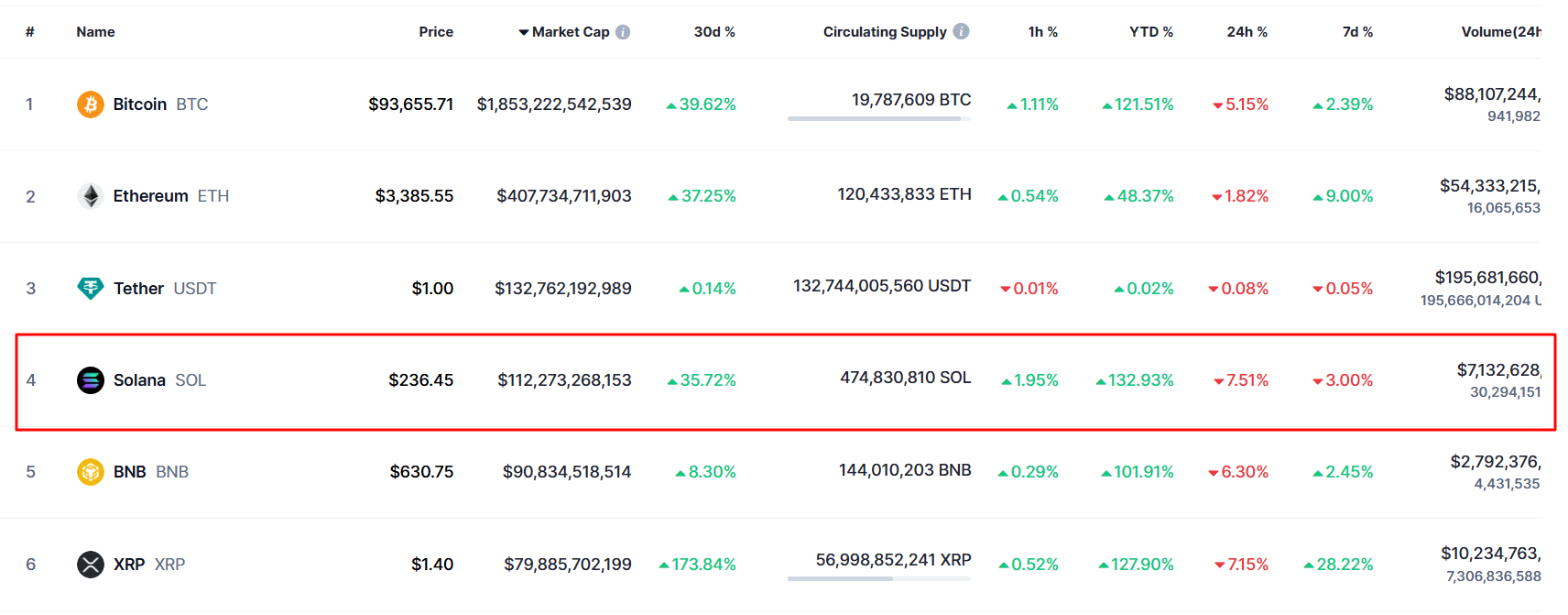

As of November 2024, Solana's price is trading around $250, with a market cap exceeding $100 billion. It has experienced a significant price surge, climbing 48% in the past month. This momentum is driven by strong network activity and positive sentiment in the crypto market.

Solana is currently the fourth-largest cryptocurrency in the entire ecosystem, with a market cap approximately $20 billion smaller than Tether, which holds the third position. Moreover, as shown in the chart below, its price has tested the highest levels in over three years, nearing the all-time high of nearly $268 set on November 8, 2021.

Metric | Value |

Current Price (SOL) | $250 |

Market Cap | $100 billion |

All-Time High (2021) | $265 |

Daily Transaction Volume | $100 billion |

Solana Blockchain and Network Performance: Network Activity

The Solana blockchain plays a crucial role in driving its ecosystem. Known for being capable of processing over 65,000 transactions per second, the network is a critical infrastructure for decentralized finance (DeFi) and non-fungible tokens (NFTs). The price of SOL benefits from this robust performance, making it a leader in the blockchain space.

- Solana Ecosystem Expansion: New projects continue to integrate with the Solana network, boosting its dominance in DeFi and NFT markets.

- Potential of Blockchain Technology: Solana's scalability highlights the broader potential of blockchain to revolutionize global finance.

- Solana Outpaces Bitcoin in Gains: Recent SOL upsides were visibly higher when compared to the BTC chart.

- Active Users: Over 25 million monthly active users.

- DEX Volume: $100 billion in decentralized exchange (DEX) transactions in November 2024.

You can also check other crypto prediction articles by Finance Magnates. For example, “Will Dogecoin Reach $1?”

Can Solana Reach $1,000? SOL Price Forecast

Reaching $1,000 would require Solana to quadruple its current price. For this to happen, several factors need to align.

Factors Supporting Price Growth

- Technological Advancements: Solana's blockchain is known for its scalability and efficiency. Future upgrades could enhance its transaction speed and network capabilities.

- Adoption in DeFi and NFTs: Solana is a major player in DeFi and NFTs, both of which are growing sectors. Increased adoption of Solana-based projects could drive demand for SOL.

- Institutional Investment: Large investors are increasingly interested in Solana due to its performance and potential. Institutional backing could provide significant capital inflows.

- Bullish Market Sentiment: Overall crypto market growth often lifts all major coins, including Solana. Bitcoin's rally toward $100,000 has a positive impact on altcoins like Solana.

"I Just Changed My $XRP and Solana Prediction For 2025 Because Of This" | Raoul Pal pic.twitter.com/HWCmsokoYc

— Levi | Crypto Crusaders (@LeviRietveld) November 19, 2024

Bitwise Asset Management, a firm recognized for its spot Bitcoin and Ether exchange-traded funds (ETFs) in the U.S., has recently taken steps toward launching a spot Solana ETF. Last week, Bitwise registered a statutory trust in Delaware, indicating its intention to offer this new investment product. This move may boost SOL prices, as it did with BTC and ETH values in the past.

Solana Technical Analysis and Investment Strategies

From a technical analysis standpoint, Solana has broken through a significant resistance zone at $190, which had contained the price within a consolidation range since April. Following this dynamic breakout, the price has moved upward, establishing new support at $230, where local lows and the 23.6% Fibonacci retracement level align.

As long as SOL remains above the psychological level of $200 and the 50-day EMA (marked in red), any pullbacks are likely to present opportunities to purchase the token at more favorable prices.

For traders and investors, technical analysis provides critical insights into Solana’s future price movements. Tools like Fibonacci retracement and moving averages help forecast price levels and identify trends in Solana trading.

- Making Investment Decisions: Investors are encouraged to use tools like price charts and study the Solana ecosystem before making any investment decisions.

- Research Before Investing: Readers are encouraged to consider issues and broader market dynamics, such as regulatory challenges, before committing capital.

Challenges Solana Price Forecast Faces

While the potential is there, several challenges could prevent Solana from reaching $1,000.

- Market Volatility: The crypto market is highly volatile, with prices often experiencing dramatic swings. A broader market downturn could negatively affect Solana’s price.

- Competition: Solana faces stiff competition from other blockchains like Ethereum, Cardano, and Avalanche. Ethereum's upgrades, such as ETH 2.0, could reduce Solana’s appeal.

- Regulatory Risks: Governments around the world are introducing regulations that could impact cryptocurrency markets. Uncertainty in regulations may discourage new investors from entering the market.

- Network Stability: Solana has faced outages and technical issues in the past. Ensuring a stable and reliable network is crucial for maintaining investor confidence.

Solana Price Forecast: Expert Predictions

Cryptocurrency analysts have mixed opinions about whether Solana can reach $1,000.

Solana Price Prediction: Bullish

- Some analysts believe Solana could hit $1,000 within the next five years if adoption continues to grow.

- Factors like institutional investment and DeFi expansion are cited as key drivers.

solana breaking out of a 8 month downtrend

— mitch (rtrd/acc) (@idrawline) November 6, 2024

eoy target is $300

2025 target is $4000

and ultimate bear rape

retardio pic.twitter.com/b3PYat5Elq

Bearish Predictions

- Others caution that Solana's price may face resistance due to market volatility and competition.

- They argue that $1,000 is an ambitious target, especially in the short term.

When Could Solana Reach $1,000?

The timeline for Solana to reach $1,000 depends on several factors, including market conditions and technological developments.

Scenario | Timeframe | Conditions |

Short-Term (1–2 Years) | Unlikely | Requires a massive bull run and adoption. |

Medium-Term (3–5 Years) | Possible | Needs consistent growth in DeFi and NFTs. |

Long-Term (5+ Years) | More Likely | Dependent on market maturity and stability. |

Analyzing Solana’s Price Action and Market Dynamics

Solana’s price prediction has become a key focus for investors and crypto analysts alike. The blockchain’s scalability and ability to process thousands of transactions per second make it a strong contender in the cryptocurrency ecosystem. This section explores Solana’s price trends, forecasts, and the factors driving its potential to dominate the market.

The $SOL price breaks through $260, setting a new #ATH!

— Lookonchain (@lookonchain) November 22, 2024

Whales continue to accumulate $SOL!

A fresh wallet withdrew 42,443 $SOL($11.14M) from #Binance in the past 2 days.https://t.co/NVEWdZJVnrhttps://t.co/v2oOIG7igP pic.twitter.com/wHjoAYneVu

Minimum and Maximum Price Predictions

Solana’s price forecast includes a range of scenarios based on technical analysis and market conditions. Analysts suggest that Solana's minimum price in the next few years could hover around $150, while the maximum price might reach $1,000 or more during a bull market. These estimates depend on factors like blockchain adoption, institutional investment, and the overall market cap of cryptocurrencies .

- Per SOL Price Trends: Current movements in Solana trading suggest strong price action, with the network showing resilience even during market corrections.

- Initial Price Recovery: After significant fluctuations, Solana continues to attract attention, demonstrating its potential for sustained growth.

2022–2023 Price Movements and Breakout Potential

In 2022 and 2023, Solana demonstrated its ability to recover from market downturns, showing significant price movements and staging multiple breakouts. The network's stability and adoption among traders and developers have strengthened its position in the crypto market.

- Solana to Hit New Highs: Analysts like Michael van de Poppe believe Solana is expected to break through resistance levels, supported by strong fundamentals and increasing adoption.

- Next Bull Run: With favorable market conditions, Solana could see another bull run that brings it closer to the $1,000 target.

Another PERFECTLY timed breakout 👌😎

— CryptoBullet (@CryptoBullet1) November 17, 2024

6 months of consolidation and boom - $SOL broke out as expected 📈

$400-600 W5 Target remains https://t.co/JtRcLm7UOu pic.twitter.com/nkNJvlXswe

Market Conditions and Broader Implications

The potential for Solana’s price in 2025 and beyond depends heavily on favorable market conditions. If the cryptocurrency market enters a long-term bull market, Solana would likely outperform many other altcoins.

- Market Conditions Are Favorable: Solana thrives in bullish conditions due to its strong fundamentals and ecosystem growth.

- Price Fails and Risks: On the other hand, if the market experiences significant downturns, Solana's price fails could deter short-term investors.

Will Solana Reach $1,000? Conclusion

Reaching $1,000 is an ambitious target for Solana, but not impossible. The platform's technological strengths, growing adoption, and market trends make it a strong contender in the cryptocurrency space. However, challenges like competition, market volatility, and regulatory risks cannot be ignored. Investors should carefully weigh the potential rewards against the risks and stay informed about market conditions.

Solana represents a significant opportunity for investors and developers, thanks to its innovative blockchain and growing ecosystem. While price predictions vary, the forecast for Solana remains bullish in favorable market conditions. Whether it achieves a breakout to $1,000 or faces setbacks, its role in the cryptocurrency landscape is undeniable.

Solana Price Prediction, FAQs

Can Solana reach $500?

Based on the latest predictions and market analysis, Solana has a strong potential to reach $500 before 2026. Multiple analysts project SOL breaking through the $500 barrier during 2025, with price targets ranging between $450–$555 that year.

Can Solana reach $1,000 in 2025?

Solana is expected to reach between $500 and $1,000, depending on market dynamics. While possible, it is unlikely without significant market and ecosystem growth. Analysts suggest that a longer timeline is more realistic.

Some experts believe Solana could achieve this price point before 2030. The most optimistic scenarios suggest SOL reaching $1,000 as early as 2026 in a best-case scenario, though more conservative estimates place this milestone around 2028–2029.

How high can Solana realistically go?

Realistically, Solana's maximum potential appears to be in the $1,250–$2,000 range before 2030, assuming widespread adoption and continued ecosystem growth. This projection considers Solana's technical capabilities, market position, and potential institutional adoption.

How much will 1 Solana be worth in 2030?

For 2030 specifically, most analysts predict Solana will trade between $1,100 and $1,325. The average consensus points to a price of around $1,136, though estimates vary significantly. Some conservative predictions suggest a price as low as $956, while optimistic forecasts extend up to $1,325. However, it's worth noting that one outlier prediction from VanEck suggests a much lower figure of $9.81, though this represents an extremely bearish scenario.

What factors drive Solana's price?

Solana’s price is influenced by adoption in DeFi and NFTs, institutional investment, and market sentiment. Solana's ability to process transactions quickly and its growing DeFi and NFT ecosystem set it apart. The potential of blockchain technology in Solana is significant, but market volatility remains a concern.

Is Solana a good investment?

Solana has shown strong growth potential, but like all cryptocurrencies, it carries risks. Conduct thorough research before investing. Its developer-friendly environment and low transaction costs make it a top choice for blockchain projects.