Dogecoin (DOGE), a meme cryptocurrency, is once again at the center of attention. Recent surges in Dogecoin price have sparked discussions among investors, analysts, and the Dogecoin community. Driven by new all-time high predictions, technical analysis, and political developments, Dogecoin continues to maintain its relevance in the cryptocurrency market. Here's a deep dive into the reasons behind the surge, expert predictions, and why investing in Dogecoin today could be worth considering.

Dogecoin Price Surge: Breaking News and Drivers

At the time of writing, Dogecoin price is surging with the current price reaching $0.39, showing remarkable price action as the cryptocurrency Dogecoin continues its upward trajectory.

The latest news in finance and trading suggests this could be just the beginning of a larger rally.

The 2024 Election and Elon Musk’s Influence

One of the most notable factors contributing to Dogecoin’s price surge is the 2024 election in the United States. Donald Trump’s victory and the appointment of Elon Musk to head the Department of Government Efficiency (DOGE) have stirred interest in Dogecoin. The humorous acronym, which aligns with Dogecoin’s ticker symbol, has caught the attention of investors.

Elon Musk, often referred to as “the Dogefather,” has consistently driven Dogecoin’s price. His tweets about Dogecoin, including mentions of its potential to reach new all-time highs, influence the crypto market. The announcement of Musk's involvement in a government department further heightened investor interest, contributing to the Dogecoin price surge over the last 24 hours.

Trump and Musk: The Catalysts. The price has increased significantly after Donald Trump’s 2024 election win and Elon Musk's continued support for Dogecoin. Musk's consistent tweeting about dogecoin, combined with his potential role in the 2024 election win, has provided strong price support

Social Media and Meme Appeal

Dogecoin thrives on its meme-based appeal and community-driven growth. Social media platforms, particularly X (formerly Twitter), play a critical role in spreading Dogecoin news. Tweets, memes, and discussions among investors and the Dogecoin community amplify its market activity.

The power of social media in driving the Dogecoin price cannot be underestimated. For instance, Elon Musk's tweets often cause the price of Doge to spike significantly, as seen in the past and during the current surge.

Expert Dogecoin Price Predictions for 2024

Analyst Projections: How High Could Dogecoin Go?

Cryptocurrency experts have weighed in on Dogecoin’s potential, offering optimistic price predictions for 2024 and beyond:

- Bluntz

- Short-Term Target: $0.85

- Quote: “DOGE could remind everyone who the king of meme coins is this week.”

- Indicator: Elliott Wave Theory.

- Ali Martinez

- Short-Term Target: $0.85

- Technical Pattern: Bull flag pattern. “If Dogecoin closes above $0.40, we could see a breakout toward $0.85.”

- Kevin (@Kev_Capital_TA)

- Long-Term Target: $3.90

- Method: Pi Cycle Top. “Dogecoin’s price could reach $3.90 during this cycle.”

- Trader Tardigrade

- Long-Term Target: $5

- Methodology: Gaussian channel. “Dogecoin could experience a massive pump, hitting $5 by 2025.”

Table of Price Predictions for Dogecoin

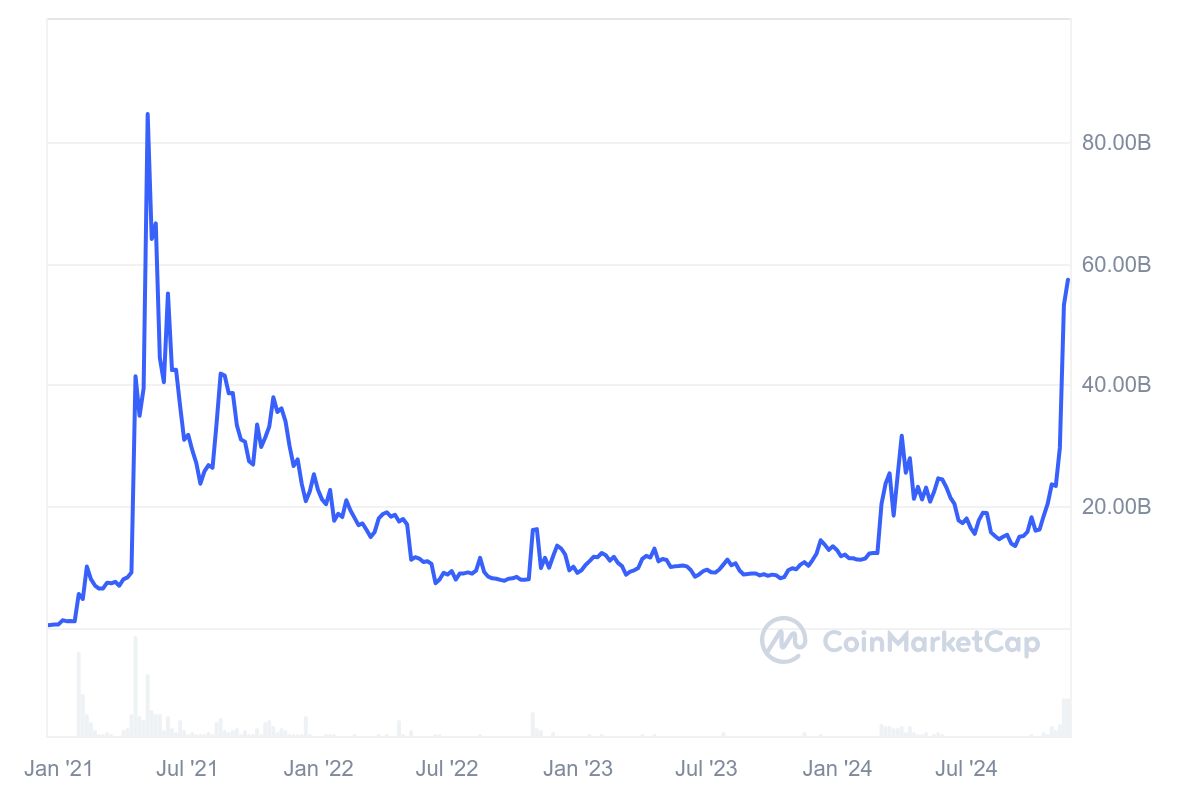

The future of Dogecoin looks promising as its market cap exceeds $100 billion. At the time of writing, with approximately 147 billion DOGE in circulation, the price reached new local highs, suggesting investors don't want to miss out on our latest bull run.

nothing changed, we just had a nice 23% ltf dip im counting as a w4 within a monster extended w3 impulse.

— Bluntz (@Bluntz_Capital) November 17, 2024

once the next $doge leg up starts it will probs start to suck liquidity out of smaller memes again, the only reason they went so hard this week was because doge has been… https://t.co/V8iYRIr0uy pic.twitter.com/rlufzPmo7a

Analyst | Short-Term Target | Long-Term Target | Methodology |

Bluntz | $0.85 | N/A | Elliott Wave Theory |

Ali Martinez | $0.85 | N/A | Bull Flag Pattern |

Kevin (@Kev_Capital_TA) | N/A | $3.90 | Pi Cycle Top Indicator |

Trader Tardigrade | $1.00–$3.00 | $5.00 | Gaussian Channel Analysis |

Analysts seem to confirm our previous forecasts, answering the question: “Will Dogecoin Reach $1?”

DOGE Price Predictions and Targets

Here's how much $100 in Dogecoin today could be worth if Doge hits new milestones:

Target Price | $100 Investment Value | Timeline |

$1.44 | $378 | 2025 |

$2.59 | $681 | 2030 |

$4.70 | $1,236 | 2040 |

The Doge price prediction suggests a maximum price of $0.494 by the end of 2024. The previous all-time high of $0.73 could be surpassed if the crypto market continues its bullish trend. Check out also our long-term DOGE price predictions for 2030.

Technical Outlook: Historical Price Trends and Technical Analysis

Historical Price Peaks

Dogecoin, created by Billy Markus in 2013, is a cryptocurrency with a history of dramatic price movements. In May 2021, Dogecoin reached an all-time high of $0.731, driven by a mix of social media campaigns and speculation. Analysts now believe Dogecoin could reach new all-time highs, surpassing its 2021 performance.

“I read people saying Dogecoin will not go higher because of market cap, sell the news, better memes. Well, when you look at the interest in DOGE over time, it isn't even at peak popularity yet,” commented pseudonymous analyst Ali. “Long story short, DOGE has waaay more room to grow.”

I read people saying #Dogecoin will not go higher because of "market cap," "sell the news," "better memes." Well, when you look at the interest in $DOGE over time, it isn't even at peak popularity yet.

— Ali (@ali_charts) November 17, 2024

Long story short, #DOGE has waaay more room to grow. #HODL pic.twitter.com/IK6KKIEtQO

Technical Indicators Supporting the Surge

Dogecoin price analysis reveals strong technical signals, including:

- Bull Flag Patterns: Suggesting an upward breakout.

- Gaussian Channels: Highlighting support levels conducive to a potential surge.

- Live Charts: Showing price consolidation at key resistance levels.

These indicators suggest Dogecoin could break resistance near $0.85, opening the door to price discovery and potential new highs.

“One of my secret indicators for #Dogecoin that is traditionally only supposed to work for BTC is the Pi Cycle tops indicator. It has accurately called every #OGE cycle top and bottom over each of its cycles,” explained Kevin, another popular analyst from X (formerly Twitter).

One of my secret indicators for #Dogecoin that is traditionally only supposed to work for #BTC is the Pi Cycle tops indicator. It has accurately called every #DOGE cycle top and bottom over each of its cycles. When the two moving averages cross along with Monthly RSI being at a… pic.twitter.com/lAxvJTJiDC

— Kevin (@Kev_Capital_TA) November 19, 2024

Technical Outlook

The XRP price correlation and broader crypto market could provide additional tailwinds. Technical analysis shows Dogecoin briefly logging new support levels, indicating potential for the asset to reach all-time highs. The price target for 2024 remains optimistic, with analysts suggesting those who sign up today could benefit from the anticipated growth

Why Invest in Dogecoin Today?

Community-Driven Growth

The Dogecoin community continues to drive its success. Investors and the Dogecoin community maintain its relevance through active participation and engagement. Dogecoin today could be worth significantly more in the future if analysts’ predictions hold true.

Price Predictions for 2024

Dogecoin price predictions suggest significant gains by the end of 2024. If Doge could reach the projected $3.90, a $100 investment in Dogecoin today could be worth $902. If Dogecoin surges to $5, the same investment would grow even further.

#Dogecoin is gaining support from the mid-band of the Gaussian Channel 🔥

— Trader Tardigrade (@TATrader_Alan) November 17, 2024

This is the third time in history this price action has occurred.

After this price action, $DOGE will experience an incredible PUMP 🚀 pic.twitter.com/02njMzdex3

Broader Cryptocurrency Market Trends

Correlation With Bitcoin and the Crypto Market

Bitcoin price trends often influence other digital currencies, including Dogecoin. As Bitcoin price surges, altcoins like Dogecoin tend to follow. The interconnected nature of the cryptocurrency market means that a bullish Bitcoin often signals gains for other cryptocurrencies.

Dogecoin’s Role in the Future of Cryptocurrencies

Dogecoin is a cryptocurrency that combines humor with real financial potential. Its ability to attract investors through memes and social media demonstrates the evolving nature of digital currencies. Analysts predict Dogecoin could play a role in shaping the broader crypto market, especially if it achieves its ambitious targets.

Conclusion: The Road Ahead for Dogecoin

Dogecoin continues to surprise investors with its resilience and potential. From its roots as a meme to a serious contender in the cryptocurrency market, Dogecoin’s journey is far from over. As analysts predict new all-time highs and long-term growth, Dogecoin remains a key player in the crypto space.

For those interested, staying updated with the latest cryptocurrency news and price analysis is essential. Dogecoin’s price today could set the stage for future success, leaving investors to wonder just how high it could climb.

Dogecoin Price, FAQ

What is causing Dogecoin to go up?

Dogecoin's recent price increase is primarily attributed to political developments in the United States. Following Donald Trump's election victory, he announced the creation of the “Department of Government Efficiency” (DOGE), to be led by Elon Musk and Vivek Ramaswamy. This announcement led to a significant surge in Dogecoin's value, as investors anticipated a more favorable regulatory environment for cryptocurrencies under the new administration.

What is happening with Dogecoin today?

As of November 20, 2024, Dogecoin is trading at approximately $0.389939 USD, reflecting a slight increase from the previous close. The cryptocurrency has experienced notable volatility, with an intraday high of $0.416658 and a low of $0.3784. The market remains responsive to ongoing political developments and investor sentiment.

Can Dogecoin reach $10,000?

Reaching a price of $10,000 per Dogecoin is highly improbable. Given Dogecoin's current supply and market dynamics, such a valuation would imply an unrealistic market capitalization, far exceeding that of the entire cryptocurrency market. While speculative forecasts exist, they are not grounded in the current economic and market realities.

Is Dogecoin expected to rise again?

Market analysts have mixed opinions on Dogecoin's future trajectory. Some predict potential gains based on technical indicators and favorable political developments, while others advise caution due to the cryptocurrency's inherent volatility and speculative nature. Investors should conduct thorough research and consider the risks before making investment decisions.