Bitcoin’s (BTC) price is surging today, leaving many investors asking what’s driving the sudden climb. Over the past 24 hours, Bitcoin (BTC) has jumped by double digits, breaching the mid-$90,000s after a period of weakness. Several key factors are behind this rally, including a high-profile endorsement from the U.S. President Donald Trump.

Donald Trump’s Influence on Bitcoin’s Price Surge

In a recent post on social media, Trump revealed plans for a U.S. “Crypto Reserve” that would include several top digital assets. Specifically, he named Bitcoin, Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA) as assets to be part of a new strategic reserve.

And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be the heart of the Reserve. I also love Bitcoin and Ethereum! https://t.co/wA6110D3aJ

— Trump Posts on 𝕏 (@trump_repost) March 2, 2025

This announcement – effectively an endorsement of these cryptocurrencies at the highest level of government – immediately sent prices soaring across the crypto market.

Bitcoin, the world’s largest cryptocurrency, jumped about 10% on the news, briefly trading around $93,000–$95,000.

The positive developments that lifted Bitcoin’s price have also caused a ripple effect across the cryptocurrency market, with many altcoins (alternative cryptocurrencies) logging impressive gains.

Here’s a look at how BTC’s movement compares with a few major altcoins and what drove their prices: Ethereum leapt about 13% to roughly $2,516. In total, over $300 billion in value was added to the crypto market’s market capitalization within hours of Trump’s message, according to CoinGecko data

Altcoin Performance vs. Bitcoin (past 24 hours):

Asset | 24h Price Change | 24h Volume Change |

Bitcoin (BTC) | +12% (to $95,000) | +140% |

Ethereum (ETH) | +17% (to $2,548) | +130% |

XRP (XRP) | +33% (to $2.97) | +500% |

Solana (SOL) | +27% (to $178.6) | +350% |

Cardano (ADA) | +75% (to $1.13) | +1450% |

Why Is Bitcoin Rising Today? BTC/USDT Technical Analysis

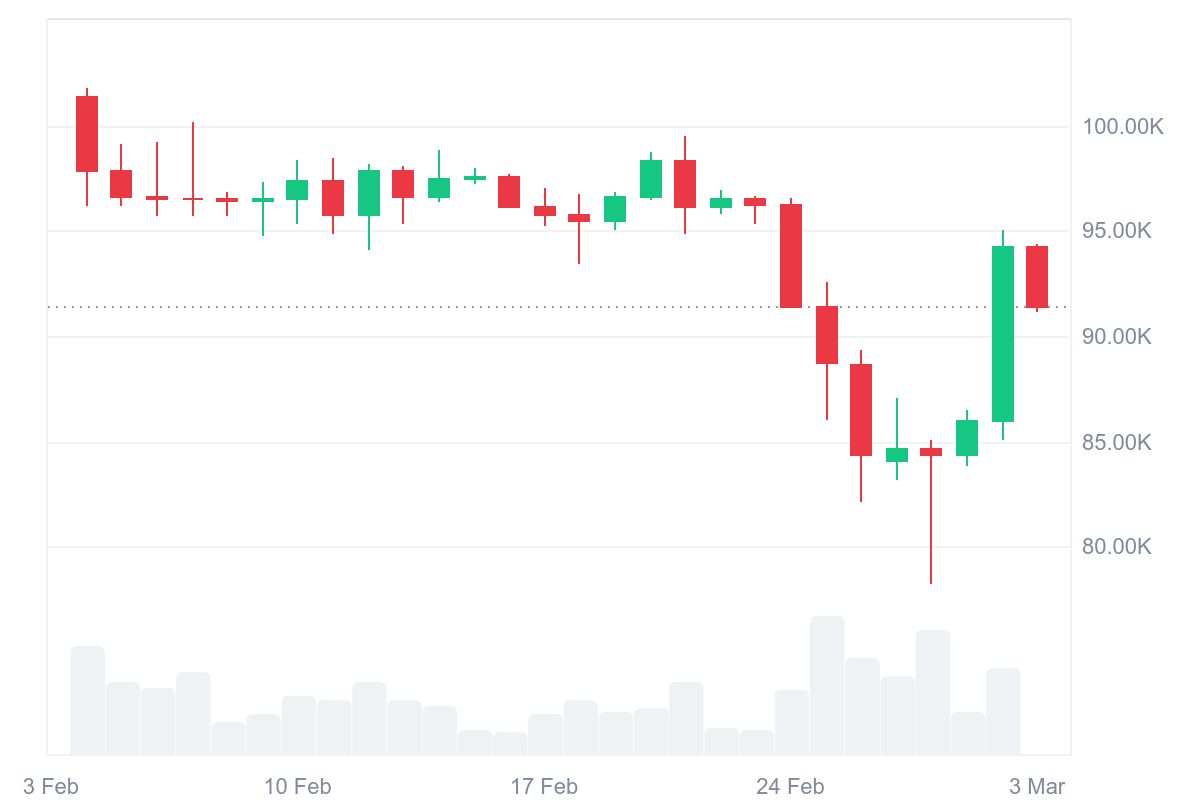

As suggested in my last Bitcoin technical analysis, the fate of BTC's price depended on movements around $80,000 and the 200 EMA. Although BTC temporarily dipped below this crucial average separating bull and bear markets, key support provided bulls with the necessary platform for a rebound, simultaneously drawing a textbook single-candle reversal formation.

We're talking about a bullish pin bar (or hammer) with an extremely long lower wick, which was a clear signal from buyers: we intend to defend this level and buy Bitcoins in its vicinity.

This provided a platform for a stronger rebound, and Donald Trump added fuel to the fire, allowing Bitcoin's price to return to the consolidation range drawn since November, between $90-92,000 (support) and $108,000 (resistance).

If Bitcoin's price holds above this level, testing new all-time highs (ATH) is, in my opinion, only a matter of time.

Bicoin Price Support and Resistance Levels

Support | Resistance |

$90-92K - lower limit of November consolidation | $95K - 50 EMA |

$86K - 200 EMA | $100K - psychological level |

$80-82K - psychological support from late February | $108K - ATH tested in December and January |

Bitcoin Macro Factors: Inflation, Interest Rates, and Economic Trends

Beyond the buzz of Trump’s crypto endorsement, macroeconomic factors have been providing a supportive backdrop for Bitcoin’s rise. Over the past few weeks, investors have been parsing economic data and central bank signals that affect all risk assets, including cryptocurrencies. Several trends stand out:

- Recession Fears and Rate Cut Bets: Recent U.S. economic data has been surprisingly soft, raising concerns about a potential economic slowdown

- Inflation and Currency Dynamics: Inflation has been a double-edged sword for Bitcoin. On one hand, high inflation increases Bitcoin’s appeal as “digital gold” – a hard asset with a capped supply. On the other hand, if inflation rises too fast, it forces central banks to tighten policy (which can hurt risk assets).

- Investor Risk Appetite: Global market sentiment has improved in early March. Stock markets, which suffered losses in February, staged a late rebound as investors grew hopeful that central banks would ease off tightening. In the U.S., the S&P 500 and Nasdaq ended last week on a rally.

Today’s Bitcoin price rise isn’t happening in a vacuum. It’s partially riding the wave of macroeconomic trends. Cooling inflation, the potential for lower interest rates, and a risk-friendly market environment have all made it easier for Bitcoin to attract buyers.

Bitcoin On-Chain Data Insights: Key Metrics

The on-chain data confirms a healthy rally supported by broad participation, strategic positioning of "smart money," and the unwinding of short positions, all contributing to Bitcoin 's significant price increase.

Metric | Description |

Trading Volume Surge | Bitcoin trading volume increased by over 140% in 24 hours, with the total crypto market volume jumping about 150% to $190 billion daily turnover. |

Whale Accumulation | Large Bitcoin holders (whales) have been accumulating during the price rise, with several significant transactions observed, including withdrawals of 600 BTC ($51.5 million) and 657 BTC ($60 million) from exchanges. |

Exchange Inflows/Outflows | Net outflows dominated, with approximately $500 million worth of Bitcoin leaving exchanges in a 24-hour period during the price rebound, indicating bullish sentiment. |

Short Squeeze Potential | On-chain data suggests that Bitcoin's jump was partly fueled by a short squeeze, with analysts estimating significant short liquidations if Bitcoin pushed past $95K. |

FAQ: Common Questions About Bitcoin’s Price Surge

Did Donald Trump’s Announcement Really Cause Bitcoin’s Price to Surge?

Yes – Trump’s announcement was a major trigger for the rally. In a post on March 2, 2025, he revealed plans for a U.S. crypto reserve including Bitcoin and several altcoins. This unprecedented endorsement by a former (and now again) U.S. President immediately boosted market confidence. Bitcoin jumped about 10% within hours of the news.

Why Is Bitcoin Going Up Now?

President Donald Trump's recent executive order establishing a Crypto Strategic Reserve, which includes Bitcoin, has significantly boosted investor confidence. This move signals formal recognition of digital assets within the U.S. financial system. Additionally, the anticipation of interest rate cuts by major central banks in 2025 is creating a risk-on sentiment that favors cryptocurrencies.

How Much Will $1 Bitcoin Be Worth in 2025?

Forecasts suggest Bitcoin could reach between $125,000 and $250,000 by 2025. If these predictions materialize, $1 invested at current prices could appreciate by 33% to 166%. It's important to note that these are speculative projections and actual performance may vary considerably due to market conditions, regulatory changes, and technological developments in the cryptocurrency space.

How Much Is Bitcoin Selling for Today?

As of March 3, 2025, Bitcoin is trading at approximately $93,913.86. This price represents a significant recovery from recent lows around $78,200 seen in late February. The cryptocurrency has shown resilience, rebounding strongly after a period of volatility. It's worth noting that Bitcoin's price is currently about 13.86% below its all-time high of $109,026.02.