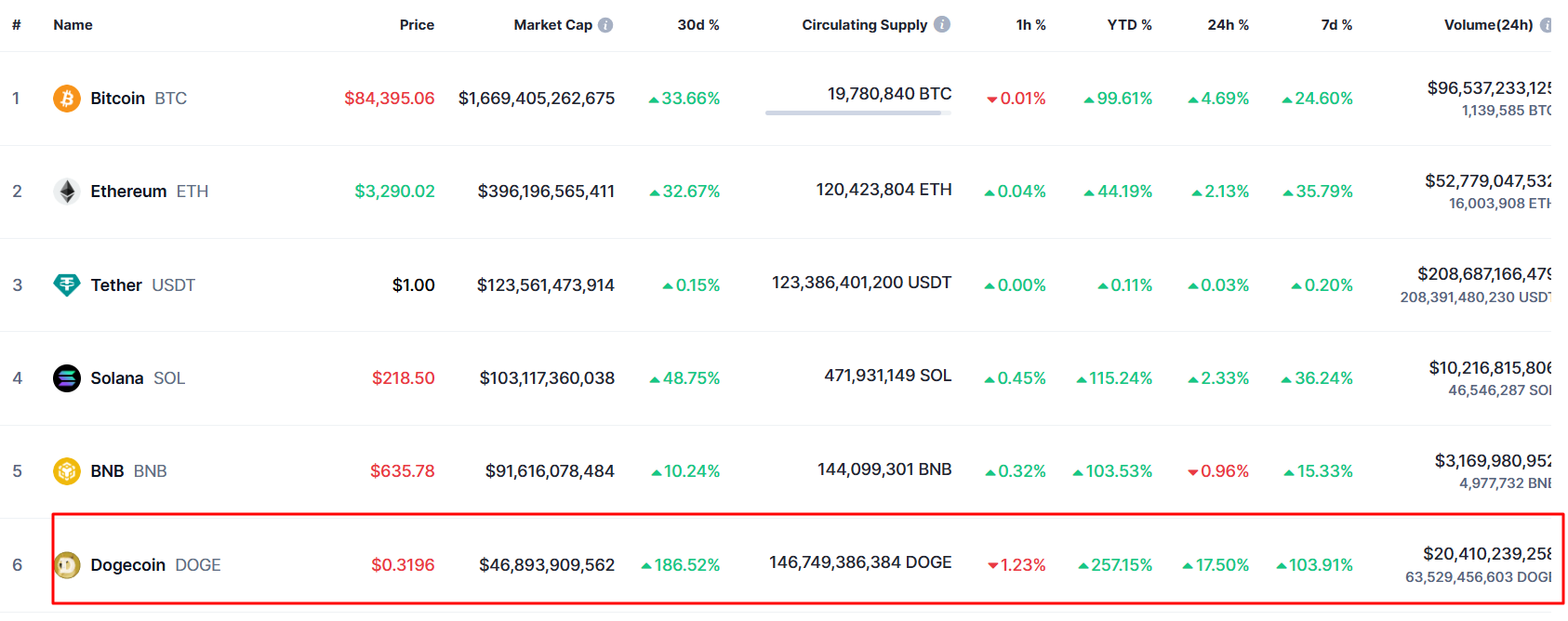

The cryptocurrency market is witnessing a remarkable phenomenon as Dogecoin's (DOGE) price continues its extraordinary ascent, reaching $0.3292 and becoming the sixth-largest crypto by market value. At the time of writing, this price action has created unprecedented excitement in the crypto space.

Dogecoin News: Current Price and Market Performance

The price of Dogecoin has shown exceptional strength in the past 24 hours, with several notable achievements:

- A staggering 152% gain over the past month

- An 86% increase in just seven days

- Trading volume reaching $21.7 billion in the last 24 hours

- Surpassing its previous peaks since the 2021 bull run

On November 11, 2024, Dogecoin (DOGE) experienced a 15% increase on Coinbase, reaching $0.3292—the highest level since October 2021.

This surge is attributed to a combination of political and economic factors, as well as technical analysis and market speculation. Notably, Bitcoin (BTC), the largest and oldest cryptocurrency, achieved a record high, testing the $85,000 mark on Monday.

Why Is Dogecoin Price Up Today? Political Catalysts and Market Sentiment

The crypto market received a significant boost following Republican candidate Donald Trump's victory. This development has particularly benefited DOGE, as Trump's pro-cryptocurrency stance has energized crypto enthusiasts. Bitcoin's price and other cryptocurrencies like Bitcoin have also reached new all-time highs.

Economic and Political Drivers:

- Pro-crypto policies expected from the Trump administration.

- Global economic instability, with investors looking for alternative assets.

- Increasing institutional acceptance of crypto as a hedge against inflation.

Elon Musk's Influence and the D.O.G.E Proposal

Musk's support for Dogecoin continues through his proposal for a “Department of Government Efficiency” (abbreviated as D.O.G.E). This concept has sparked renewed attention and interest in Dogecoin among investors and the Dogecoin community. It has also created hype around DOGE, drawing in new retail investors.

Key Social Media Influences:

- Elon Musk and other crypto-friendly figures endorsing DOGE.

- Communities on Twitter and Reddit rallying behind Dogecoin.

- Memes and viral trends keep DOGE in the public eye.

Retail and Institutional Investors

The appeal of Dogecoin has grown beyond retail investors, as institutional investors also start to show interest. Platforms like Robinhood and Coinbase have made it easier for everyday people to invest in Dogecoin, adding to its popularity. As institutional interest in DOGE grows, so does its trading volume, pushing prices higher.

Large investors, often called “whales,” have shown increased interest in Dogecoin. Data indicates that whale wallets holding between 100 billion and 1 billion coins have significantly increased their holdings from 2.68 million to 30.56 million coins. This accumulation pattern often precedes major price movements and suggests strong institutional confidence in the asset.

Investor Impact:

- Retail Investors: DOGE’s accessibility on major platforms makes it popular among small investors.

- Institutional Investors: Interest from hedge funds and financial institutions lends DOGE credibility, raising its market value.

Dogecoin's success continues to be driven by its vibrant community and social media presence. The combination of celebrity endorsements, community engagement, and viral marketing has created a powerful network effect that supports the cryptocurrency's value proposition.

Technical Analysis and Price Chart Indicators

The current price action shows several bullish technical indicators. Technical analysis shows a bullish pattern for Dogecoin. Recently, DOGE formed a golden cross pattern, a technical signal indicating future gains. This pattern, along with high trading volume, supports the likelihood of continued price increases. Additionally, DOGE’s U-shaped recovery pattern hints at a possible rise to $0.37 if it continues on its current trend.

Golden Cross Formation

A significant technical event occurred as the 50-day moving average crossed above the 200-day moving average, forming a golden cross. This pattern typically signals strong bullish momentum and has historically preceded major price rallies4.

Trading Metrics

- Funding rate reached 0.0448%, the highest since June 2024

- Short liquidations totaled $37.25 million

- Long liquidations reached $24 million

The current price shows several bullish patterns:

- Formation of a golden cross

- Strong support levels established since May 2021

- Increased institutional interest in digital assets

“Doge will be the biggest runner of this bull run,” commented popular X influencer Jeremy. “Elon Musk publicly comes out as the co-founder of Dogecoin. Trump and Elon both mentioned integrating dogecoin as a big part of America’s economy.

doge will be the biggest runner of this bull run

— Jeremy (@Jeremyybtc) November 10, 2024

elon musk publicly comes out as the co founder of dogecoin

trump and elon both mentioned integrating dogecoin as a big part of america's economy

1 $doge = $1 pic.twitter.com/7wATJmCh8V

Dogecoin Price Prediction and Future Outlook

Market analysts provide varying predictions for 2025 and beyond:

Timeline | Minimum Price | Maximum Price | Average Price |

Short-term | $0.377 | $0.45 | $0.41 |

Mid-term | $3.95 | $4.50 | $4.20 |

Long-term | $23.25 | $25.00 | $24.15 |

While the current rally is impressive, several factors suggest continued growth potential:

- Market Position

- Surpassed both XRP and USDC in market capitalization

- Established itself as a leading alternative cryptocurrency

- Increased institutional interest and adoption

The convergence of political developments, technical factors, and social sentiment has created a unique environment for Dogecoin's growth. While price predictions vary widely, the fundamental drivers behind the current rally appear robust and sustainable.

Risks to Consider:

- Volatility : DOGE’s price can fluctuate drastically.

- Speculation-driven: Dogecoin’s value relies on hype rather than intrinsic value.

- Possible regulatory restrictions could hinder its growth.

Media and FOMO (Fear of Missing Out)

Dogecoin’s rise is also driven by media coverage and the psychology of FOMO (Fear of Missing Out). Coverage from major financial news outlets, as well as social media buzz, has led to more investors buying in, hoping not to miss the gains.

DOGE’s popularity has been sustained by frequent price spikes, leading to a cycle of FOMO among both retail and institutional investors.

FOMO Factors:

- Increased media attention from platforms like Cointelegraph and Economies Times.

- DOGE’s reputation as a volatile, high-return asset appeals to thrill-seeking investors.

The Digital Currency Landscape

Unlike traditional assets, Dogecoin uses blockchain technology to decentralize transactions. Created by Billy Markus and named after the popular Doge meme, it has evolved from a joke to a serious digital currency.

Dogecoin’s recent price rise can be attributed to a mix of social media influence, retail and institutional interest, political changes, and favorable technical patterns. However, as with any investment, especially in the crypto market, investors should proceed with caution. The future of Dogecoin remains uncertain, and while there’s potential for further growth, there are also significant risks tied to its volatility and regulatory environment.

Dogecoin News and Price, FAQ

Is there a future in Dogecoin?

Dogecoin shows promising future potential with ongoing technological developments like GigaWallet and RadioDoge. While its inflationary nature presents challenges, expanding merchant adoption by companies like Microsoft and Tesla, along with potential integration into X Payments, suggests a sustainable future for DOGE as a payment solution.

Will Dogecoin reach $1 in 2024?

Most analysts predict Dogecoin is unlikely to reach $1 in 2024, with conservative estimates suggesting a maximum price range of $0.26–$0.45. Current forecasts indicate DOGE could reach $0.234 by the end of 2024, with more significant gains expected in 2025-2026.

Why is Dogecoin going up?

Dogecoin's recent surge is driven by multiple factors: Trump's victory in the 2024 election, Elon Musk's proposed Department of Government Efficiency (D.O.G.E.), increased whale activity with over $68.7 million in transactions, and the formation of a golden cross pattern on technical charts.

What is happening with DOGE?

DOGE is experiencing significant momentum, having risen 152% in the past month to reach $0.32. The cryptocurrency has become the sixth-largest by market cap ($47.9B), with a substantial trading volume of $21.7B. Major catalysts include political developments, institutional interest, and potential integration into social media platforms.