The cryptocurrency market kicks off 2025 with Dogecoin (DOGE) price maintaining strong momentum, trading at $0.34 as it solidifies its position as the seventh-largest cryptocurrency by market capitalization. With a market cap exceeding $50 billion and substantial daily trading volumes, DOGE continues to capture investors' attention.

Check why the Dogecoin price is rising today and explore the most up-to-date DOGE predictions for 2025.

Dogecoin News: Market Performance and Current Status

The meme-inspired cryptocurrency demonstrates remarkable resilience, maintaining price levels above $0.30 despite minor fluctuations. Trading volume remains robust at $3.2 billion in the last 24 hours, indicating sustained market interest.

Key Performance Metrics:

- Current Price: $0.34

- Market Cap: $50.2 billion

- 24h Trading Volume: $3 billion

- Year High: $0.48

- Year Low: $0.07

On Thursday, January 2, 2025, Dogecoin is up 5.4% on Binance, crossing the 50 EMA for the first time since mid-December, which currently serves as a dynamic resistance zone.

Buyers' dominance is also evident in other cryptocurrencies. Bitcoin is up 3.6%, reaching $96,660, while XRP leads the gains with a 15.5% surge, testing $2.40. Meanwhile, Solana strengthens by 10%, climbing to $208.50.

This trend is also reflected in the liquidation of leveraged positions over the past 24 hours. Out of $181 million in liquidations, $132 million are shorts, including $8 million in short positions on DOGE.

Why Is Dogecoin Price Up Today? Whale Activity and Institutional Interest

A significant development driving DOGE's current momentum is the unprecedented whale activity observed at the start of 2025. Large investors moved an astounding $258 million worth of DOGE in a single day, with transactions including 466.8 million DOGE followed by another 350 million DOGE transfers.

🚨 🚨 🚨 🚨 🚨 350,000,000 #DOGE (109,962,192 USD) transferred from unknown wallet to unknown wallethttps://t.co/vQaVIVC7oB

— Whale Alert (@whale_alert) December 30, 2024

🚨 🚨 🚨 🚨 🚨 🚨 466,890,148 #DOGE (149,137,073 USD) transferred from unknown wallet to unknown wallethttps://t.co/j5ByZXTJ60

— Whale Alert (@whale_alert) December 30, 2024

The surge in whale transactions, showing a 41% increase in just 24 hours, suggests strong institutional confidence in DOGE's future potential.

DOGE Technical Analysis and Price Chart Indicators

The technical outlook for Dogecoin remains predominantly bullish, with several key indicators supporting continued upward momentum. The cryptocurrency maintains its position above both the 50-day exponential moving average.

Current Technical Indicators:

- Fear & Greed Index: 72 (Greed)

- Price Volatility: 11.78%

- Main Support Level: $0.30

- Main Resistance Level: $0.34

Dogecoin's price is currently trading within a tight consolidation range between $0.30 and $0.34, which serve as key support and resistance levels as outlined above. The $0.30 level provides strong support for the bulls, and a drop below it could signal a return of bearish dominance, potentially leading to a steeper decline toward $0.20 (local highs from mid-November).

In my opinion, a bullish scenario is more likely to prevail, with DOGE gradually challenging successive resistance levels:

- $0.36: The lows from late November and early December.

- $0.439: Local highs from November, retested again in December.

- $0.48: Last year's peaks, which were tested twice over the past six weeks.

Dogecoin Price Predictions and Market Outlook for 2025

Market analysts project varied scenarios for DOGE's performance throughout 2025. While some predictions remain conservative, others suggest significant potential for growth.

For example, the Changelly portal presents rather conservative projections for the DOGE price at the beginning and end of this year, placing them noticeably below last year's peaks near the $0.50 level.

Timeline | Dogecoin Minimum Price | Dogecoin Average Price | Dogecoin Maximum Price |

January | $0.284 | $0.299 | $0.313 |

February | $0.288 | $0.340 | $0.392 |

Full Year | $0.153 | $0.313 | $0.233 |

Dogecoin price predictions. Source: Changelly.com

However, it is not difficult to find opinions suggesting that Dogecoin's price could reach $1 or even approach $5. Finance Magnates discussed such forecasts in late November when Trader Tardigrade identified the $5 level as a long-term target based on Gaussian Channel Analysis.

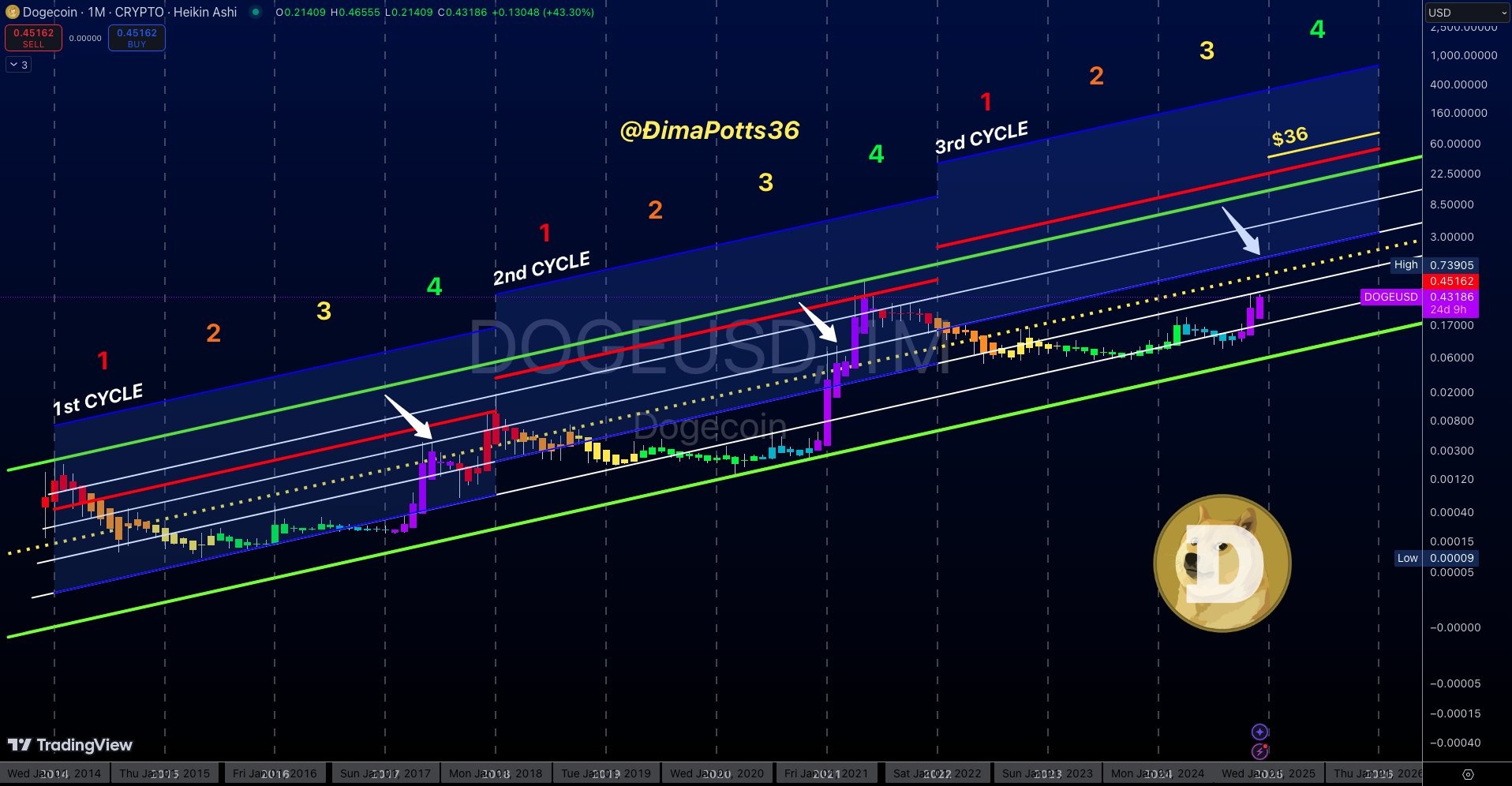

Following last year's rally between November and December, some analysts believe Dogecoin could climb to $10. One such opinion comes from crypto analyst Dima James Potts, who argues that Bitcoin is currently in its third growth cycle.

“If history repeats, I believe we'll see a similar scenario where Dogecoin reaches the same line it did in the previous two cycles before the end of January 2025 (the 4th purple candle),” Potts commented, referencing a chart he shared on X.

What level does this line correspond to? It aligns with a price of over $10 per DOGE token.

Market Catalysts

The sustained bullish momentum in DOGE can be attributed to several key factors:

- Growing Adoption: The cryptocurrency continues to gain traction as a payment method, with an expanding ecosystem of merchants and services accepting DOGE.

- Technical Strength: DOGE maintains its position above critical support levels, with the potential to challenge the $0.34 resistance zone.

- Community Engagement: The vibrant Dogecoin community continues to drive social media engagement and adoption, contributing to sustained market interest

Risk Considerations for Dogecoin

Despite the positive outlook, investors should consider several risk factors:

- Price volatility remains significant at 12%

- Resistance at $0.34 poses a significant hurdle

- Market sentiment can shift rapidly

Future Prediction and Outlook

While short-term projections suggest possible consolidation around current levels, long-term analysts maintain optimistic views. Some experts project potential gains of up to 6,770% if DOGE follows its ascending parallel channel pattern.

#Dogecoin $DOGE could rally by another 6,770% if it continues to follow the ascending parallel channel pattern! pic.twitter.com/Js9mYGwevK

— Ali (@ali_charts) December 30, 2024

The convergence of institutional interest, technical strength, and community support positions Dogecoin for potential continued growth in 2025. However, investors should maintain a balanced approach, considering both the opportunities and risks inherent in cryptocurrency investments.

Dogecoin News and Price, FAQ

Why is the Dogecoin price going up?

Dogecoin's current price surge to $0.34 is driven by multiple factors. The cryptocurrency has seen unprecedented whale activity, with transactions totaling over $258 million in a single day. The technical indicators show strong bullish momentum, supported by the formation of golden cross patterns and maintaining position above critical support levels. Additionally, increased institutional interest and growing adoption as a payment method have contributed to sustained market confidence.

Will Dogecoin ever hit $1?

While reaching $1 remains a significant milestone, current market analysis suggests it's possible but not guaranteed in the immediate future. Technical analysts project varied scenarios, with some predicting potential price targets of $0.50, $1.00, and $1.50. The cryptocurrency's ascending parallel channel pattern suggests potential for significant growth, though most conservative estimates place DOGE between $0.85–$1.00 by the end of 2025.

Why is DOGE pumping now?

The current DOGE pump is attributed to several key factors. Trading volume has reached $3.2 billion in 24 hours, indicating robust market interest. The Fear & Greed Index stands at 72, showing strong market confidence. Whale activity has shown a notable increase, with large investors moving substantial amounts of DOGE. The cryptocurrency maintains its position as the seventh-largest by market capitalization, with a total value exceeding $50 billion.

How high can DOGE go realistically?

Based on current market analysis and expert predictions, DOGE shows potential for significant growth while maintaining realistic expectations. Short-term projections suggest possible consolidation around current levels, with resistance at $0.35. Long-term analysts maintain optimistic views, with some projecting gains of up to 6,770% if DOGE follows its ascending parallel channel pattern.