MARA Holdings, the publicly listed Bitcoin (BTC) miner from Wall Street (NASDAQ: MARA), announced record financial results for the fourth quarter and full year 2024. Revenue, net income, and adjusted EBITDA significantly increased despite April's bitcoin halving event.

MARA Reports Record Q4 and Full-Year Results,

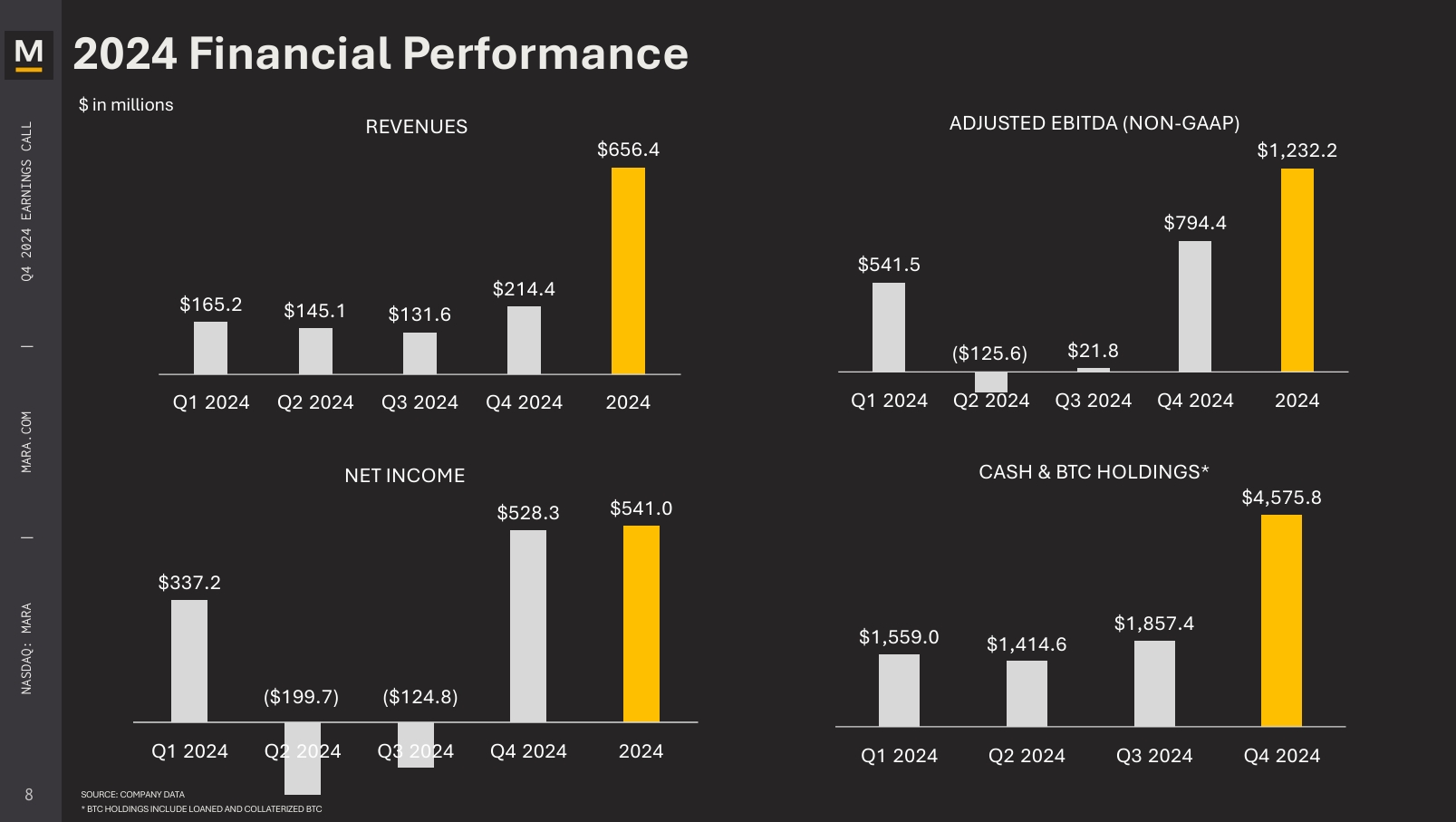

The cryptocurrency mining giant reported a 37% increase in Q4 revenue to $214.4 million and full-year revenue growth of 69% to $656.4 million. Net income surged 248% to $528.3 million for the quarter, while adjusted EBITDA reached an industry benchmark of $794.4 million, up 207% from the previous year.

“2024 was a transformative year for MARA. We accelerated our transition to a vertically integrated energy and digital infrastructure company,” the company wrote in the shareholder letter. “We now have greater control over our energy, infrastructure, technology, and ultimately, our future.”

The Bitcoin miner significantly expanded its energy capacity, securing approximately 1.2 gigawatts at prices 28% lower than industry peers paid for similar acquisitions. This move increased MARA's owned data center portfolio from 0% to approximately 70% since the beginning of 2024.

The move comes as smaller miners, including Cipher Mining and Bitdeer Technologies, reported worse net results than in the previous year. Cipher’s net loss deepened to $45 million from $26 million, while Bitdeer’s net loss widened to $599.2 million from $56.7 million a year earlier.

MARA’s Q4 2024 Shareholder Letter is here. Read the full report: https://t.co/w0iDVVZ3RV

— MARA (@MARAHoldings) February 26, 2025

Chairman & CEO @fgthiel shares key insights on our record-breaking year and what’s next for MARA. pic.twitter.com/xmFZYcwcUX

MARA News: Bitcoin Holdings Worth $4.6 Billion

MARA stock has been closely watched by investors as the company deploys its first owned power generating assets, now operating 136 MW of capacity. The company launched a 25-megawatt micro data center initiative at wellheads in Texas and North Dakota and acquired a wind farm in Texas with 240 MW of interconnection capacity.

Analysts following MARA news note the company's bitcoin holdings increased 197% to 44,893 BTC, valued at approximately $4.6 billion at year-end. During Q4, MARA mined 2,492 BTC and purchased an additional 15,574 BTC using proceeds from convertible senior notes offerings.

“Our HODL strategy and the opportunistic BTC purchases have benefited our shareholders as they continue to see sustained yield when it comes to our BTC holdings from a per share perspective,” MARA continued in the report.

The MARA forecast for 2025 focuses on three key themes: Generate, Activate, and Differentiate. The company aims to own and operate not just data center assets but energy generation assets as well, potentially impacting MARA stock price prediction 2025.

“By owning energy assets, we optimize how power is consumed, stored, and distributed. This allows us to activate new services for data centers, AI operators, and energy markets,” the company further explained.

MARA Forecast: The Second Wave of AI

Looking ahead, MARA is positioning itself for the second wave of AI, focusing on inference at the edge rather than training. The company believes this shift presents significant opportunities for its infrastructure and energy management capabilities.

“While many of our competitors rushed into AI hosting and high-performance compute build outs, betting on large, high-capex data centers, MARA took a strategic pause, and for good reason,” the Wall Street Bitcoin miner noted. “History has shown that the biggest opportunities often emerge in the second wave.”

Certainly, there’s plenty at stake. According to a VanEck report from last year, cryptocurrency miners could unlock nearly $40 billion in additional revenue through AI.

The company's return on capital employed during the last 12-month period remains top tier amongst competitors at 30.6%, highlighting MARA's capital efficiency in a capital-intensive industry.

MARA Stock News: It Hasn’t Been This Bad Since November 2023

Although the market has yet to show a clear reaction to MARA’s latest financial results, the stock is currently trading near $12, its lowest level since November 2023. This aligns with Bitcoin’s recent drop—testing multi-month lows—which is pulling cryptocurrency mining stocks down significantly.

MARA’s shares have plummeted by 60%, highlighting that, for most investors, publicly traded miners remain primarily a proxy for Bitcoin exposure on Wall Street. As a result, their share prices are closely tied to the performance of BTC.

MARA Stock Price Prediction 2025

Analysts from major financial institutions have provided 12-month price targets for MARA stock, with forecasts extending into late 2025. The consensus average price target as of early 2025 stands at approximately $26–27, derived from evaluations by 13 analysts.

The range spans a low of $20 to a high of $43, indicating varied expectations depending on market conditions and company execution.

- B. Riley Securities: Analyst Lucas Pipes raised the price target from $21.00 to $23.00, maintaining a “Neutral” rating, suggesting a 71.90% upside from the then-current price of

- Piper Sandler: Set a $28.00 target with an “Overweight” rating.

- JP Morgan: Issued a $29.00 target with a “Neutral” rating, balancing MARA’s robust 2024 performance against volatility risks in the crypto market.

- Cantor Fitzgerald: Analyst Brett Knoblauch lifted the target to $42.00 from $33.00, retaining an “Overweight” rating, one of the most bullish outlooks, driven by MARA’s vertical integration and potential AI infrastructure expansion.

- Macquarie: Raised its target to $29.00 from $22.00, signaling confidence in MARA’s energy cost management and bitcoin accumulation strategy.

Another Wall Street Bitcoin Miner Also Reported 2024 Results

Alongside MARA Holdings’ Q4 and full-year 2024 results, Core Scientific (NASDAQ: CORZ), another major player in the Bitcoin mining and digital infrastructure space, also released its financial performance for the same period, reporting a net loss of $265.5 million for Q4, largely due to a $224.7 million non-cash adjustment tied to warrants and contingent liabilities, compared to a $195.7 million loss in Q4 2023.

The Austin-based company generated $94.9 million in revenue, driven by $79.9 million from self-mining 974 bitcoins at an average cash cost of $51,035 per BTC, alongside contributions from hosted mining and high-performance computing (HPC).

Adding to its momentum, Core Scientific announced a $1.2 billion expansion of its Denton, Texas data center with CoreWeave, boosting its AI and cloud computing capacity and projecting $10.2 billion in revenue over a 12-year contract term, further solidifying its growth trajectory in both crypto and HPC markets.

MARA Stock News, FAQ

What Is MARA’s 12-Month Price Target?

The 12-month price target for MARA stock, as of early 2025, averages between $25.67 and $27.45, according to analyst consensus from platforms like MarketBeat and TipRanks. This range is based on evaluations from 8 to 13 analysts, with targets spanning a low of $20.00 (HC Wainwright) to a high of $43.00 (Cantor Fitzgerald).

Is MARA a Buy, Sell, or Hold?

Analyst sentiment on MARA leans toward “Buy” or “Hold” as of February 2025. MarketBeat reports a “Buy” consensus from 11 analysts, with no “Sell” ratings, driven by MARA’s record $656.4 million revenue and $541 million net income in 2024. The “Buy” case hinges on MARA’s bitcoin holdings and AI potential, though “Hold” ratings caution against crypto volatility.

Will MARA Stock Go Back Up?

Whether MARA stock rises in 2025 depends on several factors, but analysts are cautiously optimistic. After a 115% hashrate increase to 53.2 EH/s and Bitcoin holdings growing to 44,893 BTC (valued at $4.6 billion), MARA’s fundamentals are robust. Analysts like Cantor Fitzgerald ($42 target) see upside, though short-term dips remain possible.