The Bad Kind of Glocal

'Glocal' is a term mostly used positively to describe something which enjoys both the advantages of a global mindset and the benefits of a local community.

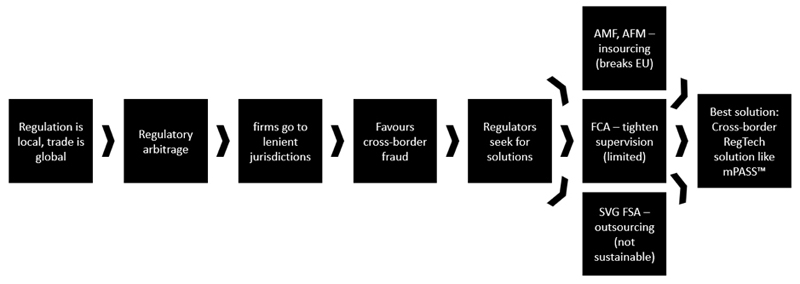

However, 'Glocal' has its dark side, too. For example, since regulation is local, but trade is global, companies are incentivised to set shop in a jurisdiction whose regulatory and supervisory regimes are relatively lenient and provide services from there.

The combination of a jurisdiction with a lenient regulatory and supervisory regime, as well as companies who choose to set shop in it for that reason, make it very hard for those who see themselves deceived by said companies to recover their funds from them.

Therefore, 'Glocal' doesn’t always mean enjoying the best of the two; it can sometimes actually be suffering their worst.

Insourcing – the French and Dutch Approach to Regtech

The above-described phenomenon is nothing new, of course. What is new is the way regulators are attempting to deal with it?

In December 2021 the AFM and AMF (French and Dutch regulators) published a very unusual joint statement, in which they stated they “increasingly observe practices of financial firms obtaining a license and European passport in other EU member states than that of their target audience,” and that these firms especially are prominent when it comes to “offering high-risk products (such as CFDs) as well as in terms of the complaints received from consumers on their practices”.

Therefore, the AFM and AMF asked to transfer supervision over those firms to them – a quite dramatic move, as it contradicts the very notion of a unified European market.

Effectively, what the AFM and AMF were saying was that they no longer wish to 'outsource' the supervision over French and Dutch residents to other EU regulators; and wish to 'insource' the supervision back to them.

Apart from being contradictory to the very notion of the EU, this type of 'reverse supervision' seems also quite impractical, as both the criteria for its imposing are fluid and imprecise, at best; and as the actual abilities of a regulatory authority to exercise effective supervision over a body in a different jurisdiction is unclear.

Outsourcing – the Saint Vincent and Grenadine Approach

Just over a year later, on January 6, 2023, the Saint Vincent and the Grenadines (SVG) Financial Services Authority (FSA) took the exact opposite approach.

In a memorandum titled “Requirements for Business Companies (BCs) and Limited Liability Companies (LLCs) Engaging in Forex Business Activity,” the FSA stated the following:

“Owing to the sharp increase in the frequency and number of complaints and allegations of fraud against SVG registered BCs and LLCs which are engaged in FOREX trading or brokerage and the potential detrimental effects on the reputation of St. Vincent and the Grenadines as an International Financial Centre, the Financial Services Authority (FSA) has adopted the following policy decision… Companies wishing to engage in FOREX business must provide a certified copy of requisite licences/approval from the jurisdiction(s)/authorities where their business activities will be conducted…”

Without such evidence, states the memorandum, applications for new licenses will be rejected; and existing brokers have until 10.03.23 to provide said evidence to the FSA, or risk being sanctioned.

This is a very unusual step taken by the FSA. Of course, strictly speaking, in order to legally operate in a jurisdiction, one usually requires to obtain a license there (there might also be other legal possibilities, though, such as reverse solicitation or 'soft licensing' of various sorts).

However, here the FSA is effectively outsourcing its supervisory powers to overseas regulators, saying it will only grant a license (except for those who wish to operate only in SVG) to a firm that has been previously licensed by a different regulatory authority.

This can be very effective, in the sense that the FSA understands it cannot regulate the actions of financial institutions in their operations elsewhere, and it is also aware firms are mis-using its license to harm investors in those jurisdictions, and therefore wishes to remove from its shores those specific firms who are interested in an unfair advantage.

However, this seems non-sustainable on a large scale, as it is doubtful many regulators will follow suit. After all, this means that there will be very little value to an offshore license. Also, not all regulators are able to withstand the incentive to provide a lenient regulatory environment in order to attract investments. And, this is before we even mention the paradox that might be created, if ALL the regulators in the world (or at least many of them) will implement a similar criterion…

Watch the recent FMLS22 panel discuss Regulation Roundup: Everything you need to know for 2023.

The Traditional Approach – Tightening Supervision

In December 2022, the FCA tackled the same issue of cross-border trading. In a quite direct “Dear CEO” letter, the FCA highlighted problems of bad practices in CFD trading, related among others to firms trading in the UK via a temporary passporting regime, and made it clear it intends to prioritise this issue, and expects firms to take clear action on this.

Contrary to the SVG FSA and the AMF, AFM approaches, the FCA’s approach can be described as a “traditional” – tightening of supervision. The advantages of this approach are clear; but so are its disadvantages. Among other things, the FCA can only deal with the matter in its own “backyard”; and that is, of course, only half the solution.

The Market Already Knows – Regulatory Challenges Are Solved by Regulatory Technology

One regulator tightens its supervision; others ask to insource it; another to outsource it. The variety of approaches is wide, and it won’t come as too big of a surprise if a regulator would even choose to ban electronic trading in their jurisdiction altogether (drastic as it may sound). However, we would like to suggest a better solution, harmonisation through technology.

As any market-maker or participant already knows, regulatory challenges are solvable or at least are considerably eased by the use of appropriate technology. Regulatory Technology solutions, or 'RegTech solutions', have been cutting costs, streamlining processes and shortening times-to-market for decades now, and are an essential and inseparable part of the day-to-day practice of compliance, onboarding, reporting etc. teams in financial institutions.

It makes perfect sense, then, to look for a RegTech solution for this problem of cross-border trading as well. And, the solution exists, Muinmos’ mPASS™, an automated investor protection module, which automatically categorises a client, assesses suitability and appropriateness, assigns it with a risk profile etc., according to the legal systems of both the financial institution’s domicile AND that of the client.

The implementation of such a system, of course, won’t solve all the issues concerning cross-border trading. But, it will provide a much better compliance starting point; can be implemented fast and at a relatively low cost; and is a lot more realistic than expecting all the regulators in the world to ask for each other’s licenses before granting their own (something that is also, as stated above, actually paradoxical).

Such is the power of RegTech: it can solve a regulatory problem with relative ease and at a relatively fast pace, low cost, and to the benefit of all regulators, firms and investors alike. In the context discussed here, mPASS™ even presents a unique opportunity to create a unified legal benchmark, thus eliminating regulatory arbitrage, proving that technology, very much like trade, has the potential to transcend jurisdictional boundaries.

Remonda Kirketerp-Møller is the CEO/Founder of Muinmos