On the heels of latest controversy surrounding the ostensibly low growth number of FXCM we at Forex Magnates decided to compile a short guide for capital markets analysts and hedge fund investors which will help them better understand how this animal called forex broker is different from the typical multi asset brokerage. Differences are quite substantial and therefore analyzing forex brokers through standard protocols may lead to erroneous decisions. Not all points raised will result in a more positive analysis of forex brokers' public results but it will surely contribute to much better understanding.

A currency trader is known by many names: scalper, carry trader, swing trader, and even hedger. Currency traders in the US are known to wake up at 3am to catch a few pips during the London session when the British Pound makes its move. They are educated and well-informed citizens of the world who understand the implications of the Middle East unrest on the US dollar. He or she is very active in online communities, finding the latest trading strategies and reading up the latest reviews of forex brokers. A currency trader is a unique title that has gained popularity in the last decade or so... and as we will see in the next few paragraphs, shares very few similarities with their cousins: the stock trader.

A typical currency trader starts out with one broker, but over the course of his/trading career ends up maintaining accounts at multiple brokers. Why is that? The over-the-counter nature of the currency market means that all price feeds are not made the same. The business practices of brokers are partly responsible for this. A broker like FXCM advertises that they are a Non Dealing Desk broker (passing your trade to interbank counter parties) while another, GFT openly advertise that they are not a bank but a dealer. Each business model comes with an array of issues that a trader must understand. Even the rollover rates (used by carry traders to earn interest on their positions) vary from broker to broker. Add to this the multitude of advanced charting platforms available to a trader and sooner or later a trader’s equity is split amongst multiple brokers. Not long ago a survey done by an independent research firm in the UK found that the average British trader has 3 - 4 brokers.

Stock brokers compete with each other on platforms and additional services, but on the pricing point their commissions are very close to each other for a given volume level. In the currency trading world, Oanda advertises an average 0.9 pip spread on EURUSD, whereas FX Solution has a fixed spread of 3.0 pips on the EURUSD. Until the NFA recently changed the minimum margin requirements in the US, leverage available to a US trader was not the same. Even now, international traders can choose anywhere from 400:1 to 50:1 leverage, based on the platform.

Execution varies wildly from broker to broker. We have seen high profile cases like State Street, which is under SEC investigation for giving the worst price to several state pension funds. A few pips make a big difference to a trader who is trading on a large position using leverage. For stock traders, company earnings and important announcements are made before the market opens or after the market closes. Given the 24-hour nature of the currency market, news announcements are always made during trading sessions. It is important to choose a good broker because some brokers’ platforms are notorious for going down, whether intentionally or not, during news announcements.

Client demographic tends to vary from broker to broker. The online margin trading arm of Citi bank named CitiFX Pro has a minimum deposit requirement of $10,000 in addition to net worth requirements, whereas online currency broker Oanda allows a trader to place a trade even with a $1 deposit in their trading account. A $1 deposit is unimaginable with a stock broker.

Not only do clients have accounts with multiple brokers, they have multiple accounts with the same broker, as well. For example a trader with FXCM might have an account on the Metatrader platform (for his automated robots), a second one on the FXCM Trading Station (for his manual trading) and a third account traded by a money manager (under an Introducing Broker agreement). This is a typical profile of an experienced currency trader and something not found with stock traders.

Majority of currency traders are intraday traders, whereas most stock traders come with the mindset of investing for the long term, and are not likely to try as many different strategies or platforms as currency traders. At traditional brokers like Schwab, a trader is not able to get access to their active trader platform unless they specifically request it and meet certain requirements. Otherwise, they are stuck with their website for placing orders and left without a whole lot of tools for charting or analysis. Such limited functionality would never be acceptable at a currency broker.

The currency brokers have had a long struggle with client retention. To increase retention, brokers are increasing emphasis on lower leverage trading and focusing on educating clients. Some currency traders think of trading through a forex broker like going to a casino. It’s always easier to blame the casino for your losses. A visitor to Vegas will try his or her luck on different tables with different casinos. A currency trader will similarly try various brokers. Interestingly, in the UK, currency trading can be classified as financial spread betting. The UK tax authorities designate financial spread betting as gambling and not investing, making currency trading profits free from capital gains tax and stamp tax.

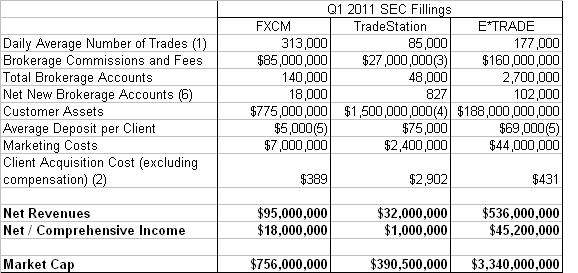

- TradeStation and E*TRADE offer futures,options and stocks and have different methods of calculating daily average for each asset class

- Derived by dividing marketing costs by net new brokerage accounts, also see fourth bullet in the notes below

- Commissions, Fess and Services Charges added together

- We looked at the amount payable to brokerage customers to approximate customer assets

- Approximated by dividing customer assets by brokerage accounts

- Compared to Q1 2010

Further important notes:

Why is it important for anyone analyzing the performance of a forex broker to understand the profile of a forex trader? We believe that there is still a lot of misunderstanding about the performance of firms like FXCM (NYSE:FXCM) and Gain Capital (NYSE:GCAP), especially because they are the first forex brokers to go public in the US. We did a side by side comparison using data from the latest quarterly SEC fillings from FXCM (NYSE:FXCM), E*TRADE Financial Corporation (NasdaqGS:ETFC), and TradeStation Group (NasdaqGS:TRAD). We summarized our analysis below:

- Even though the average deposit per client at FXCM is $5,000 ($75,000 at TradeStation vs $69,000 at E*TRADE), FXCM’s platforms processed an average of 313K trades a day which is almost 1.7 times the number of trades processed on E*TRADE’s platform and 3.6 times the number of trades processed on a daily basis on TradeStations’ software.

- FXCM serviced 140K brokerage accounts earning commissions and fees of $85 million. E*TRADE earned $160 million in commissions and fees while servicing 2.7 million brokerage accounts (almost 20 times the number of accounts at FXCM)

- FXCM has the lowest amount of customer assets in our comparison study. Keep in mind that FXCM does not offer interest on idle funds, whereas E*TRADE also offers checking accounts to US clients. In addition to that, forex brokers do not attract as many retirement accounts (IRA and 401k) as stock brokers do. Average balances in IRA retirement balances tend to be higher. Retirement accounts at stock brokers offer mutual funds, ETF’s and various other investment products and are most often restricted from Forex Trading .

- In our study, E*TRADE attracted the most number of newer accounts in Q1 2011 with a marketing budget of $44 million compared to FXCM’s $7 million. This gives E*TRADE a per client acquisition cost of $431. At first sight, it may appear that FXCM and E*TRADE’s per client acquisition cost are in line with each other. However forex brokers like FXCM have low client retention rate compared to stock brokers. The average life of an account opened at a forex broker is 3 months. New traders tend to blow up their accounts using high leverage. It is rare for a retail trader to have access to enough leverage to blow up their stock brokerage account. When quarterly numbers are complied, forex brokers have to exclude clients that are no longer active. Even though FXCM reported only 18K net new brokerage accounts, we can safely assume that it obtained another 10K new accounts additionally, that it can no longer include because of low balance / inactivity. This will make FXCM’s acquisition cost per client much lower than what it appears based solely on reported number of active clients. We can estimate FXCM's effective per client acquisition to be $250 (including client turnover.) Also because E*TRADE markets investments, retirement and checking accounts, it is not easy to do a side by side comparison in terms of per client acquisition cost.

- At the time of writing, FXCM has a market cap of $756 million on $18 million in net income as compared to TradeStation’s market cap of $390 million on $1 million in net income for Q1 2011. TradeStation Group agreed to be acquired by Monex Group out of Japan through a cash tender offer followed by a merger. The deal announced on April 21, 2011 valued the transaction at $411 million.

In conclusion, profit margins are high for brokers offering forex accounts. It does not surprise me that traditional stock brokers are adding spot forex to their list of products. Some recent notable ones: Tradestation Group launched its own forex related subsidiary called TradeStation Forex. OptionsXpress (acquired by Charles Schwab) is developing a currency trading offering. TD Waterhouse (one of UK’s largest broker) entered into a partnership with Saxo Bank to offer CFD’s and Forex.