The retail FX/CFD industry in Europe is facing a significant shift, and 92% of surveyed companies are concerned about their future due to increasing regulatory restrictions. A recent report by Acuiti titled "Retail Revolution" delves into the potential impact of these changes and how the industry responds.

The report suggested that companies might shift from their current instruments to "listed derivatives." Despite being "muted" in recent years, they may gain significance due to their more regulated nature and lower counterparty risk.

The Changing Landscape of Retail FX/CFD Trading in Europe

Contracts for Difference, or CFDs, have been a popular retail trading product in Europe, with an estimated market size of $3.2 billion in 2023. However, regulators across the continent have grown increasingly concerned about the risks posed to retail investors.

The Spanish regulator CNMV banned the promotion and distribution of CFDs to retail clients last year, citing aggressive marketing strategies and significant losses incurred by investors.

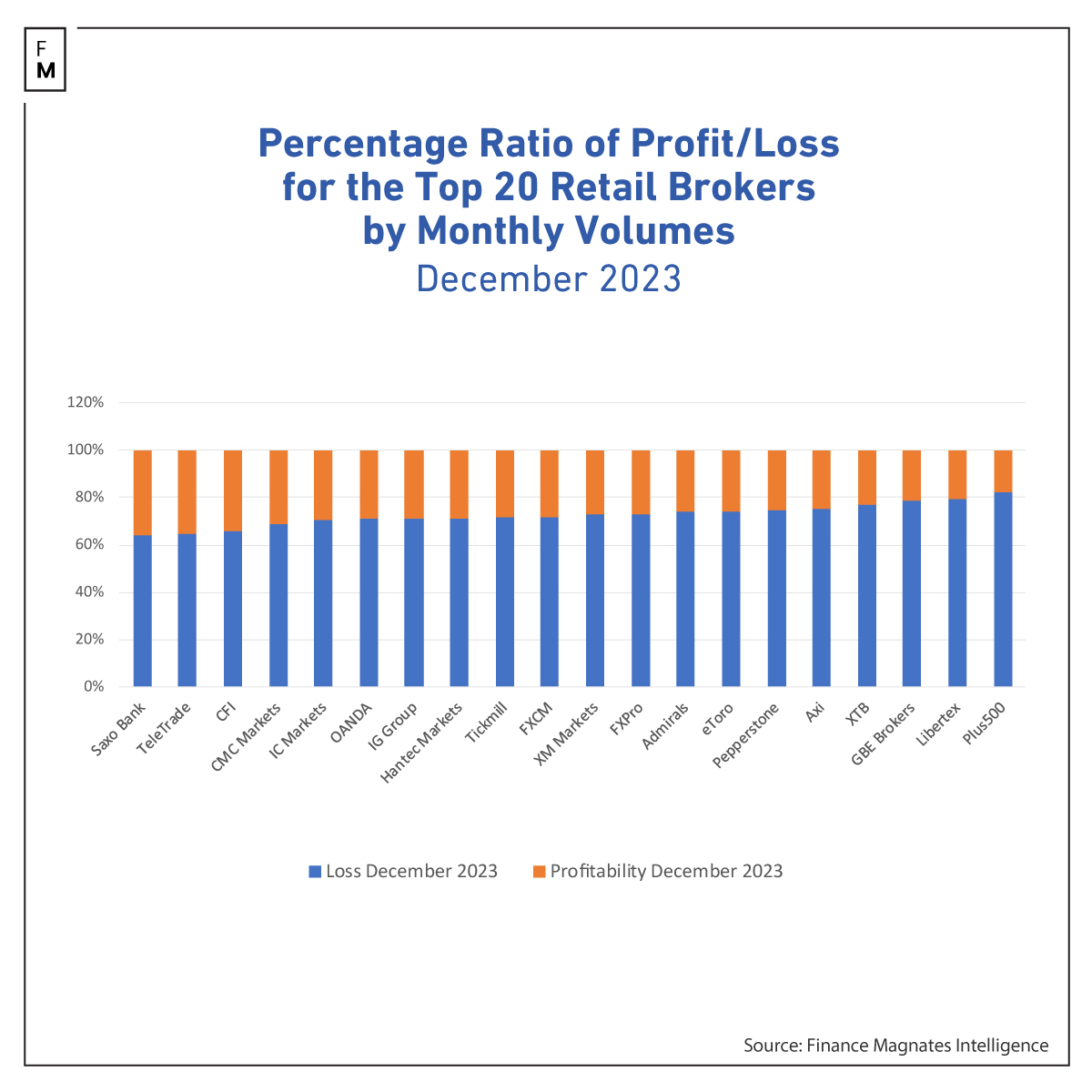

Across Europe, retail brokers are required to disclose the percentage of clients who lost money trading CFDs over the past 12 months, which typically ranges from 70% to 80%. Studies have shown that the average retail investor lost €2680 trading CFDs between June 2017 and June 2018. Most recent studies conducted by Finance Magnates Intelligence confirm those findings.

Beyond investor losses, regulators are worried about the counterparty risk retail brokers are exposed to by offering CFDs that are not centrally cleared. The UK's FCA is said to be closely monitoring the size of positions retail brokers are carrying and the potential wider market impact if a key player were to collapse.

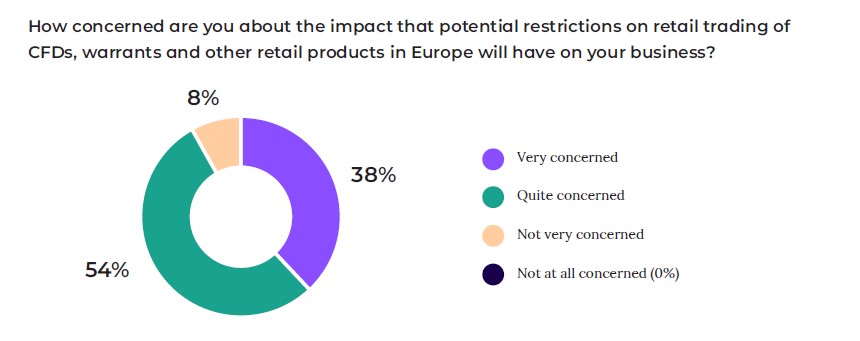

Regulatory concerns have led to intensified regulatory actions, which in turn have alarmed FX/CFD brokers and retail trading firms. 38% of those surveyed expressed that they are "very concerned" about their future, while 54% are "quite concerned." Consequently, 9 out of 10 brokers fear that excessive regulations may adversely affect their businesses.

Industry Response and Opportunities

The Acuiti report surveyed 72 firms in the European market to understand how retail brokers are responding to the challenges posed by regulatory restrictions. Over two-thirds of retail brokers said 76-100% of their revenues come from retail trading, highlighting the significant impact any restrictions would have on their businesses.

Most retail brokers plan to expand into other regions, target institutional flows, and grow their listed futures and options offerings to mitigate potential revenue losses.

"There are several examples globally of brokers who initially focused on retail and subsequently became major players in institutional markets," said Will Mitting, the Founder of Acuiti. "In Europe, there is the potential for significant numbers of brokers to enter the institutional market over the next three years."

In fact, over half of the respondents believe restrictions on retail products would positively impact listed derivatives markets in Europe and overall competition.

However, some structural changes are needed for Europe to capitalize on the retail trading opportunity in listed markets fully. Retail investors cited the need for more education and concerns about higher trading costs, particularly market data charges.

For the institutional sell-side, the influx of retail flow into listed markets presents both opportunities and threats. Proprietary trading firms predict it would improve liquidity , provide greater opportunities, and boost revenues, with less than 10% thinking it would increase volatility.

However, incumbent brokers seem to underestimate the competitive threat posed by ambitious and tech-savvy retail brokers entering the institutional space.

The Future of Retail Trading in Europe

The industry is at an inflection point as European regulators continue to clamp down on risky retail products like CFDs. Retail brokers are being forced to adapt their business models, with many setting their sights on institutional markets and the potential growth in listed derivatives.

"Regulators in Europe are only going one way with regards to retail trading of CFDs," noted one retail broker interviewed for the Acuiti study.

This shifting landscape will likely bring the institutional and retail markets closer together, potentially providing a significant boost to Europe's listed derivative volumes, which have lagged behind the retail-driven growth seen in US options markets in recent years.

"Should retail trading shift to listed derivatives markets, the overall market available to institutional brokers will grow. However, there will also be major disruption as the retail firms bring fresh competition to the markets. Our view based on this research is that the institutional incumbents underestimate the extent of the potential disruption," Mitting added.

While challenges remain in terms of market structure, costs, and education, the retail trading revolution in Europe seems poised to shake up the status quo. As one participant put it: "Ultimately, regulatory actions may well force institutional and retail markets closer together, with listed derivatives markets in Europe set for a significant boost."

Another study by Acuiti conducted last year showed, that European industry participants thinks FX markets will see a huge influx of prop trading firms.