Nvidia is buying into Intel and building with it, but the partnership leans on CPU and interconnect synergy, not a miracle cure for Intel’s manufacturing woes. Still, the stock price is up.

What Nvidia is Actually Buying

Nvidia is investing $5 billion in Intel’s common stock, with the purchase priced at $23.28 per share and subject to regulatory approvals. That is not just a financial gesture, it sits alongside a product roadmap where the two companies plan “multiple generations” of custom data center and PC products. The technical spine is clear. Intel will design and manufacture custom x86 CPUs that Nvidia will integrate into its AI infrastructure platforms, and for PCs Intel will build x86 system-on-chips that integrate Nvidia RTX GPU chiplets, with NVLink used to connect the worlds. That is real product, not a handshake.

Join us live! The CEOs of Intel and @nvidia will host a webcast press conference today at 10 a.m. PT (1 p.m. ET) to talk about our new partnership.

— Intel (@intel) September 18, 2025

Tune in here: https://t.co/z2SPmDtIjN https://t.co/3cTzXcuboq

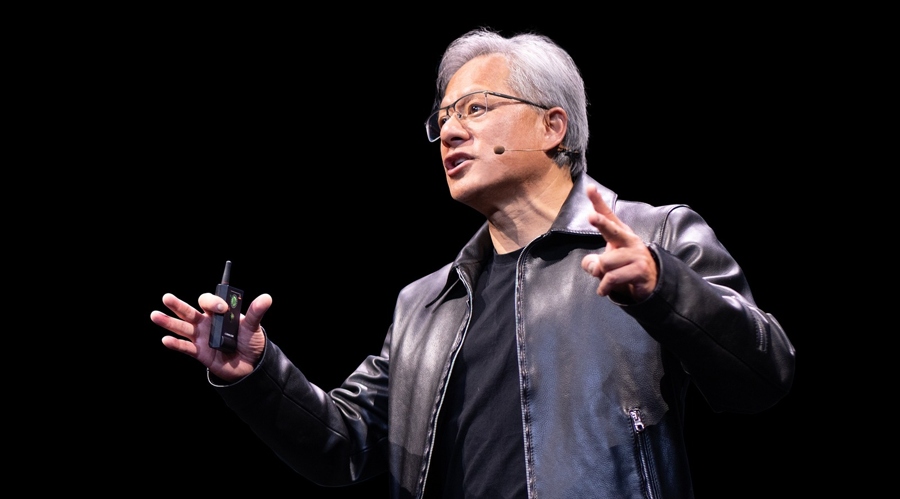

Nvidia’s line is that AI is remaking the stack, from silicon up. Jensen Huang called it a “new industrial revolution,” and framed this tie-up as a way to fuse Nvidia’s AI stack with Intel’s x86 ecosystem. Intel’s leadership pitched Intel’s process, packaging, and platforms as a complement to Nvidia’s acceleration lead. The upshot is simple. Nvidia gets custom CPUs aligned to its platforms, Intel gets RTX in client silicon, and customers get a cleaner bridge between CPU and GPU domains.

Why Is This Happening?

Follow the incentives. Nvidia wants CPU optionality that slots cleanly into its AI infrastructure and a stronger PC story that pairs RTX with Intel’s volume engine. Intel wants relevance in AI data centers and a differentiated client roadmap that borrows Nvidia’s halo. Both want to tell big customers that the bottleneck between x86 and accelerated compute is easing, thanks to NVLink and co-design at the platform level. That is the logic.

NEWS: @NVIDIA and @Intel to develop AI infrastructure and personal computing products.

— NVIDIA Newsroom (@nvidianewsroom) September 18, 2025

Read the announcement: https://t.co/Gl28iWwSZc pic.twitter.com/srOhEnr0Ja

Financially, the investment price gives Intel breathing room and a signal to the market that the two of the most consequential compute franchises can collaborate when it suits them … the other being AMD, who are going toe-to-toe with both Intel and Nvidia.

The core takeaway remains product-first. This is a go-to-market and engineering alignment, not a wholesale rewrite of Intel’s manufacturing destiny.

- Trump Eyes Intel Stake as Chip Politics Go Wild

- Intel’s Earnings Report: Chip Giant Stumbles While Microsoft Sails On

- Breaking: IG Group Buys Australian Crypto Exchange for £87 Million

Intel’s Real Headache

Here is the catch. Intel’s biggest structural problem is not whether it can co-design a nice CPU for Nvidia or slip RTX chiplets into client silicon. Its problem is whether Intel Foundry becomes a competitive, durable, external business. Nvidia’s cash and collaboration do not make the foundry issue disappear. The alliance does not automatically fix process execution, cost, or the credibility deficit that comes with recent slips. That is the mountain, and it remains tall.

How Wall Street Actually Reacted

Markets cheered. The Intel stock price jumped more than 20 percent on the news, reflecting a classic relief rally as investors priced in fresh capital, brand validation, and a clearer product story. The move came alongside headlines that highlighted the $23.28 purchase price and the multi-generation roadmap, which helped bulls sketch a near-term narrative that Intel will have more than good intentions behind its AI pitch.

Nvidia and Intel announce jointly developed "Intel x86 RTX SoCs" for PCs with Nvidia graphics and custom Nvidia data center x86 processors.

— Pirat_Nation 🔴 (@Pirat_Nation) September 18, 2025

Nvidia acquires $5 billion in Intel stock in a major deal.

Intel stock price +30% pic.twitter.com/wLGm86vLNT

It is worth separating pop from proof. A big one-day gain is a sentiment reset, not a solved thesis. The stock can re-rate on partnership optics and incremental balance-sheet comfort, but the durable multiple lives or dies on whether Intel executes on manufacturing, cost, and external customer wins. Prices move fast. Process nodes do not.

What the Deal Does Not Do

Critically, this announcement is not Nvidia migrating its GPU manufacturing to Intel’s fabs. Reporting on the tie-up underscores that there are no immediate plans for Nvidia to rely on Intel’s foundry services.

Translation for the back row: Great for co-developed products. Not a contract that backfills Intel’s fab utilization with Nvidia’s hottest wafers. If your bull case required Nvidia to flip from its established foundry relationships to Intel right now, this is not that movie.

A Near-Term Win and Long-Term Question

Near term, everyone gets something. Nvidia adds CPU muscle tuned to its platforms and a PC story that feels more like a system than a parts bin. Intel locks arms with the category leader in acceleration and tells investors that the AI party is not happening without x86 at the door. Customers get a cleaner, faster bridge across CPU and GPU, which is what most real workloads want. That is the tidy version.

Long term, the uncomfortable part remains. Intel still has to prove that its manufacturing roadmap is on time, cost-competitive, and attractive to third parties who are not being coaxed with one-off prestige projects. This collaboration does not erase the need for external customers that choose Intel Foundry on merit. It does not snap Intel to parity with the world’s leading process nodes. It does not guarantee that packaging and yield stories scale gracefully. Those answers live in wafers and P&L, not in a press release.

The Bottom Line

As strategy, the move is elegant. Nvidia buys influence and CPU alignment. Intel buys time and relevance. Intel’s faltering stock price goes up. As operations, the hard work is elsewhere. Co-developed parts can ship on schedule and still leave the foundry question unsolved. If Intel nails the manufacturing turnaround, this partnership will look like the smart prequel to a bigger comeback. If it does not, $5 billion will read like a great chapter title that never became the book.

For more stories around the edges of finance and tech, visit our Trending section.