As NVIDIA hits record highs and adds a $1 billion strategic stake in Nokia, the AI-fueled jump in both stocks says one thing: telecoms are now tomorrow’s battlefield.

NVIDIA Stock Hits the Stratosphere

Let’s start with the obvious: NVIDIA is on a tear. After unveiling a series of updates at its GTC event, NVIDIA stock rose sharply, pushing the company’s market capitalization close to the $5 trillion mark.

WATCH: All three major US stock indexes posted record closing highs again as Nvidia shares gained following news it will build artificial intelligence supercomputers for the US energy department, and as investors were optimistic about corporate earnings https://t.co/zS8cp8sGAi pic.twitter.com/sf5Asqa9aI

— Reuters Business (@ReutersBiz) October 29, 2025

Yes, you read that right: $5 trillion. That kind of number puts NVIDIA in the company of the gods (or at least near them). Its ascension is being fueled by the explosive demand for AI-hardware, GPUs, accelerators, you name it, and investors appear comfortable betting big.

The question, of course, is whether that valuation is all gravy or if some of it is baked into a big leap. For now the market seems to believe it.

Nokia Stock Rockets on Strategic Bet

Now turn to Nokia. The Finnish telecom gear maker has had a rough ride in recent years, but the announcement from NVIDIA gives it the kind of headline injection that’s rare: NVIDIA is investing $1 billion in Nokia, acquiring a 2.9 % stake at a subscription price of $6.01 per share, as part of a strategic tie-up to develop “AI-native” mobile networks.

BREAKING: Nokia stock, $NOK, surges nearly +30% after announcing a $1 billion investment from Nvidia. pic.twitter.com/14cewE2pNf

— The Kobeissi Letter (@KobeissiLetter) October 28, 2025

Unsurprisingly, Nokia stock surged more than 20%, reaching their highest level in nearly a decade. A hardware vendor that many had somewhat written off is suddenly in the spotlight, thanks to this alignment with the major AI wave.

- Nvidia Visits TSMC as China Clouds Gather Over AI Chips

- China Tells Tech Giants to Cool It on Nvidia H20 Chips

- How Jensen Huang Got Trump to Greenlight AI Chips for China

Turning Telecom into AI Infrastructure

So what exactly is going on here? Why is NVIDIA, the chip/AI company, taking a stake in Nokia, the telecom infrastructure company? And why are both stocks benefiting?

We are thrilled to announce that @NVIDIA will invest $1 billion in Nokia to accelerate AI-RAN innovation and lead the transition from 5G to 6G as part of a new strategic partnership. https://t.co/pxGT5DYsA2 #NVIDIAGTC #Nokia pic.twitter.com/XBtsQgNuBw

— Nokia (@nokia) October 28, 2025

The answer lies in the concept of AI-RAN (Radio Access Network) and the shift towards “AI-native connectivity.” According to NVIDIA, they and Nokia will jointly develop AI-RAN products so that telecom operators can support generative AI, edge computing, 5G-Advanced and 6G infrastructure.

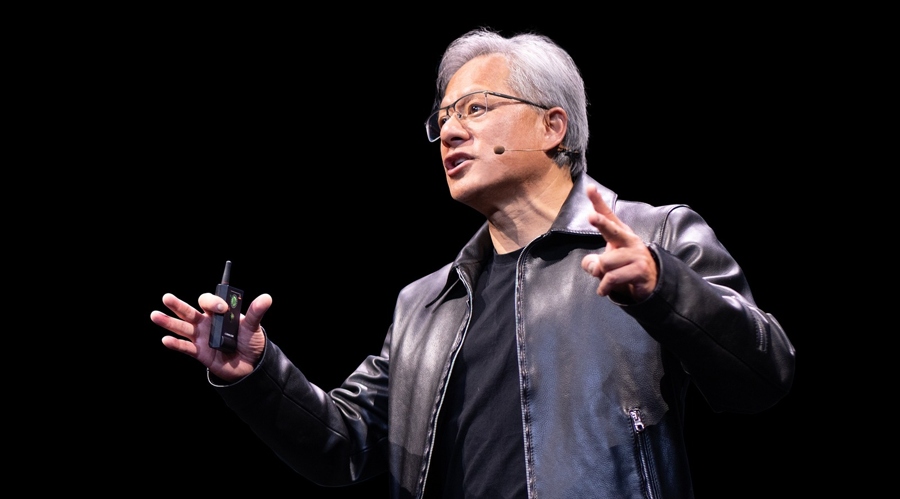

NVIDIA’s CEO, Jensen Huang, puts it bluntly: “Telecommunications is a critical national infrastructure – the digital nervous system of our economy and security. Built on NVIDIA CUDA and AI, AI-RAN will revolutionize telecommunications…”

Nokia’s CEO, Justin Hotard, adds: “The next leap in telecom isn’t just from 5G to 6G – it’s a fundamental redesign of the network to deliver AI-powered connectivity, capable of processing intelligence from the data center all the way to the edge.”

Exactly Why the Stocks Are Up

• For NVIDIA: This move strengthens its role not just as a data-center AI chip provider but as a key component of next-generation connectivity infrastructure. More chips, more edge computing, more subscriptions.

• For Nokia: It gains renewed relevance. The backing of NVIDIA gives the company a strong signal to investors that it is pivoting into high-growth territory, not just legacy network gear.

• For investors: You get a two-fer, exposure to the AI hardware boom and the telecom infrastructure reboot all in one play.

Stock Surge Mechanics

Let’s dig into the figures. For NVIDIA, the stock gained roughly 5% when the updates were announced, bringing the cap to around $4.89 trillion.

For Nokia, after the investment announcement, the shares jumped roughly 22.8 %, reaching highs not seen for a decade.

In other words: the market rewarded the

narrative. Hardware + AI + connectivity = good.

Still, worth noting: such big jumps can fade as easily as they come if the

delivery doesn’t follow. Execution risk is real.

What You Should Keep an Eye On

- Closing conditions: The investment by NVIDIA is “subject to customary closing conditions.” If anything goes wrong there, the premium in Nokia stock could evaporate.

- Commercial deployment timing: Nokia and NVIDIA expect field trials of AI-RAN solutions (with US operator T‑Mobile US) in 2026 and full roll-out likely later. If real revenue doesn’t kick in, the story could stall.

- Valuation risk: NVIDIA’s valuation is already enormous. For it to justify that price, the AI hardware/telecom angle must scale significantly.

- Competitive risk: Other players (like Ericsson, Huawei, and others) have stakes in RAN/6G infrastructure. If Nokia/NVIDIA stumble, others could grab share.

- Regulatory/geopolitical risks: Telecom infra is national infrastructure. Governments will be keen on sovereignty, supply chains, export controls. NVIDIA and Nokia are playing in a high-stakes zone.

Final Take

In the world of stocks, narrative sometimes drives as much value as numbers. Here we have a narrative check-boxed: NVIDIA, the poster child of the AI chip boom, links up with Nokia, a telecom operator looking for a second act, to build the networks of tomorrow.

NVIDIA stock is riding high and arguably now embedded into the connective tissue of tomorrow’s digital world. Nokia stock is catching a wave of optimism it hasn’t seen in years. The catch? The wave has to carry them both through real deployments and monetization. If it does, both stocks may be up for more. If it doesn’t, the premium is at risk of being pruned.

For more stories of finance and tech, visit our Trending pages.