As September rolls on, a handful of mega cap stocks are running hot while others are struggling to keep pace. Momentum is strong in some corners, weakness is showing in others, and with the Fed decision and Jerome Powell’s press conference looming, the question is whether these leaders still have room to run or whether they are sitting ducks for a reversal.

A look at the big movers so far this month

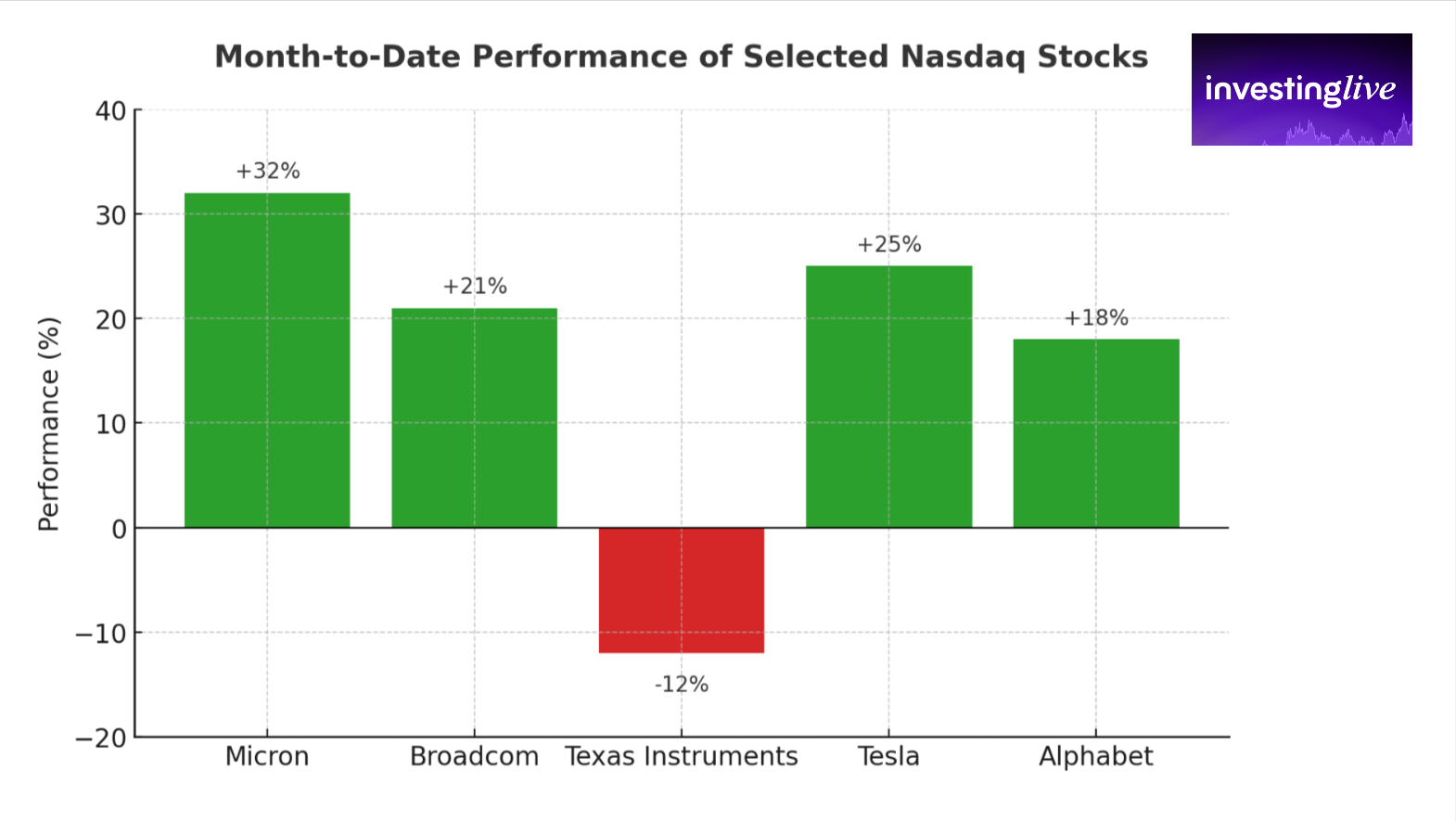

Semiconductors remain the headline act. Micron is up more than 32 percent month to date, easily the strongest in the group. Broadcom follows with a near 21 percent gain, not only outperforming peers but also showing a clean follow-through after its latest earnings day when shares jumped 9.4 percent. Texas Instruments is the clear laggard, down about 12 percent this month after collapsing more than 13 percent on its earnings day, a move that was larger than what the options market had priced. That combination of weak earnings-day reaction and continued drift lower points to sustained pressure rather than a one-off miss.

In consumer cyclicals, Tesla is telling one of the more fascinating stories. The stock initially dropped 8.2 percent on earnings day, but since then it has surged about 25 percent month to date. Some of that rally may have been fueled by weak hands getting shaken out, making room for accumulation, while part of it may also be linked to Elon Musk revealing that he personally bought one billion dollars worth of stock in the open market. Just this week, Tesla shares rose another 7 percent as the surge extended for a third day. Whether this means Tesla is simply extended and fragile and therefore vulnerable to a bearish Powell message, or whether it reflects deeper strength and insider confidence, the setup is one of the most volatile and interesting heading into today’s Fed announcement.

Over in communication services, Alphabet has quietly gained about 18 percent this month, showing strength relative to peers. Meta is up 5 percent, positive but not explosive, while Netflix is flat to slightly negative, lagging in the same category. Alphabet’s post-earnings follow-through makes it one of the steadier momentum stories of the month so far.

Why earnings reactions set the tone

Earnings-day reactions continue to be one of the clearest tells for where momentum sticks and where it fades. Broadcom is the textbook example of strength: strong results, a powerful initial reaction, and steady follow-through. Texas Instruments is the mirror image: a poor print, a collapse larger than implied by options pricing, and no real recovery. Tesla is somewhere in the middle, mixing an initially ugly reaction with an unexpected rebound that now has all eyes on how it will respond to macro news.

The Fed wildcard today

The Fed is expected to keep rates unchanged, but what matters most is how Powell frames the outlook. If the message reassures investors that easing is still on the horizon, momentum leaders like Micron, Broadcom, Alphabet, and Tesla could push even higher. If instead Powell comes across as too cautious or too hawkish, then the stocks that have run the hardest, especially Tesla, may be the first to crack.

Whichever way the market breaks after today’s announcement, the month-to-date scoreboard shows just how much is at stake. Leaders look stretched, laggards look heavy, and the Fed could be the trigger that decides whether September ends with another leg higher or a sharp correction.

In other words, while the Fed’s decision is the obvious wildcard, the real preparation comes from studying the biggest winners and losers month to date and layering that against how they behaved on earnings day. Those initial reactions often leave footprints — Tesla, for example, flashed weakness on earnings, only to rocket higher this month, leaving it potentially overextended. If the market sells off regardless of what Powell says, Tesla may be the first to reveal that fragility. That kind of stock-specific lead, grounded in earnings reaction and recent momentum, offers traders a far sharper edge than simply staring at the index and waiting for the Fed.

In other words, while the Fed’s decision is the obvious wildcard, the real preparation comes from studying the biggest winners and losers month to date and comparing that with how they behaved on earnings day. Those initial reactions often leave footprints. Tesla, for example, flashed weakness on earnings, only to rocket higher this month, leaving it potentially overextended. If the market turns lower regardless of what Powell says, Tesla may be the first to expose that fragility.

To frame today’s meeting more effectively, it also helps to understand the balance inside the Fed itself. FOMC Hawks and Doves: A comprehensive overview gives a clear breakdown of which policymakers lean hawkish, which lean dovish, and who is in the middle. With that context in mind, traders can better assess how Powell’s tone might influence the broader market.

That is why traders should not only focus on the index. Stock-specific leads, grounded in earnings reactions and recent momentum, can offer a sharper edge when navigating big macro events. Preparation of this kind can make the difference between reacting late and being positioned ahead of the move.

This article is for information only and does not constitute financial advice.