Crypto traders rattled, then the tape got louder

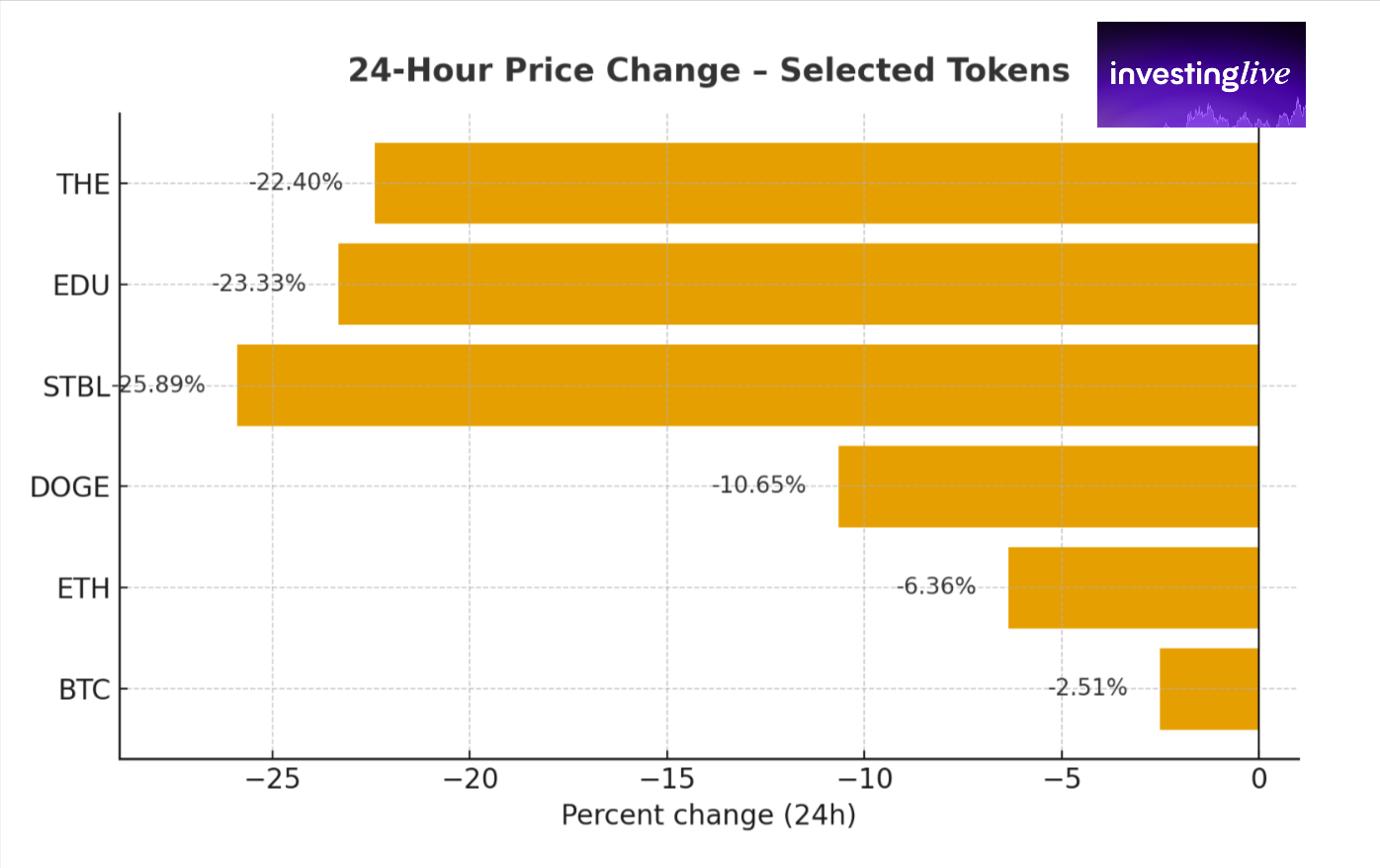

The last 24 hours were a wake-up call. Major coins slid in unison, and the move came with heavy participation. Bitcoin fell about -2.5%, Ethereum -6.4%, Solana -6.8%, XRP -6.3%, while Dogecoin dropped -10.7%. What made it sting was the surge in activity: ETH volume jumped roughly +188%, SOL +131%, XRP +152%, DOGE +191%. That pairing of lower prices and bigger volume is exactly what you expect when more traders try to use the same exit at the same time. According to investingLive.com (formerly ForexLive.com), there was no single catalyst and the selling gathered pace into the European open.

The sharpest 24-hour decliners in crypto and what their internals say

Looking past the mega caps, five mid-cap names stood out with losses beyond 20 percent. The internals help separate panic from simple drift.

EDU: Price -23.3%, Volume +64.5%, Open Interest -49.1%

This looks like a flush. Positions were forced out, volume was there to meet them, and remaining OI shrank fast. Bears in control, longs capitulating.THE: Price -22.4%, Volume +295.1%, Open Interest -19.8%

A crowd showed up. Huge two-way activity with only a modest OI drop means positions still sit on the book. Expect aftershocks both ways.STBL: Price -25.9%, Volume -47.4%, Open Interest -25.1%

Weakness without sponsorship. Liquidity thinned and traders stepped aside. These are the types that can keep sliding if attention stays elsewhere.ALPHA: Price -21.7%, Volume +31.9%, Open Interest -25.0%

Pressure with participation. Similar to STBL on OI, but with enough volume to say sellers were active rather than absent.BOT: Price -21.6%, Volume -25.1%, Open Interest -7.4%

A quieter fade. More neglect than panic. Often these find a floor only when interest returns.

How to read today's crypto market from here

Traders do not need to guess. Let price, volume, and open interest narrow the path.

1) Continuation risk

Price keeps making lower lows.

Volume remains elevated or rises again on down days.

OI stays flat to higher on down days as fresh shorts press, or drops sharply as forced liquidations continue.

If you see this combination, bounces are for trimming, not chasing. Short sellers prefer lower-timeframe breakdowns after weak retests.

2) Capitulation and rebound potential

Price spikes lower intraday but closes off the lows.

Volume is very high on the washout, then lower on the next down attempt.

OI plunges on the flush and stabilizes the next session.

This is the classic bear exhaustion look. Longs wait for a higher low or a reclaim of a clear intraday level such as VWAP, the prior day low, or a simple 50 percent retrace of the dump.

3) Dead-cat bounce

Big green candle after a heavy selloff, but volume on the bounce is noticeably lighter than the sell volume.

OI rises into the bounce.

This often signals shorts re-loading into strength. If price stalls below obvious resistance, the move can roll over.

4) Rotation back to quality

Leaders with fundamental or liquidity support bounce first, laggards stay heavy.

On green days, watch if volume and OI migrate toward majors while smaller names remain quiet.

In that case, traders reduce high beta and move up the market-cap curve.

Practical checklist for the next sessions in crypto

Always pair price with context: red day plus rising volume is not the same as red day plus drying volume.

Track OI direction: rising OI with falling price suggests new shorts, falling OI suggests position exits.

Define your trigger: reclaim of intraday VWAP, break and hold above the prior day’s low turned resistance, or a first higher low after a capitulation spike.

Respect liquidity: thin books exaggerate moves. Scale sizes accordingly and avoid chasing at the extremes.

Pre-plan both sides: identify one continuation scenario and one mean-reversion scenario for each coin you watch. Act only when one shows up on the tape.

Use alerts: set simple price or VWAP alerts rather than staring at every tick.

Where the opportunity may be for crypto traders

High-energy names like EDU and THE will likely stay volatile. If continuation prints, intraday shorts can work, but only with tight risk above recent micro-structure highs. If a capitulation signature appears, the first higher low after the flush can be a tradable long back to VWAP or the first resistance shelf.

Low-liquidity decliners like STBL and BOT need evidence that interest is returning. Without a volume comeback, rallies may be brief and noisy.

Majors deserve a separate track. If BTC and ETH stabilize while OI cleans up, many alts will follow. If majors continue to bleed on strong volume, prioritize defense.

- Enosys Loans Lets Users Mint First XRP-Backed Stablecoins on Flare

- Leverage.Trading Founder Anton Palovaara Talks Risk in Crypto Futures & Margin Trading

- Binance Coin (BNB) Outshines Peers as Binance Nears DOJ Compliance Exit

Sometimes the biggest moves arrive without headlines. Yesterday’s European open reminded the market of that. The edge comes from reading what the crowd is doing, not what the calendar says. Watch the relationship between price, volume, and open interest, decide your triggers in advance, and let the market prove which scenario you are getting before you commit. This is not financial advice and crypto traders and investors must always trade and invest at their own risk only.