Binance Coin (BNB) Outshines Peers While Crypto Investors Look for Direction

Crypto markets have had a choppy week, with sudden waves of selling followed by quick rebounds. For many investors it has been unsettling. Yet within that noise, one theme has been consistent: Binance Coin has continued to outshine its peers.

At Finance Magnates we previously pointed out that BNB was setting up for a test of the $1,000 psychological round number. That move unfolded quickly. The token not only touched that level, it climbed a further 8.3 percent. It now trades just above and below the $1,000 mark, which has become a magnet for order flow as bulls and bears contest control.

BNB bulls are still in charge

The technical picture remains constructive. The latest chart from investingLive.com, formerly ForexLive.com, shows how the dip from recent highs was caught precisely at the upper standard deviation of the anchored VWAP from the August pivot low. Anchored VWAP levels matter because they reflect where participants are positioned from key turning points. The defense of that line shows buyers are still active and willing to reload on weakness.

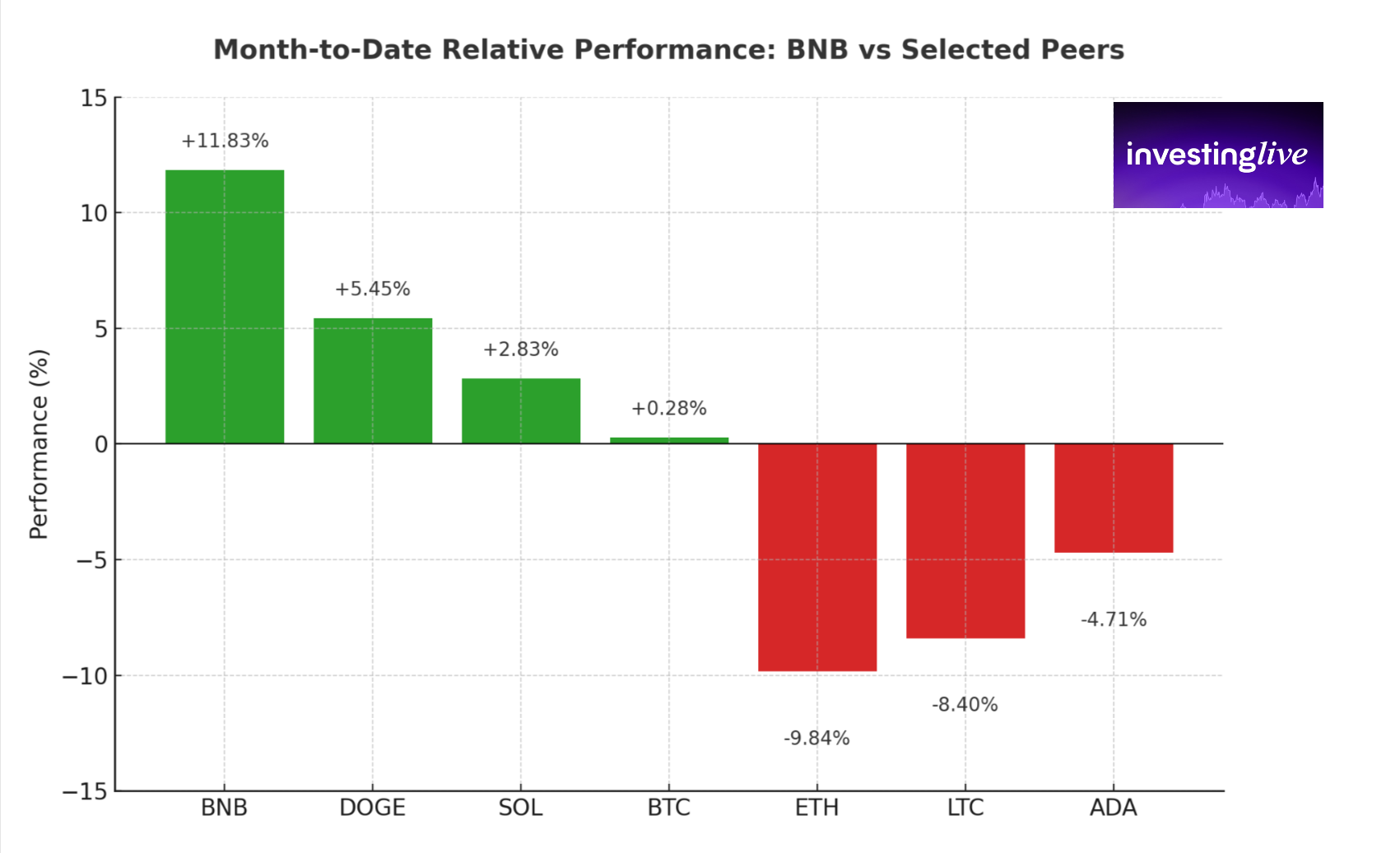

Relative performance adds to the story. Month to date, BNB is up 11.8 percent, comfortably ahead of Dogecoin at 5.4 percent and Solana at 2.8 percent. Ethereum, Litecoin, and Cardano are all down on the month, while Bitcoin is only marginally higher. The spread tells you where traders are putting their money, and at the moment it is concentrated in BNB.

The $1,000 line is a natural battleground. Around such levels you often find stop orders, profit targets, and breakout triggers. It is normal to see price swing above and below before settling. Short-term volatility is likely, but the bigger picture is that BNB is showing leadership and bulls continue to defend dips.

Reading the broader tape

While BNB has led, investors should also keep an eye on broader flows. Three insights stand out for those trying to judge whether yesterday’s selling was just a pause or something more lasting.

Stablecoin flows show caution. USDT has seen strong inflows, with more than $181 million over the past day and $862 million over 15 days. USDC by contrast has recorded heavy outflows. This split suggests investors are still parking capital in the safety of stablecoins, waiting for clearer conditions before redeploying into risk.

Relief bounces were sold. Majors such as Bitcoin and Solana recorded brief inflows in short windows, but those quickly flipped back to outflows by the 8- to 24-hour marks. That is a sign rallies are still being sold into rather than extended.

Relative strength matters. BNB stands out not only in price but in positioning. It has attracted fresh inflows even as peers saw distribution. In markets that remain cautious, leadership tokens with stronger technical backdrops are the ones that hold up best.

China’s caution is also shaping the broader digital asset landscape. The China Securities Regulatory Commission (CSRC) has reportedly told some brokerages to pause real-world asset (RWA) tokenisation in Hong Kong, reflecting concern about overheating in fast-growing markets that turn stocks, bonds, or property into blockchain-based tokens. While Hong Kong is marketing itself as a hub for tokenised products and virtual assets, Beijing’s stance highlights the regulatory divide. For crypto watchers, it is a reminder that even as coins like BNB attract strong demand, policy uncertainty in China remains a factor that can influence sentiment and flows.

What traders can take from this

For investors unsettled by the swings, the tape is sending a clear message. As long as USDT inflows remain high the market is cautious. Until those flows cool or flatten it is early to call an “all clear.”

If prices keep making lower lows while volumes rise and open interest stays heavy, bounces are more likely to be selling opportunities than fresh entries. If you see heavy down-day volume followed by lighter volume on subsequent declines, along with open interest stabilizing, that is a sign sellers may be tiring and a rebound can stick.

Most important, watch the leadership names. BNB has shown the ability to attract dip buying and maintain relative strength. If the market stabilizes, leadership tokens like this usually extend first. If the risk environment worsens, they tend to hold better than weaker majors.

Those interested if ETH is actually ripe for dip buying, they can check out if it becomes bullish or bearish according to a unique trading methodology called tradeCompass at investingLive.com, see today's ETH analysis with tradeCompass.

- Crypto Prices Today: Sharp Selloff as Volume Spikes

- Enosys Loans Lets Users Mint First XRP-Backed Stablecoins on Flare

- Leverage.Trading Founder Anton Palovaara Talks Risk in Crypto Futures & Margin Trading

Crypto has rattled nerves this week, but the message is not all negative. Binance Coin has proved resilient, buyers continue to defend key levels, and relative performance is firmly in its favor. For now the smart approach is to respect the caution implied by stablecoin inflows, while also recognizing that BNB remains a standout performer with bulls not yet finished.

This article is for information only and does not constitute financial advice.