From Zuckerberg’s $1B talent raids to Nvidia’s “outrageous lies,” Amodei is calling out Silicon Valley’s power plays and setting a few bridges on fire.

The AI Talent War Has a New Loudest Voice

Forget quiet quitting, Dario Amodei is loudly combusting. The Anthropic CEO is lashing out in all directions, accusing Meta of luring away his engineers with $1 billion signing packages and calling Nvidia’s recent remarks about Anthropic "an outrageous lie."

#ThinkingMachines #SafeSuperIntelligence #Meta #Anthropic #OpenAI #AI #AGI #ASI competition great, relationships more important #NewAge @miramurati @ilyasut @DarioAmodei @mattdeitke @elonmusk @sama remember this pic.twitter.com/gbzZckPVhA

— John M. Spallanzani (@JohnSpall247) August 2, 2025

In a scathing internal email to Anthropic staff, Amodei didn’t mince words. After news broke that Meta, led by a reportedly talent-hungry Mark Zuckerberg, was offering massive bonuses, sometimes up to $1 million a head for artificial intelligence (AI ) researchers, Amodei accused the tech giant of trying to "destroy" what startups like his are trying to build.

Speaking of Meta’s hiring spree, and the obscene amounts of money they’re spending, Amodei claimed it could “destroy” Anthropic’s culture, and presumably that of AI startups in general. Sure, “destroy” might sound dramatic. But in a space increasingly driven by GPU hoarding, regulatory chess, and “move fast, break open-source ethics” strategies, Amodei’s frustration is more than performative. It’s personal.

Would You Say No to a Million Bucks?

Amodei’s real gripe isn’t just the brain drain. It’s the corrosion of what he sees as the startup spirit: building ambitious things, not just stockpiling talent like trading cards. In his internal message, he didn’t just blame Meta, he accused them of waging an ideological war.

Amodei claimed that many of his employees had rejected (presumably vast) offers and that others "wouldn't even talk to Mark Zuckerberg." "This was a unifying moment for the company where we didn't give in," Amodei said. "We refuse to compromise our principles because we have the confidence that people are at Anthropic because they truly believe in the mission."

But… it’s hard to argue with the numbers. Meta is reportedly offering compensation packages worth up to $1 million each for researchers to abandon ship. That’s enough to make even the most idealistic AI scientists think twice. For Amodei, though, this is less about cash and more about collapse.

Amodei’s rallying call? Essentially, it’s about the “soul” of AI and Anthropic. His argument is essentially that the company is special, and that if you truly care about AI, you should reject Meta et al. But, remember, we’re talking $1M signing bonuses here.

It’s a rallying cry with a guilt-trip and glimpses of truth. After all, it’s not easy to turn down $1 million when you’re debugging neural networks at 2 a.m. Still, Amodei’s ask is clear: Stay scrappy. Stay weird. Don’t sell out to Zuck.

Hopeful? Sure. Realistic? We’ll see.

Nvidia vs. Anthropic: AI Heavyweights In a Scuffle

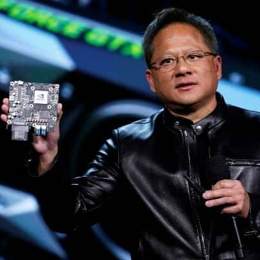

Meta isn’t the only target of Amodei’s fury. Nvidia CEO Jensen Huang also caught some strays last week when he appeared to throw shade at Anthropic during a Q&A. Huang claimed that “Dario thinks he’s the only one who can build this safely and therefore wants to control the entire industry”. Amodei’s response? “That is an outrageous lie.”

In response to Huang, Amodei says he’s “one of the most bullish” voices when it comes to AI’s rapid acceleration. He’s long argued that progress in AI is exponential: throw more data, compute, and training at a model, and its capabilities jump dramatically. That pace of improvement, he warns, is bringing serious national security and economic risks into the immediate future. Much of this is driven by his father's death to a disease that, had research moved faster, he probably would have survived. But, despite his desire to drive things forward, there's a problem: Our ability to manage those risks.

Anthropic's Dario Amodei reveals his father's death is a key reason he pushes AI forward. He says critics who call him a "doomer" for discussing risks lack moral credibility, as he understands the human cost of delaying technological progress more than most. pic.twitter.com/FLBVtIJOYU

— Neo Niche (@theneoniche) July 30, 2025

To counter that imbalance, Amodei is pushing for clear regulations and what he calls “responsible scaling policies.” He wants a “race to the top”—where companies compete to build safer, more trustworthy systems—instead of half-baked AI products. Anthropic was the first to publish such a policy, and Amodei sees that transparency as part of the job. He believes safety research like their work on interpretability and constitutional AI shouldn’t be trade secrets—it should be shared as a public good.

This is more than an ego bruise. The comment hits at Anthropic’s very purpose in a fiercely competitive sector. Luckily for Anthropic, Amodei doesn’t seem to be a shrinking violet.

Silicon Valley’s Culture War, Now with GPUs

Between the Meta poaching saga and the Nvidia drama, Amodei’s week has been more public meltdown than polished PR. But is he wrong?

Anthropic, which counts Amazon and Google among its investors, was meant to be a different kind of AI company—one that emphasized safety, interpretability, and slower, more thoughtful development. But that position seems to be open to ridicule and is getting harder to uphold in a world where AI researchers are becoming free agents in a billion-dollar arms race.

Amodei may not win every battle. Meta will keep writing checks. Nvidia will always be a power player. But by speaking up, he's at least asking a question Silicon Valley increasingly prefers to ignore: what does all this money actually build?

For now, Amodei seems determined not to cash out or shut up. Naïve, or noble? Perhaps both, but regardless, Amodei’s obviously passionate responses open up an interesting conversation.

For more of tech and finance around the fringes, visit our Trending section.