Many investors are still on the fence whether or not they will embrace crypto trading. The high volatility of cryptocurrency prices has been the space’s double-edge sword. Double-digit price swings within a day could give investors instant profits, however this also means that investors must religiously keep an eye on price actions. This same volatility also exposes them to risks of losses.

Up until now, the market has been trading mainly on speculation. Coins were able to reach their all-time highs last January without any fundamental bases. Most were only driven by the exuberance brought about by new entrants’ fear of missing out. The massive correction in February following this rapid rise saw major coins like Bitcoin lose as much as two-thirds of their value eventually rattling many of these new crypto traders.

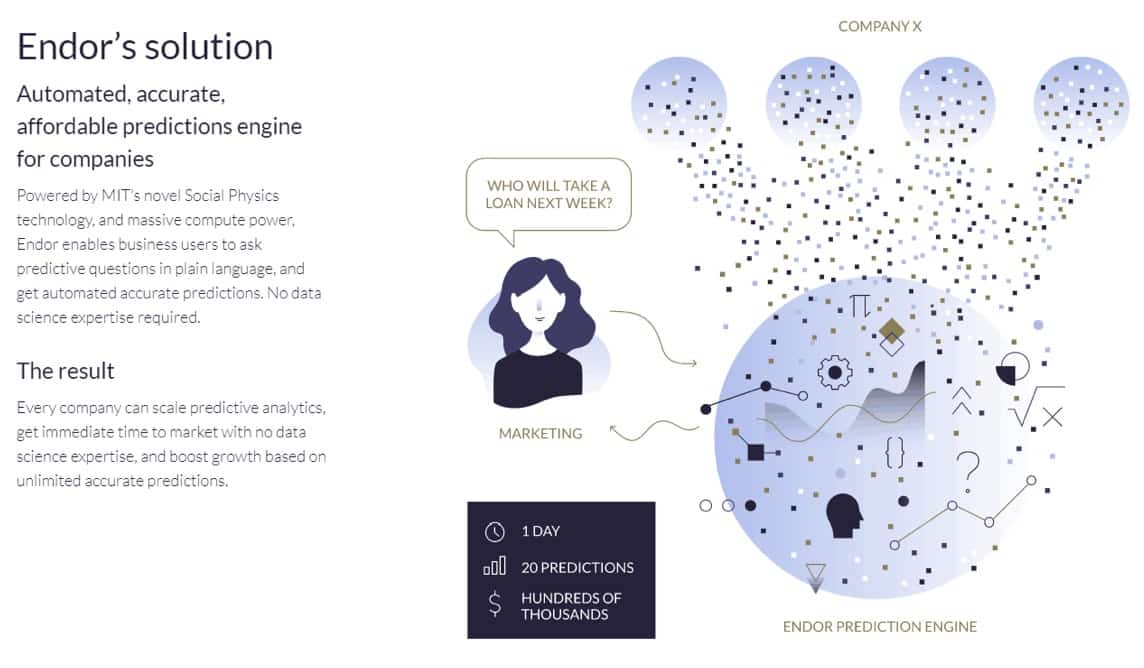

Trying to make sense of the crypto market has had its challenges especially when it is erratic human sentiment that drives investors. Offering a solution to this conundrum is predictive Analytics venture, Endor.

As an MIT spinoff, the firm leverages social physics – or the use of data-driven tools inspired by physics – to study human activity. By applying these methodologies to analyze Blockchain data, Endor could enable crypto stakeholders to finally be in step with the market and lessen the impact of volatility.

The company just closed a massive round of $45 million and it now expanding its operations.

Accessible Predictions

Founded in 2014, Endor has already made a name for itself servicing large enterprises through its data-as-a-service platform. It uses artificial intelligence (AI) and machine learning (ML) alongside social physics to deliver predictions and insights to these organizations. The company has partnered with the likes of Coca-Cola, Mastercard and Walmart in various marketing and brand loyalty campaigns.

Now, Endor is making its foray into the crypto space. It is set to launch its Endor.coin Protocol – a blockchain-based system that makes AI-based predictions accessible to the public. The company has come up with what it calls the “Google of predictions” where a user can simply enter a question to the system to get predictions.

Previously, such capabilities are only available to large organizations. Predictive analytics typically requires the means and resources to acquire data and hire data experts to build models and generate insights from the data.

The protocol also establishes an ecosystem that nurtures data providers, developers, and users. Data providers can use the platform to privately crunch and analyze their information. All they need is to spend Endor’s EDR tokens to pay for the service.

Individual users can likewise spend EDR for every predictive question they want answered. Developers who contribute to the enhancement of the protocol can also earn EDR. Such an economy makes predictive analytics self-sustaining and accessible to end users.

Impact on Crypto

MIT professor and Endor co-Founder, Alex Pentland anticipates a highly tokenized future. However, he also shares the concern about crypto’s high volatility citing people’s excitement and cooling off as the key triggers to the market’s ups and downs. Fortunately, this human element is what social physics can study in order to make the market more predictable.

Endor is capable of tapping into blockchain data. By analyzing the transactional information contained in blockchains, the protocol can expose trends such as herding that could help anticipate whether a coin’s price may rise or fall.

The insights and predictions from analytics could help minimize the impact of volatility to traders. By using AI and ML, Endor is also able to take into account big data to make the protocol more reliable than most human traders.

Endor CEO Dr. Yaniv Altshuler also commented, “The brain of a human investor uses the data it was exposed to, like from reading or watching the news. This data can be translated to prediction. We could think of our brain as a huge neural network, and our ‘intuition’ and experience as the training this network had underwent. From a mathematical point of view, it is likely that commercial AI machines will be exposed to vastly more information than any professional trader can possible digest, giving a clear ‘win’ to AI and ML models on the ‘data’ aspect.”

Having such a publicly accessible prediction mechanism in place could encourage investors to eventually start tempering their emotion-driven approach to trading. Fundamentals or the strength of the projects behind the coins and their respective utility and value should begin to matter in the market. This could potentially minimize volatility altogether. The space seems to be quite excited by this prospect.

Beyond Trading

A key way for the crypto space to win investor confidence is to encourage mainstream adoption. But for this to happen, the market should exhibit reliability and show that fundamentals matter. Emotions from both ends of the spectrum, shouldn’t be the primary basis for trading. Having a reliable way such as analytics to make the market predictable could finally bring order to the frenzied crypto space.

Endor’s applications beyond anticipating crypto prices must not also be overlooked. It is a predictions protocol after all with a technology that has already delivered success for a variety purposes including intelligence and security. In crypto, analytics could help in improving security by spotting fraudulent accounts or suspicious activities such as crypto theft and money laundering.

By addressing such issues, Endor could boost the profile of crypto activities as legitimate investment plays in which the ordinary person should seriously consider participating.