As an increasing number of Indian traders seek opportunities to enhance their financial stability, Forex trading has emerged as a popular investment pathway. However, with so many platforms available on the market, it can be difficult to know which ones are worthwhile. One popular option in India is OctaFX, and in this Octa FX review, we will investigate its features and its legal status in India.

What is OctaFX?

OctaFX, now known as Octa, is a Forex broker that has been thriving since its inception in 2011, primarily thanks to its commission-free access to financial markets and trading services. The broker has attracted a staggering 42 million trading accounts, and it’s clear why; it goes far beyond trading, offering free educational webinars, articles, and cutting-edge analytical tools. Naturally, this has led to OctaFX being popularized across more than 180 countries worldwide.

What sets OctaFX apart is its commitment to humanitarian and charitable initiatives, focusing on improving educational infrastructure and emergency relief campaigns to aid local communities.

Over the years, the ‘above and beyond’ attitude of the broker has helped OctaFX receive numerous accolades, including the prestigious 'Most Reliable Broker Asia 2023' and 'Best FX Broker India 2022' awards from the World Finance and Global Forex Awards.

Trading platforms

Whilst Octa FX offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), it also provides its in-house OctaTrader platform. This unifies all the tools traders need into an all-in-one space, including analytics, indicators, data visualization, custom time frames, and trade management.

OctaTrader is also designed for both mobile and web users, ensuring that traders can always operate consistently whether they’re in their home office or on the go, without being limited by frustrating login or app switches, inconsistent profile management, or fragmented deposits and withdrawals.

Account types

OctaFX offers MT4 and MT5 compatibility, two distinct types of trading accounts that cater to different clientele. MT4 is tailored toward beginner traders with its user-friendly interface and minimalist design, whilst MT5 is the preferred choice for experienced Forex traders. Its features are far more advanced, offering a wider range of trading tools and supporting higher trading volumes.

Thankfully, whether you are a Forex beginner or a seasoned pro, opening an account with OctaFX is a straightforward process. It simply requires you to enter your name, email address, and set up a password. Ensuring anyone can get started with OctaFX within minutes, without any hassle.

Spread, commission, and leverage

OctaFX is also critically acclaimed for its competitive spreads, which are among the most attractive in the industry. Both MT4 and MT5 accounts feature floating spreads that start at a mere 0.6 pips, ensuring that price changes never limit trade. Furthermore, OctaFX does not impose swaps, effectively rendering its services as commission-free.

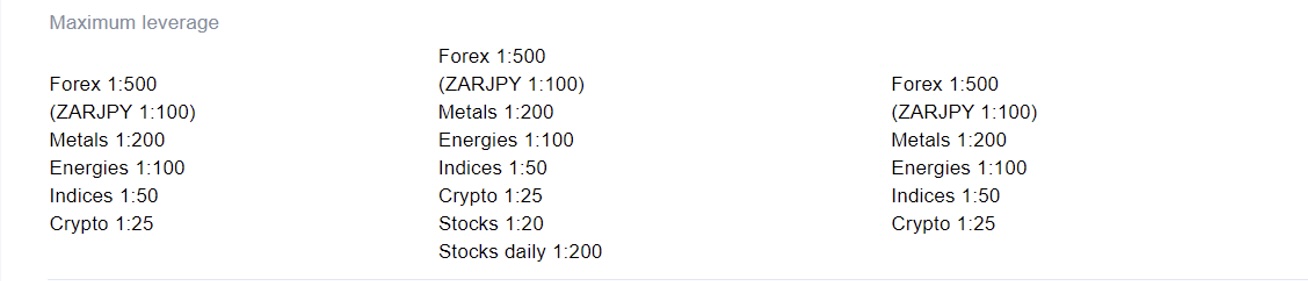

Interestingly, OctaFX’s leverage options are set to an impressive maximum of 1:500, although this depends on the trading instrument, and doesn’t include ZARJPY. For other instruments, the following leverage options can be expected:

1:200 for metals

1:200 for daily stocks

1:100 for energies

1:50 for indices

1:25 for cryptocurrencies

1:20 for stocks

Please note that leverage may vary across different trading platforms*

Trading instruments

Another highly appealing aspect of OctaFX is its extensive selection of trading instruments. This covers a diverse range of asset categories, including Forex, commodities, indices, stocks, and even cryptocurrencies.

Trading diversity has always been encouraged by OctaFX, and this is easily possible thanks to this vast array of on-platform market opportunities. Furthermore, CFD trading is also available through OctaFX, empowering traders to speculate on both upward and downward market movements, maximizing their profit potential.

Bonuses and promotions

Despite OctaFX India already holding a competitive edge, the platform also offers incentives for its clients through various bonuses and promotions. Primarily, it offers a loyalty program, allowing traders to convert their accumulated trades into valuable gifts. These gifts include premium gadgets, smartphones, exclusive branded items, and more, and can be either earned or won in exciting contests.

The platform’s incentives even extend to trading-related benefits, such as sought-after trading signals, expedited transfers, reduced spreads, and more. The enticing offerings include exciting contests with opportunities to win exclusive branded items and precious prizes.

Free education

Amongst all of OctaFX’s unique features, the platform also provides a comprehensive educational program, ensuring that no trader enters the world of Forex without guidance. These include tutorials, informative articles, and frequent webinars that cover the fundamentals of smart Forex trading. OctaFX also maintains a blog on its website, which features further in-depth articles for those seeking a deeper understanding of financial markets and trading strategies.

Deposits and withdrawals

OctaFX’s deposit and withdrawal methods are vast; these include staples such as credit/debit cards and online bank transfers, in addition to cutting-edge methods such as cryptocurrencies and e-wallets. Typically, Octa FX payments are processed instantly, and withdrawal requests are prompt. Transactions do not come with pesky fees, although some deposit options are subject to minimum spending, as illustrated below:

Payment option | Min. deposit | Min. withdrawal |

UPI | 1500 INR | 350 INR |

India NetBanking | 1500 INR | 350 INR |

India Cash | 5,00,000 INR | 5,00,000 INR |

Neteller, Skrill | 50 USD/ 50 EUR | 5 USD/ 5 EUR |

Bitcoin | 0.0003 BTC | 0.00009 BTC |

Litecoin | 0.3 Ł | 0.11 Ł |

Dogecoin | 230 Ð | 75 Ð |

Tether TRC20 | 50 ₮ | 10 ₮ |

Tether ERC20 | 50 ₮ | 10 ₮ |

Ethereum | 0.02 ETH | 0.005 ETH |

Note that some of the methods are available only after user verification

Is OctaFX legal in India?

Recently some accusations of an OctaFX scam have led some traders to believe the platform is too good to be true, but thankfully, these allegations are unfounded. The broker is an internationally established company with a remarkable track record, holding solid status in the market for over 12 years.

While Octa India may not possess a local license in India, it's important to note that this does not mean that OctaFX scam accusations are trustworthy; many international Forex brokers opt not to obtain local licenses. Instead, they secure licenses in jurisdictions where regulatory constraints do not hinder their ability to compete globally; for example, OctaFX holds licenses from FSCA in South Africa and CySEC in Cyprus. These licenses have enabled OctaFX to earn the trust of millions of clients across 180+ countries.

So, why has Octa FX India avoided obtaining an office Indian brokerage license? Well, local regulatory frameworks, such as those imposed by the RBI, can be overly stringent, negatively affecting a broker's operations. This can limit the provision of trading instruments and promotional offers, whilst also limiting brokers’ ability to engage with multiple liquidity providers. Ultimately, this can lead to slippages, chart irregularities, and liquidity shortages.

However, the lack of an official Indian license does not mean OctaFX does not protect the security of its clients' funds. A thorough OctaFX India review demonstrates that the broker employs robust security measures including segregated accounts and negative balance protection, following international standards.

Furthermore, OctaFX requires identical payment details for both deposits and withdrawals, safeguarding users against unauthorized third-party withdrawal attempts. Additionally, 3D secure technology is leveraged for protection when processing Visa credit and debit card transactions, ensuring transparency and security.