ETH turns up front

Ethereum has been thrust into the spotlight over the past week, marking a decisive break from the bearish sentiment that weighed on the asset during the first half of 2025. As of this writing, ETH has delivered a standout 7-day return of 23.9%, outperforming both Bitcoin (0.1%) and Solana (9.7%) over the same period. This sharp rebound has reignited market optimism, and positioned ETH as the focal point of community discussions.

The question is: What catalyzed this reversal?

ETH becomes the second treasury token

Ethereum’s core infrastructure and design remain unchanged, and there have been no overnight protocol upgrades or architectural shifts. However, news momentum has accelerated following BlackRock’s proposal to incorporate staking into its iShares Ethereum Trust ETF (ETHA), in response to the SEC's regulatory clarity provided in May 2025. This move signals growing institutional interest in on-chain yield generation.

Investor enthusiasm has also been catalyzed by aggressive corporate accumulation. For example, SharpLink Gaming has acquired over 353,000 ETH, establishing itself as the largest Ether-holding treasury entity to date. BitMine has added 300,657 ETH to its balance sheet, backed by a 9.1% stake from Peter Thiel–linked investment vehicles. In parallel, crypto miner Bit Digital has disclosed a substantial 120,306 ETH holding.

Collectively, these developments reflect a strategic shift among TradFi players, many of whom are emulating Strategy’s precedent-setting Bitcoin accumulation. Ether is now widely regarded as the second treasury-grade digital asset — positioned just behind Bitcoin — marking a significant milestone in its institutional adoption journey.

However, the ETH treasury concept is at an early stage

. | Number of ETH | % of total circulating ETH |

Holdings by SharpLink, BitMine and Bit Digital | 773,963 | 0.64% |

. | Number of BTC | % of total circulating BTC |

Holding by Strategy | 601,550 | 3.01% |

Source: Bybit

As highlighted in the table above, ETH accumulation remains in its early phase. Notably, the share of circulating Bitcoin held by Strategy (formerly MicroStrategy) alone exceeds the combined holdings of the top three ETH accumulators when measured as a percentage of the total Ether supply. This disparity underscores the relative nascence of ETH's adoption as a treasury-grade asset as compared to Bitcoin.

Leverage: What makes the ETH treasury better than Bitcoin

BTCS Inc. (NASDAQ: BTCS) reportedly holds 31,855 ETH, of which 16,232 ETH have been collateralized to secure a loan on AAVE. This exemplifies Ethereum's extensive utility within decentralized finance (DeFi), particularly when contrasted with Bitcoin, which lacks comparable on-chain lending infrastructure. And while Strategy raises traditional finance (TradFi) bonds to leverage its Bitcoin positions, institutional and corporate actors can readily access DeFi lending protocols such as Aave (AAVE) in order to obtain ETH-backed liquidity.

DeFi’s inherent flexibility and accessibility allow for higher leverage levels on ETH accumulation without necessitating reliance on conventional lending channels. This dynamic introduces a compounding effect, whereby increased leverage amplifies buying power, potentially exacerbating imbalances between ETH supply and demand. As such, the decentralized nature of ETH-based financing could intensify its price trajectory and market volatility, relative to assets governed by stricter TradFi constraints.

ETH Spot ETFs still lag behind Bitcoin Spot ETFs

Corporate treasuries remain a minority in the acquisition of treasury tokens. For example, Bitcoin Spot ETFs hold a significantly larger amount of spot Bitcoin as compared to all corporate buyers (including Strategy). Specifically, the top 10 corporate owners of Bitcoin Strategy hold approximately 700,000 bitcoins, whereas all of the Bitcoin Spot ETFs collectively own approximately 1,459K bitcoins.

Bitcoin held by Bitcoin Spot ETFs and funds | approx. 1,459K |

Percent of the total BTC circulating supply | 6.9% |

Ether held by ETH Spot ETFs | approx. 3,983K |

As % of the total ETH circulating supply | 3.3% |

Source: Bybit

As illustrated in the table above, ETH Spot ETFs currently hold only half the percentage of the circulating supply, compared to Bitcoin Spot ETFs. This disparity underscores a significant gap in treasury accumulation, suggesting that Ether still has considerable room to grow in aligning with Bitcoin’s institutional adoption levels.

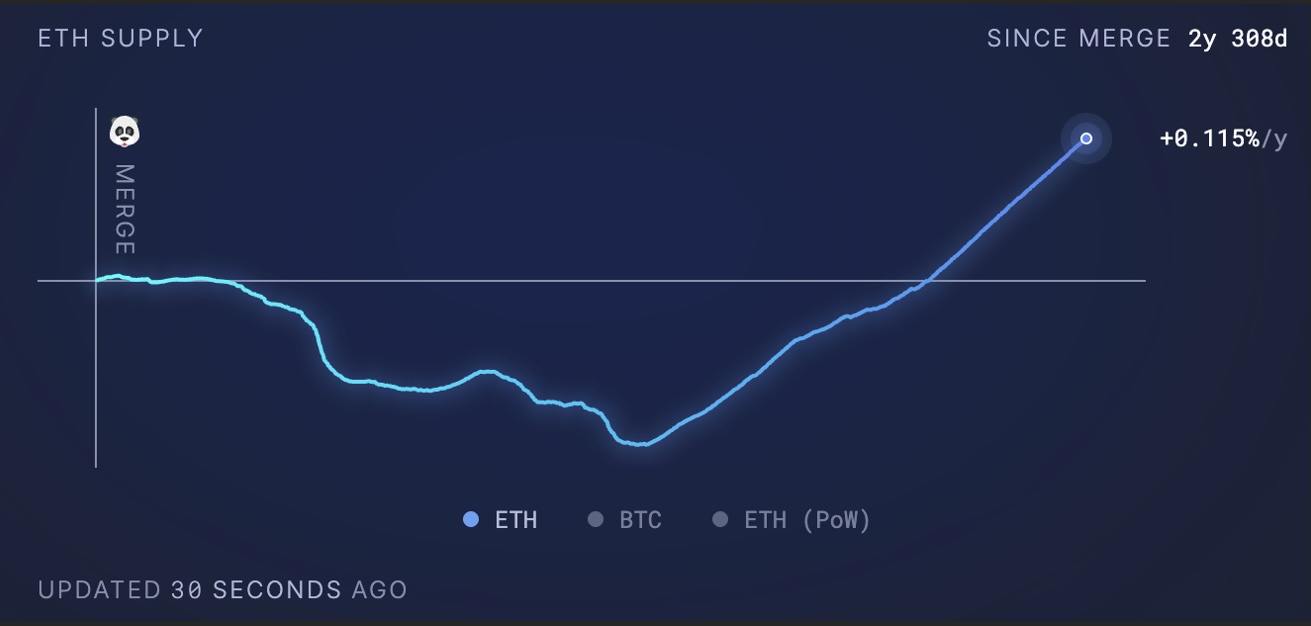

Still, Ether is a net inflationary token

Since February 2025, Ethereum’s supply has turned net inflationary, driven by a reduction in on-chain activity and lower burn rates of transaction fees. This shift weakens the potential for a supply squeeze, particularly when large corporate treasuries accumulate ETH for long-term strategic purposes without clear short-term liquidation plans. In contrast, Bitcoin’s hard-coded supply cap of 21 million remains a core pillar of its value proposition, reinforcing scarcity and strengthening investor conviction through predictable issuance.

Nonetheless, ETH accumulation in recent months has been exceptionally robust — far outpacing its annual net issuance of approximately 836,000 ETH. This strong buy-side pressure indicates heightened demand from institutional players, DeFi protocols and treasury investors. If accumulation continues at this rate, Ether could face a structural supply imbalance, triggering a pronounced squeeze effect despite its inflationary supply profile. Such dynamics may accelerate upward price momentum and place ETH on a realistic trajectory to revisit its all-time high of $4,891 that was set in November 2021.

Moving forward, treasury token status and RWAs could provide support for ETH’s price movements

While ETH's price struggles with declining on-chain transactions, Layer 2 (L2) solutions demonstrate significant growth. Daily L2 transactions now surpass those on L1s by a factor of 12.7x, and active L2 addresses outnumber L1s five to one. Furthermore, L2s host almost six times as many smart contracts, with over 500 daily interactions, and L2 DeFi velocity is 7.5x that of L1s.

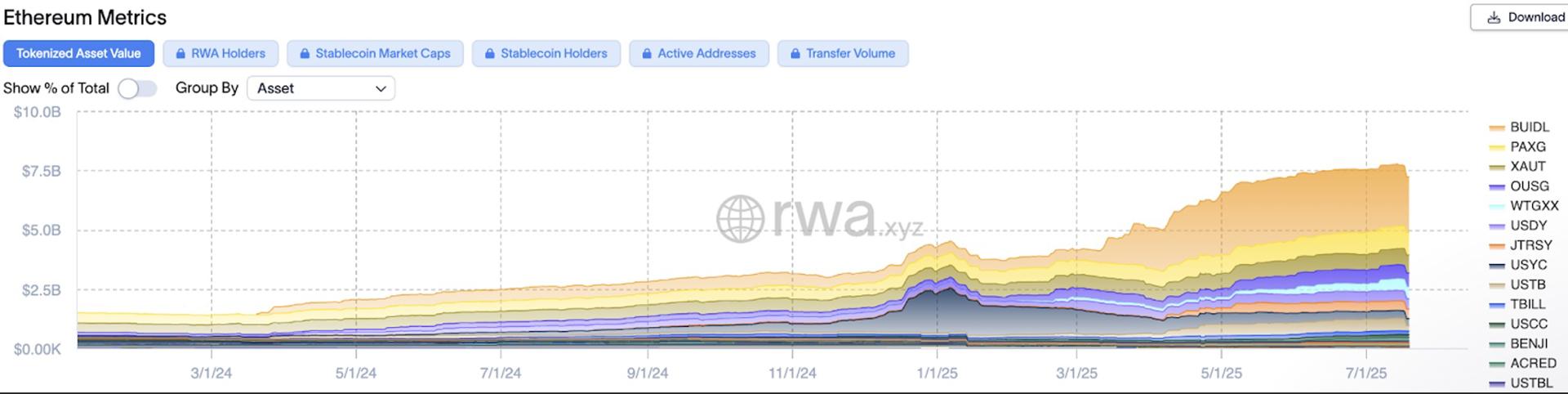

Source: rwa.xyz

Despite transactions moving to L2s, capital remains predominantly concentrated within the Ethereum mainnet, with real-world assets (RWAs) increasingly gaining institutional traction. BlackRock’s tokenized treasury product, BUIDL, has recorded sustained inflows from TradFi institutions, signaling growing confidence in on-chain fixed income instruments.

In parallel, Ether (ETH) continues to solidify its status as a treasury-grade asset. Note that, if current adoption trends and macroeconomic conditions persist, ETH is well-positioned to reach the $5,000 mark by Q4 2025.