China’s President Xi Jinping has said that legitimizing the Chinese economy and currency is a tent pole of what he wants his administration’s legacy to be. Pursuant to that point, in December of 2014, China’s Premiere Li Keqiang announced a 10-point economic plan that included using government reserve funds to stimulate domestic growth instead of the decade old practice of continuously purchasing US Treasuries to keep interest rates low to manipulate the value of the USD-pegged Yuan.

After the first moves, March of 2015 saw the Governor of the People’s Bank of China (PBOC), Zhou Xiaochuan, announce major economic reforms that included liberating Chinese investors from needing approval to put capital into offshore markets.

More on trading:

Setting the right time frames with support and resistance

From the grounds-up: binary options beginners guide

In August of 2015 the PBOC devalued the currency about 4.00% with back-to-back devaluations to bring the pegged value closer to the implied market value, gearing up to make the Yuan a more free-floating currency.

This past November, as a result of economic reforms, the Yuan was included in the IMF’s reserve currency basket, which consisted of the US dollar, the Euro, the Pound, and the Yen.

According to an article published by the Wall Street Journal, leaked PBOC minutes show that it only took the Chinese government a little over two months to reverse course on all of their reforms. Starting in January of 2016, China has maintained tight control of the country’s finances to engineer a growth narrative for the decelerating economy, doing whatever it takes to make it appear as though they are hitting ambitious growth targets.

Government Interference in the Economy

The WSJ’s report on the leaked notes confirms observed market movements that show a reversal of China’s announced move towards more free market policies.

While the leak did not give names or the full transcript of the notes, some of the stories and quotes are quite eye opening. For instance, on January 4th, bank officials apparently began adjusting the Yuan’s daily value higher or lower as needed. The PBOC’s market fixing has led to a 0.31% appreciation against the dollar even after first quarter GDP printed at 6.70% year over year, the slowest pace since the 2009 recession.

The Asian Development Bank expects China’s slow growth to continue with GDP growth of 6.50% in 2016 and 6.30% in 2017. As this would fall well shy of China’s official growth target of 6.50%-7.00%, it is no wonder that the PBOC minutes emphasized a return to inorganic GDP growth, with one central bank official quoted as saying, “the primary task is to maintain stability.”

With the US dollar strengthening on speculation of a June interest rate hike, China has more overtly pumped more money into the economy than any time since announcing a move towards embracing more free market principles.

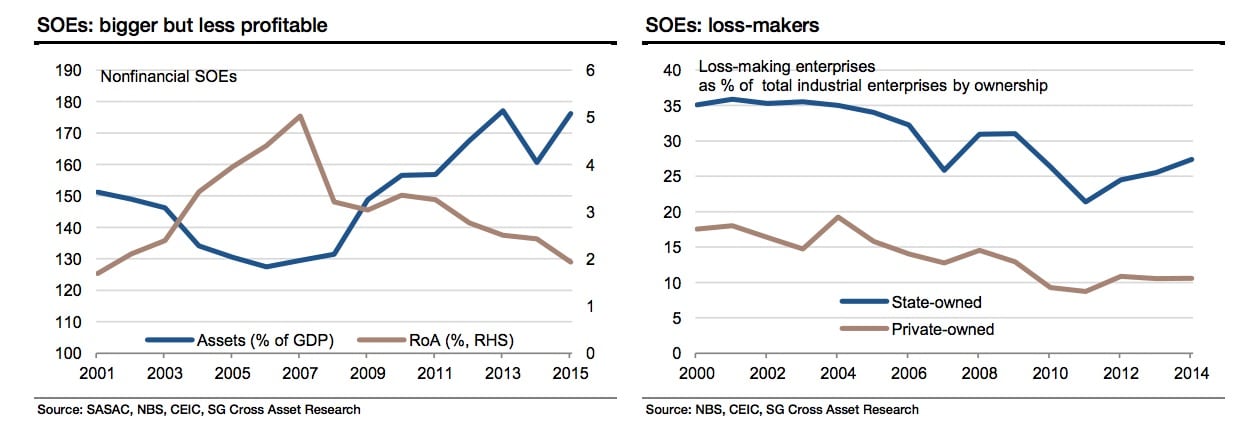

Though many sectors in China’s economy are showing double digit growth, the growth appears to be an inorganic result of increasing the debt burden of already underwater state owned enterprises (SOE’s). This phenomenon, referred to by many as China’s zombie companies, is a trend in which SOE’s display cronyism at its highest form, as these companies are led by ranking party members or their families, yet continuously underperform or are highly inefficient at allocating resources.

These companies are then buoyed by saddling themselves with more debt, including many with loans which should be booked as nonperforming as soon as they are issued. While investment in factories, buildings and other fixed assets grew 10.70% quarter over quarter during the first quarter of the year, the increase was up 23.30% for SOE’s and only 5.70% at private firms.

As far as returns on that investment goes, last year SOE profits fell by 21.90%, compared with a 3.70% increase for private companies. Continuously throwing good money after bad is not the road to legitimizing the Chinese economic system.

Free Market Expectations Versus Reality

When the FOMC Minutes were first released the Yuan plunged versus the dollar, as did China’s Asian contemporary’s currencies. On speculation that China will control outflows more than those currencies, the Yuan has since soared to a one month high against a basket of currencies.

The market’s conjecture is further supported by China’s decrease in foreign exchange reserves. Since 2014, reserves had consistently declined, falling from $4.00 trillion to $3.22 trillion in April. According to a US Treasury Department finding, they released an estimate that in order to support the Yuan, Beijing sold more than $480.00 billion in foreign-currency assets from August through March to support the Yuan devaluation versus the Dollar.

The Forex market is not the only indicator that the PBOC is back to manipulating the currency. Money had been flowing out of China at an alarming rate when restrictions on capital outflows were lifted. Estimates from UBS Group AG show that outflows were more than $100.00 billion in December and January alone, but have slowed to $28.00 billion in April as Chinese authorities have stepped up controls to discourage outflows.

This observance is no more evident than in California’s Silicon Valley region. One of the fastest growing high end real estate markets in the continental US, Chinese investors had been attributed to between 5.00%-7.00% of real estate transactions until recently. However, capital flows from China have pulled back sharply thanks to tighter capital controls, with many realtors hoping for an easing of restrictions to help sustain elevated prices.

What it Means and the Risks

A clear tapering of growth and heightened outflows from the economy are typically telltale signs of currency weakness ahead. Despite all of the evidence of a weakening currency, the Chinese Yuan is relatively stable with respect to the US dollar after strengthening against other major currencies thanks to the rising dollar. If the dollar continues its recent ascent, the Yuan peg will likely force a further round of devaluation to offset the strengthening against other peer currencies the Yuan floats against.

Any Yuan appreciation will hurt the outlook even further, especially the export economy as Chinese products become more expensive by comparison to other export powerhouses.

The key to divining any further changes in strategy by Chinese policymakers will heavily depend to a large degree on the behavior of the US Federal Reserve. More tightening could lead to Dollar appreciation which creates a stronger case for further devaluation. However, it completely flies in the face of efforts to liberalize the economy.

Growing debt at SOE’s, constraints on capital outflows, and efforts devoted to stabilizing the currency are proving to the marketplace that Xi Jinping is not ready to take the training wheels off the economy. In many ways, China is just back to its old tricks.

Idan is the VP trading for anyoption.com. He is a seasoned professional with years of experience trading and has a vast knowledge of the financial markets. An expert in the binary options hedging field - Idan provides insights, guidance and coordination in business planning, Risk Management and technology strategies. He holds a BA in Economics Management and is now busy finishing his MBA in Finance.