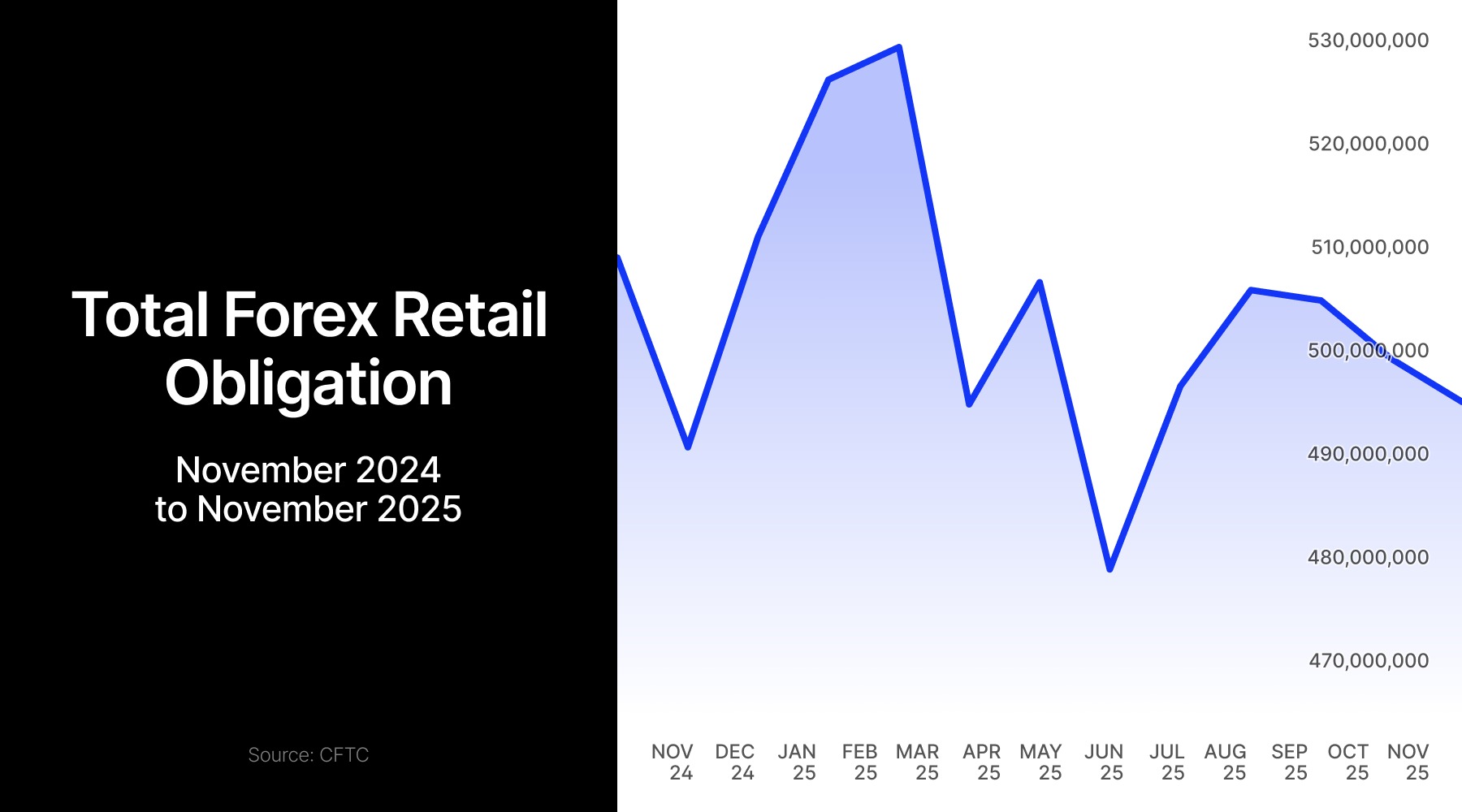

Retail forex deposits across major US platforms slipped 0.8% in November 2025, falling to $495.7 million from October's $499.9 million as the industry posted its third consecutive monthly decline.

The slide extended a losing streak that began in September and pushed total deposits below the $500 million mark for the first time in months. Year-over-year, the industry shed 3% from November 2024's $509.7 million, reflecting persistent headwinds facing currency traders despite pockets of growth at smaller platforms.

Interactive Brokers Suffers Sharp Pullback

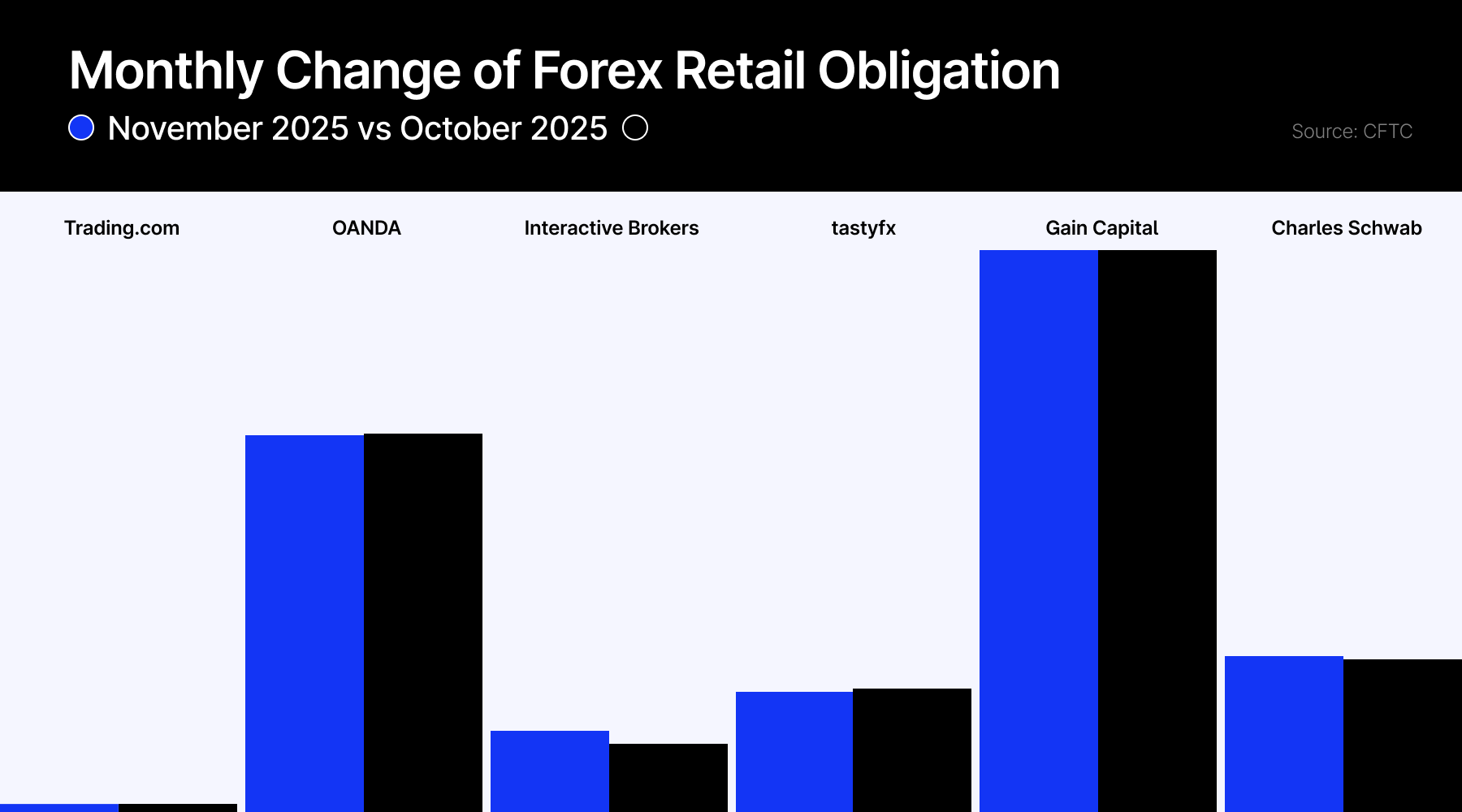

Interactive Brokers recorded the month's steepest decline, plunging 20% to $25.7 million from October's $31.0 million. The $5.2 million outflow marked the broker's worst monthly performance in recent periods and wiped out gains accumulated earlier in the year.

Despite the November setback, Interactive Brokers posted a modest 1% year-over-year gain from November 2024's $25.6 million, suggesting the platform retained some longer-term client acquisition momentum even as short-term flows reversed.

- Major Forex Brokers Feel the Pain as Dollar Hit Rock Bottom

- US Forex Deposits Rebound From 4-Month Lows as Dollar Strengthens

- US Forex Deposits Crash 7% as Dollar Hits 3-Year Low

Charles Schwab declined 2.4% to $58.5 million from $59.9 million, shedding $1.4 million during the month. The institutional broker faced steeper annual pressure with deposits down 10% from November 2024's $64.4 million, marking one of the sharper year-over-year declines among major platforms.

Smaller Platforms Buck Industry Weakness

tastyfx emerged as November's strongest performer among major brokers, jumping 2.8% to $47.5 million from October's $46.2 million. The $1.3 million monthly gain bucked the broader downtrend and extended the platform's recovery from earlier weakness. Year-over-year, tastyfx posted a 10% gain from November 2024's $42.8 million.

Trading.com delivered the month's most impressive performance with a 16.4% surge to $3.0 million from October's $2.5 million. The $498,000 monthly gain represented the highest percentage increase among tracked brokers.

The platform showed even stronger annual momentum with deposits up 37% from November 2024's $1.9 million, marking the fastest growth rate in the industry.

Market Leaders Show Mixed Results

GAIN Capital held steady with a marginal 0.1% increase to $215.8 million from October's $215.4 million, adding just $316,000 in new deposits. The platform maintained its position as the largest US retail forex broker by client funds. Year-over-year, GAIN Capital posted a 5% gain from November 2024's $204.6 million, demonstrating resilience amid industry-wide pressure.

OANDA inched up 0.2% to $145.2 million from October's $144.9 million, gaining $325,000 during the month. However, the broker faced steeper annual headwinds with deposits down 17% from November 2024's $170.4 million, reflecting sustained client fund outflows over the past year.

The November decline continued a pattern that began in September when deposits first turned negative after a brief summer recovery. The three-month slide has now erased gains posted during mid-2025 as traders pulled back from currency positions amid shifting market conditions.