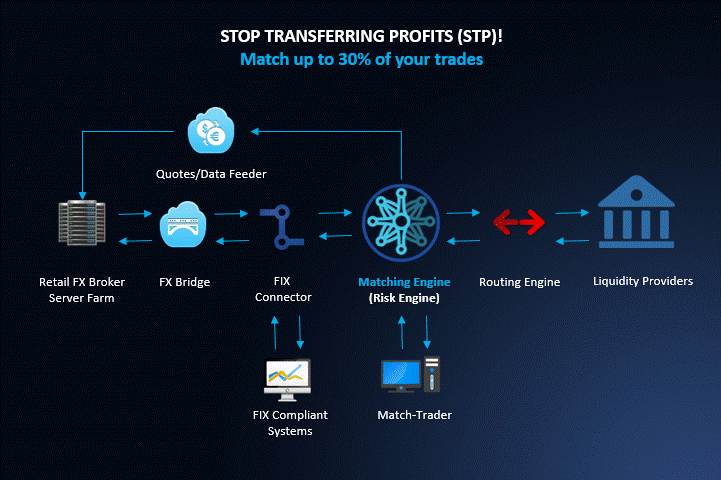

Match-Trade Technologies, a US-based technology firm, has developed a solution that redeems FX order flow. The firm’s matching engine enables brokerage firms to reuse liquidity and act as a Liquidity provider. The new mechanism has a monetary value as firms can benefit from earning revenues from the spread. The move comes on the back of technological enhancements in the middle and back-office, as participants in the FX markets look to optimize profitability from current trading activity.

An evolving trading environment has meant that firms offering margin products have had to adapt the way they manage and deal with client order flow, automated and algorithmic trading strategies have been spearheading this notion where brokers are directing client trades to liquidity providers, as opposed to internally managing the risk.

“The STP model has value for brokers, however through our matching engine, firms can take control of flow that would normally be passed onto Liquidity Providers (LPs), in this case orders are matched against other client orders and this generates spread income,” said a spokesperson for Match–Trade Technologies LLC in a telephone interview with Forex Magnates.

Imran Firoz

FX traders are no longer immune to the way brokers operate, the taboo around market-making and running a ‘B-Book’ have become common knowledge and serious FX traders demand a STP offering in a bid to remove potential malpractises. A Cyprus- based dealing manager comments about how the industry has changed in its perception of Risk Management , he said: “Retail investors have become savvy and by implementing robots and systems to make their trading decisions it has become harder to warehouse trades in the traditional approach, all we seem to do is pass on the volumes and earn very little in commissions.”

Users of Match-Trade can benefit from the numerous functionality the solution offers, this includes redirecting certain client orders back to the broker's order book, as well as creating a new pool of liquidity, thus opening up a new model for the broker where it acts as both a taker and provider. Imran Firoz, Managing Director of Match-Trade Technologies LLC, describes the advantages in an emailed statement to Forex Magnates: “Our matching engine technology allows STP forex brokers to have the opportunity to change from a liquidity taker to a liquidity provider when our Match-Trade System matches trades internally between the forex broker’s trading clients. STP forex brokers have their own ‘bottom-up’ liquidity when clients initiate limit or market orders based on the available margins in their respective accounts. Generally, all these orders are sent as market orders to LPs, when there are opportunities available during the trading session to match some of the limit orders of clients with limit/market orders of other clients.”

Internalizing client order flow is a common aspect of retail trading platforms that net the respective buy and sell orders, however firms are looking for advanced solutions that can create new revenue streams. MahiFX’s Compass, acts in a similar fashion whereby it allows firms to internalize activity. In addition, users of Compass, a solution for institutional players, has a number of modules, including price formation, visualization of trades, rates dissemination and algorithmic trading.

David Cooney, CEO of MahiFX, commented to the media: "Internalising flow, at the right rate, is key to increasing profitability and market share. But it's a tough puzzle. Assembling the teams to build an internal solution is expensive, and sometimes, where it has been attempted, the results have been less than hoped for. Compass provides a proven solution - the technology and advice on its operation - with minimal lead time and variable, performance based costs."

David Cooney

Match-Trade Technologies’ solution also addresses the notion of last look, faced by many participants in the FX markets, Mr. Firoz outlines the steps the matching engine takes when addressing the last look dilemma, he stated: “Our matching engine works according to a standard price/time priority algorithm, which means that at first an order with a better price will be matched. In cases where orders are at the same price, the one placed earlier will have priority in execution. Each limit order (e.g. buy limit at 1.2245 vol. 100.000) placed by the client is sent to the aggregated order book, which builds the forex brokers' own liquidity and thus reduces the spreads for the forex brokers' trading clients.

This means that trades can be executed at the forex brokers' clients prices and will not be passed on to the Liquidity Providers. If this limit order meets with other client orders (market or limit) the transaction will be executed by the Matching Engine, which will result in a transaction directly between two clients. So basically this is an ‘open look’ where trading clients can see the price/volume and execute.”

The way FX brokers manage their dealing operations has been a talking point during the past four years, a period where markets were choppy and traded in a range. Several FX brokers opted for a modest approach and limited the risk they took and consequently applied the non-dealing desk method and sent orders to their liquidity providers, however Carl Elsammak, an experienced trader who runs Kammas Trading, an outsourced risk management unit, believes firms who run a principal model (B-Book) can produce higher returns than the simple A-Book model. Mr. Elsammak stated in a comment to Forex Magnates: “It is my opinion that all brokers are better off running a B-Book regardless of higher or lower volume trends. This is particularly true as volumes drop. A proper B-Book process helps the bottom line of brokers to remain profitable through the difficult periods.

Carl Elsammak

The key to running a 'B-Book' is having a conservative strategy executed by an experienced team that predictably provides an enhanced return over STP at achievable reasonable levels.”

The FX markets face numerous challenges from market structures, regulators and the demands of its users, however the ongoing developments in technology and advancements in the way firms manage risk and perceive foreign exchange trading is creating a literate environment where participants look at progressing forward.