The technological advancements which have taken place during the last few weeks have been largely concentrated on infrastructure, and the increasing overall trend toward creating increased availability by large network providers connecting to more and more executing venues, and the moves toward extremely fast Execution speeds by collocating servers and in some cases using cloud based technology.

Today, Californian packet microwave backhaul system provider Exalt Technology has revealed that it has its sights set on raising the bar even further, having embarked on a development project in which the firm intends to put into place ultra-low latency microwave systems for of financial trading networks, aimed at supporting high frequency trading (HFT).

Overall, recent notable advancements have arrived on the scene in many forms, all aimed at greater connectivity and lower execution times, as well as globalizing the access to low-latency. Some firms achieve this via software, as in the case of last week’s strategic alliance between Azul Systems and Solarflare in order that Solarflare’s intuitive networking software could allow faster trade processing by reducing jitter associated with Java Virtual Machine applications when carrying out high-speed transactions.

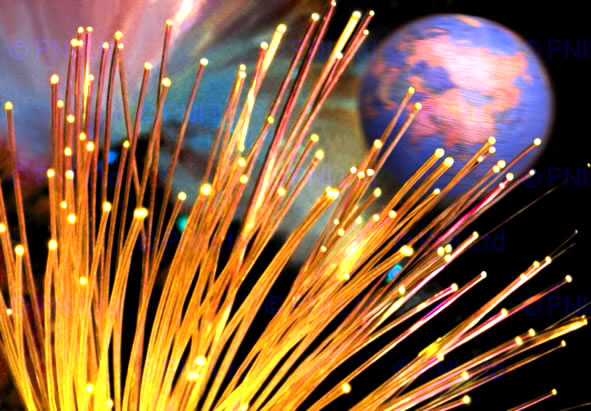

Could Ubiquitous Fiber Optics Become Obsolete?

On the infrastructure side, many infrastructure providers are experiencing the need to upgrade their connection to meet volume demand whilst still demonstrating fast trade execution performance, as in the case of Hotspot FX’s requirement for upgraded service from TMX Atrium last week, whilst large software giants such as SS&C seek to access executing venues, as well as develop their own hubs as in the case of CFN Services in its launch of TradingHUB this month.

Microwave Connectivity

“In high-frequency trading, where being ahead of the competition can mean profits worth millions, every microsecond shaved off a trade can make the difference,” said Exalt Technology’s CEO Amir Zoufonoun on behalf of the company yesterday.

“Microwave delivers this competitive edge. It’s faster than fiber’s near-speed of light, can go where fiber cannot over the shortest distance between two points, and it does all this for less cost. When we decided to apply our microwave expertise to this unique market, we committed for the long-term, recognizing that our unique expertise would allow us to make a significant contribution to the evolution of HFT networks by delivering the ultimate in speed, reliability, and flexibility.”

HFT and the Need for Speed

One of the most significant drivers of high frequency trading in recent times has been the growth of market participants and fragmentation of exchanges, creating dozens of venues quoting the same tradable instruments and resulting in massive amounts of data to review.

According to Exalt Technologies, estimates state that more than 50 percent of all equity-trading volume in the U.S. is executed by high frequency traders, and global market estimates top 35% and growing. HFTs do not trade entire markets, but only a subset of symbols, funds, or contracts, with tens of millions of dollars at stake each day. These traders make money a fraction of a cent at a time, multiplied by hundreds of shares, tens of thousands of times per day, and the opportunity to make money may exist only for microseconds.

On this basis, HFT applications support the rapid turnover of positions through the use of sophisticated trading algorithms, which process hundreds of trades in fractions of a second on the basis of changing market conditions.

Fiber Optics – Built-In Obsolescence?

Whilst high speed fiber optic connectivity is still very much the norm, and has proved very popular in its application within point-to-point connectivity solutions as in the link between London and Moscow for which demand is increasing.

In the past, increasing trading network speed required the different physical components of network infrastructure including switches, software, TCP offload devices, and other components to be compatible in terms of speed in order to avoid a “lowest common denominator” situation whereby massive investment is made in new infrastructure, only to find that the data transfer speed is hampered by one particular component.

In order to support HFT, obtaining and acting on real-time equities, options, and other financial information microseconds faster than competitors is paramount, hence the onset of what has become something of a technology arms race between market participants.

For these networks, with trading and information centers often separated by hundreds of miles, the goal is ultra-low latency, and variations in transmission delay can make millions of dollars’ worth of difference to high-frequency traders.

While fiber can deliver adequately high speed over short distances, such as found within a Data Center building, it suffers latency delays of about eight microseconds per mile over longer distances. For example, for one of world’s most popular routes from Chicago to New York, typical round trip latencies with adequate transmission capacity measure around 16 milliseconds for premium “dark fiber” service (a connection that doesn’t have to be shared with other customers).

Microwave, on the other hand, is nearly twice as fast as the speed of fiber over long distances, making wireless transmission the ideal choice for trading, not for the entire market but for a select group – such as HFT traders – with a clear strategy and algorithmic tools who can truly benefit from the faster transmissions.

Microwave’s advantage over fiber stems from two factors. First, microwave links are shorter, because signals can be beamed across the most direct path between two points, while fiber routes are usually much longer due to rights-of-way restrictions.

Second, since electromagnetic wave transmission speed is inversely proportional to the density of the medium, microwaves are naturally faster than fiber optic waves due to the higher density of glass vs. air. In the Chicago - New York example, the currently installed Exalt microwave systems transport data at 8 milliseconds round trip vs. the fastest fiber network at 13.1 milliseconds. Furthermore, while fiber has already reached its minimum potential latency, microwave technology continues to evolve toward even lower latencies.

In HFT, positions are often held for an extremely short time, with no open positions remaining at the end of the day. The faster a trading application responds to market signals - completing an analysis, arriving at a decision, and sending a market order - the higher the chances of getting an order filled. The ratio of orders filled to orders unfilled is a common metric for gauging the success of a given algorithm and infrastructure.

To beat their competition, traders must identify and act more quickly on opportunities, and that translates to the need for speed. If a computer algorithm can spot a millisecond-level opportunity in which a stock is – instantly – worth more on one exchange than another, it can make quick money, and conversely if it is not executed correctly, it can cause irreparable damage.

Once microwave has been chosen over fiber, the very next consideration is to choose the microwave radio vendor and type of systems. With the goal of minimizing the overall latency for a particular route, network planners must simultaneously seek to minimize the number of microwave links and the average latency per link, while maximizing system availability and transmission capacity.

Other parameters in network planning are the choice of frequencies, site-specific conditions, and equipment configurations. To optimize this set of complex, interrelated parameters, Exalt has applied its advanced DSP and RF technologies specifically geared toward ultra-low latency designs.

Latency Control Goes Live

As a further innovation, Exalt Technologies yesterday launched adaptive latency control which minimizes latency and noise accumulation in HFT transmission systems.

Mr. Zoufonoun explained the reasoning behind the development of such a control: “In the early stages of the market, network operators tested traditional microwave as an alternative to fiber for financial trading, and they proved its superiority for high speed transmission.”

“Now they are looking for a better microwave designed specifically to achieve ultra-low latency. This is next generation HFT microwave, and Exalt is delivering it today with advances in technology such as our unique Adaptive Latency Control.”

Key To Instant Execution Or White Elephant?

These multiple radio personalities work with Exalt’s built-in diagnostic stress testing mechanisms to provide a clear view of latency and noise at each link in the overall network. Using Exalt system diagnostics, network operators can view the number of packet errors at each link in the network and then adjust Exalt microwave radio personalities to optimize network performance and reliability. Network statistics are available minute-by-minute, hour-by-hour, or day-by-day.

The question which still looms overhead, however, is as to what this race-to-zero competition between technology firms will lead to if regulators apply mandatory delays in execution times to mitigate what they see as potentially disruptive behavior from algorithmic traders. If regulators implement such rulings, such advancements may never achieve their intended goal in some jurisdictions.